In Vitro Diagnostics Market Size in 2023: $130 Billion

The in vitro diagnostics (IVD) market has experienced significant growth over the years. From $25.2 billion in 2001, it has surpassed $127 billion and is projected to exceed $120 billion in 2022, according to the latest estimates from Kalorama Information.

Market Trends and Projections

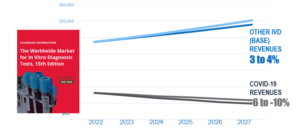

Despite the challenges posed by the COVID-19 pandemic, 2023 will be a year of resetting and rebuilding for the IVD market. The decline in COVID-19 testing will be met by base market gains, as evidenced by the financial reports of major companies such as Roche, Abbott, Hologic, Quest, and LabCorp in January 2023. Revenues from non-COVID-19 IVD tests, including chemistries, cardiac markers, and glucose tests, are expected to make gains as COVID-19 cases decline.

The continued expansion of the IVD market is projected to increase its growth by 2 percent compound annual growth per year. While COVID-19 testing will contribute $32.6 billion to the market, the bulk of the revenues, $94.8 billion, will be generated by non-COVID-19 IVD tests. Kalorama’s analysts anticipate that the IVD market will exceed $140 billion by 2027, driven by increased sales of existing products and new product development.

Emerging Trends and Market Growth

In vitro diagnostics are now being utilized beyond traditional applications. The use of IVD for diagnosing potential head trauma in sports or aiding in the diagnosis of depression is becoming a reality. Genetic tests, despite some caution from medical societies and governments, are experiencing revenue growth.

The adoption of mass spectrometry, once limited to a few university hospitals, has expanded into advanced microbiology systems, diabetes testing, and vitamin C tests. Cancer testing, although overshadowed by the COVID-19 pandemic, continues to thrive. Revenue segments related to cancer testing, including in situ hybridization tissue DNA tests, blood tests for molecular cancer markers, immunohistochemistry, and HPV molecular tests, are among the fastest-growing.

Additionally, drug-of-abuse tests, cardiac markers, fecal occult blood tests, glucose tests, inherited disease tests, and molecular tests for organ transplants are expected to show greater than average growth.

Market Leaders

Several dominant companies report most of the revenues in the IVD market. Abbott, with its point-of-care products, products developed for COVID-19 testing, and a strong presence in the infectious disease testing market, holds a leading position. Roche’s partnerships with pharmaceutical companies, tissue diagnostics offerings, and presence in large hospital systems also contribute to its leading position.

Other market leaders include Siemens Healthineers, Beckman Coulter, BioMérieux, QuidelOrtho, Bio-Rad, Sysmex, Cepheid, and Becton Dickinson.

Geographic Trends

China and Korea are identified as key growth markets in the global IVD market. China’s market growth,

Lab Automation

Clinical lab medicine plays an integral role in healthcare and disease management. It is estimated that some 70% of diagnoses and treatment plans are based on clinical lab test results. Diagnostic laboratory medicine has changed dramatically since the 1970s. Until the 1970s lab medicine was comprised of some 500 to 4000 tests performed manually with the aid of test tubes and a spectrophotometer or microscope. Proteomic research then led to the discovery of important disease markers such as proteins, enzymes and hormones. Enzyme immunoassay techniques provided a tool by which to assay these and other markers.

In the 1980s, the development of enzyme immunoassays and automation led to an almost a doubling in the number of tests that could be performed in hospital labs. Then the launch of polymerase chain reaction (PCR), the completion of the Human Genome Project and molecular test modalities added yet another dimension to clinical lab testing. By the 1990s and 2000s developments in molecular biology, proteomics, disease management research and the unraveling of the human genome further expanded the menu of tests available. Thus tests used to analyze biopsied tissue; to measure nucleic acids in blood, sputum, urine, cervical fluid and other samples; and to diagnose infectious diseases created a rapid expansion in clinical lab medicine. These tests provide physicians information that could be readily applied to therapy selection and patient outcome particularly in cancer diagnosis and disease management, in diabetes and in infectious diseases.

A brochure summarizing lab test activities at Baylor University Medical Center (Wako, TX) during 1951–1952 reported that 245,296 laboratory tests were completed, for a daily average of 672 tests. Since that time, the article states “the number of tests processed has tended to increase at a rate of about 10% per year” and therefore by our calculation the Baylor labs would have processed at least 100 million tests in 2019 (or some 285,000 tests per day). The figure shown below illustrates the expansion of tests available for inclusion in a laboratory’s test menu.

It is obvious that the manual test methods used in most labs until the mid 1960s and 1970s could not cope with the increased expansion of the test menu. Automated instrumentation was a solution that allowed test results to be generated in a fraction of the time that they used to take. For the purposes of this report; laboratory automation is defined as the use of technology to streamline or substitute manual manipulation of test processes including: simple capping and decapping of sample tubes and bottles, creating test lists, high throughput screening of test samples, the storage of patient samples and the communication of test results to a laboratory information system.

The use of automation in labs progressed step by step. Barcoding and scanners replaced hand-written test lists and have speeded up the specimen tracking process. This was accompanied by automated clinical chemistry, immunoassay and hematology/coagulation instrumentation. Next came what are termed independent “islands of automation” used to conduct pre-analytical sample manipulation, automated testing and sample storage modules. The final and most sophisticated phase resulted in “total lab automation” whereby these independent modules are linked by a track that is powered by advanced robotic solutions with multiple connectivity options. These track-based automation solutions are scalable and flexible to meet the demands of any size laboratory.

Total automation solutions can be open or closed. Closed automation track solutions are provided by instrument manufacturers and typically connect only to instruments from that vendor or assigned partners. All of the major diagnostic companies including Abbott Diagnostics, Beckman Coulter/Danaher Diagnostics, Ortho Clinical Diagnostics, Roche Diagnostics and Siemens Healthineers offer total lab automation solutions. Open automation solutions are designed and acquired by labs independently and can interface with any instrument, regardless of the vendor. They are built by independent companies and interface to the instruments and the lab information system to automate the pre- and post-analytical work flow.

Tecan Group, Copan, Kiestra, Hitachi High Technologies, and others are among the major automation companies that partner with IVD companies to provide customized automation solutions.

One of the most popular automation solutions for any size lab has been the pre-analytical sample preparation station. This is because the pre-analytical phase is associated with more than half of all laboratory costs and has been shown to be the source of laboratory errors due to specimen mislabeling, misidentification, missorting, and improper routing, and decanting. While Beckman Coulter/Danaher has been a pioneer in this area, other major IVD vendors now offer a variety of automated pre-analytical solutions including Bio-Rad Laboratories, Abbott Diagnostics, Siemens Healthineers, Roche Diagnostics and others.

The ultimate goal of these various automated systems is to minimize labor intensive manual work previously performed by medical technicians (sorting tubes, decapping, centrifuging, loading analyzers, prepping and sorting materials for storage, etc.) while optimizing workflow, improving productivity, and increasing patient safety.

Simply put, a fully automated laboratory is one in which samples are loaded into racks, transported to and loaded onto/off analyzers and stored for further processing – all without the human touch. All analyzers are linked together physically by sample conveyor systems and electronically by a laboratory information system.

Automation of lab equipment is not necessarily new, but the technology is advancing and spreading across more fields than ever anticipated. At this time, just about every lab discipline has incorporated some form of automation. The fields of clinical chemistry and hematology were the first to be fully automated. Microbiology has begun the journey with the arrival of fully automated microbiology platforms that automate the entire work flow with one system. Molecular diagnostics and anatomic pathology followed. Evidence of this is automated instruments such as immunostainer platforms in hematology, microbiology and anatomic pathology or DNA extraction and amplification in molecular diagnostics. The convergence of the disciplines of laboratory medicine (anatomic pathology, clinical pathology, molecular diagnostics) is driving the movement of specimens across disciplines. Therefore laboratory automation has come to the fore to expand and to connect all parts of the laboratory as well.

The major reasons for automation in the laboratory are fast test procedures, error reduction and staff augmentation. This is driven by increased testing demands and laboratory staffing needs. With the current situation of labs having to do more with less, total lab automation has become a necessity for large hospital and reference laboratories. Various degrees of automated systems are also a must have for any clinical laboratory.

Automation has long been regarded as an important means for clinical laboratories to achieve greater efficiency, accuracy, standardization, and test quality. Lab consolidation increases the number of samples processed in one facility and with increasing competition and demands for higher levels of performance, the need for automation has become more and more essential, even among smaller labs that have often resisted high priced automation solutions. Meanwhile, the development of new generations of automated stand-alone and benchtop equipment has made lab automation a more and more viable option for labs of all sizes. The remainder of this report summarizes the progress of automation in various clinical laboratory departments.

Test Efficiencies with Automation

The first automated instrument was introduced in 1957. The Technicon Corp. (U.S.) Autoanalyzer I, utilized continuous flow analysis to perform basic chemistry tests then referred to as a Chem 7. AutoAnalyzers automated repetitive sample analysis steps, which would otherwise be done manually. This way, an AutoAnalyzer could analyze hundreds of samples every day by only one operator. Ultimately, after a series of purchases the Autoanalyzer technology became the property of Siemens Healthineers.

Technicon was not alone for long. From the 1960s to the present other companies including Abbott Diagnostics, Bayer Diagnostics (now Siemens Healthineers), Beckman Instruments (now Beckman Coulter), Roche Diagnostics, and Boehringer Mannheim (now part of Roche Diagnostics) and Nova Biochem brought automated systems to market.

In the 1980s Japan demonstrated the potential of full automation with the introduction of a fully automated urinalysis lab where urine samples for standard dipstick analysis were tested without any human intervention. Japanese chemist Dr. Masahide Sasaki developed the first fully automated laboratory, and he popularized this innovation internationally. Sasaki and his associates invented total lab automation, which was to become the greatest revolution in clinical laboratory technology since Technicon’s Autoanalyzer.

Sasaki is credited with being the father of modern clinical laboratory automation. His work with conveyor belts, circuit boards, and programmable robots created the first automated laboratory. This opened the door for the expansion of automation outside the confines of the instrument to reach pre- and post-analytical work flows. The automation trend continues today with each new generation of instruments that increase the number of patient samples that can be tested at any one time and also the number of assays available on a single instrument.

Laboratory information systems/laboratory information management systems (LIS/LIMS) began to take shape in the 1970s. LIS/LIMS platforms brought electronic data management to the laboratory to manage the work flow and electronic interfaces to the instruments. Driven by an initial need to accurately capture billing codes, these systems helped automate laboratory operation by removing paper-based patient/test lists and capturing data electronically, directly from laboratory instruments. Coupled with automated instruments, the throughput of the clinical laboratory dramatically increased around the marriage of information systems and automated instruments.

Automation in The Core Lab

Senior lab professionals can remember the time when chemistry, hematology, coagulation, microbiology immunoassays and molecular testing were housed in separate rooms. For at least the past 20-25 years this has been replaced by the core lab concept. Large institutions may still house molecular testing in a separate room because of the need for ultra sterile test conditions and special instrumentation to perform a wide variety of tests. The core lab trend has been driven by the need to economize on lab personnel, the commercialization of connect-ready instrumentation and information technologies that can accommodate the amalgamation of disparate test modalities. These needs also apply to smaller labs where there too the lab walls have come down. They that have begun to invest in core lab workstation instrumentation and/or some form of lab automation.

For the purposes of this report core lab instrumentation is defined as the chemistry/immunoassay workstation and individual clinical chemistry, hematology and immunochemistry analyzers linked by a track or by some sort of laboratory automation and information technology tools.

At this time, almost all chemistry analyzers offer a mix of clinical chemistries with a selection of immunoassays that test for analytes in clinical chemistry, infectious diseases, hematological markers, cancers and chronic diseases. Therefore a more widely used term for chemistry/immunoassay analyzers is clinical workstations.

The trend for the consolidation of routine lab tests from multiple disciplines – chemistry, immunoassay, urinalysis, microbiology, coagulation, HPV cytology – into the core lab continues apace. In the past few years the number of analytes that would normally be found only on dedicated immunoanalyzers and that have migrated to consolidated workstations has increased dramatically. This table lists some of the immunoassays that have migrated to clinical chemistry/immunoassay workstations.

Selected Workstation Immunoassays

| anti-CCP, autoimmune marker |

| BNP |

| cystatin |

| D-Dimer (coagulation) |

| HCV |

| HE4 cancer marker |

| Hepatitis assays |

| HgA1c (diabetes) |

| HIV |

| hsCRP |

| Lipid profiles |

| NGAL cardiac marker |

| Procalcitonin for sepsis |

| vitamin D |

In fact, traditional specialization barriers, such as microbiology, hematology, blood banking, immunology and even anatomical pathology are fading. This trend makes the core lab a true hub for lab medicine. The next logical step is to incorporate a variety of molecular tests in the core lab. At that time, the lineup of red, lavender, green, gray, yellow and blue stoppered tubes would eventually be treated in an automated core lab.

The expansion of the core lab is a response to a number of environmental conditions. Economic pressures and labor shortages have been further exasperated by the economic meltdown of 2008. There is also a continuous addition of new tests to the lab menu. At this time there are at least 80 immunoassays available on clinical workstations. Therefore, it is not too unrealistic to anticipate that most routine tests that would require manual processing will one day be automated.

The push for economies has led even smaller hospitals to amalgamate routine tests from different disciplines into a core lab. In response to this demand, new tabletop instruments designed for small labs are multianalyte workstations that run chemistries and a large menu of immunoassays. New instruments (large and small) for clinical chemistry, immunoassays, hematology, coagulation, urinalysis, and microbiology (urines) are now developed with the capability to link to a lab information system and to a central lab track.

Of particular interest is the migration of advanced technologies to the core lab. With clinical market clearance for mass spectrometry instruments such as the Bruker Maldi Typer and bioMérieux’s VITEK MS, it is not too farfetched to see microbiology and other tests on mass spectrometry come to the core lab. This eventuality is supported by preanalytical sample preparation system that can decap and process screw cap tubes used to transport urinalysis, cytology and microbiology samples as well as traditional blood tubes.

Already mass spectrometry specialist AB Sciex has introduced a test for HbA1c and the company also offers a mass spec kit for vitamin D. Newomics Inc. (U.S.) was awarded the CE Mark for its IVD-MS Kit for 25-OH-vitamin D2/D3 on a Sciex mass spec system. Liposcience (U.S.) is developing a silicon-microfluidic-chip, LC-MS, for HgA1c. Others tests are bound to follow.

The importance of HgA1c in monitoring diabetic glucose management has been advanced with the market clearance of this test for diabetes diagnosis as well as disease monitoring. The result has been a spate of HgA1c tests on automated analyzers. More importantly, major quality control companies have launched HgA1c control products in an effort to standardize test results.

High sensitivity troponin (hsTroponin) testing has become a method of choice in the triage of acute cardiac disease in emergency room patients. The past few years a number of these tests have been added to the traditional cardiac marker panel: BNP, myoglobin and troponin.

Lipid profile and cholesterol testing has gained importance, driven by growing awareness about the risks of heart attack and increasing realization among individuals to control their cholesterol levels. Overall growth in the testing volumes is driven by factors such as aging population and growing number of people at risk of cardiovascular disease including those with hypertension, diabetes mellitus, and abdominal obesity. Thus automated lipid profile tests are becoming more and more evident in the core lab.

Vitamin D deficiency has been linked to various diseases including cancers, cardiovascular disease, diabetes, osteoporosis, multiple sclerosis, Alzheimer’s disease and all-cause mortality. This new understanding of importance of Vitamin D levels has driven an increase in the number of physician requests for total 25-Hydroxy Vitamin D tests in the United States and worldwide.

In spite of research indicating the overestimate of the impact that a lack of vitamin D may have on overall wellness and decreased disease risk, vitamin D testing has quickly migrated from dedicated immunoanalyzers and ELISA testing to integrated chemistry analyzers.

For esoteric immunoassays, microplate-based ELISA assays are commonly used to process tests that are not available on automated platforms. With the ongoing consolidation among laboratories, however, the demand for esoteric immunoassays is reaching volumes that require automation. Therefore ELISA system manufacturers have automated the test process from stand-alone washers and readers to fully automated workstations and solutions so that they can respond to a clinical laboratory’s assay and throughput requirements.

The table below presents a selection of automation innovations (across lab disciplines) that continue to expand the reach of the core lab in the centralized execution of patient testing. Company reports indicate the trend is to more and more consolidation of clinical chemistry, immunoassays, infectious diseases, blood and plasma screening, hematology, cytology, and molecular diagnostics — all on a single modular automated solution. The first target for this advanced automation strategy is large hospital and reference labs. However with modular adjustments even smaller institutions could modify their core labs to be more multidisciplinary.

Selected Lab Automation Innovations

| Abbott Diagnostics has chosen to the open lab automation concept with its GLP, ACCELERATOR and Alinity lines of lab-automation system. The strategy involves the development of next-generation blood screening, hematology, and immunochemistry instrument systems, as well as assays in various areas including: infectious disease, cardiac care, metabolics, and oncology for the core lab. Therefore, Abbott’s high end ACCELERATOR a3600 and GLP automation solutions allow labs to connect multiple vendors on a single automation platform.

On the drawing board is the Alinity automation solution a next-generation family of instruments, across key laboratory disciplines, that is designed to simplify diagnostics. The Alinity portfolio includes clinical chemistry, immunoassay, blood and plasma screening, point of care, hematology and molecular diagnostics, along with Abbott’s Alinity PRO software that works to fully maximize the potential of the network of linked instruments. |

| Beckman Instruments (now Beckman Coulter Diagnostics) was one of the first diagnostics companies to market lab automation and its most popular module at that time was the AutoMate family of systems that managed pre-analytical test procedures. July 2018, Beckman Coulter showcased its lab automation portfolio, including the Power Express laboratory automation system, with a full complement of clinical information technology solutions. Beckman Coulter’s Power Express laboratory automation system connects all core disciplines on one line, providing a single point of entry for the company’s pre-analytical, clinical chemistry, immunoassay and hematology analyzers, with the flexibility to connect with select third-party analyzers.

Beckman Coulter’s latest addition to its automation portfolio, the CE Marked DxA 5000 total laboratory automation solution. The first in a suite of DxA systems in development, the DxA 5000 is a key component of its vision to bring workflow automation to laboratories of all sizes. The DxA 5000 utilizes Intelligent Routing dynamic system software to bring automated patient-centric workflow. It continuously calculates the most expeditious route for every patient sample—both STAT and routine. In the area of information technology, Beckman Coulter provides a comprehensive suite of software and middleware. According to Beckman Coulter, the company’s DxONE Workflow Manager is the “first and only cloud-based middleware offered by a major in-vitro diagnostics organization, designed to help low-volume laboratories deliver timely results for patient care by enhancing consistency, accuracy and efficiency.” Beckman Coulter reports that leveraging cloud-based technology enables laboratories to utilize their existing IT hardware while requiring very little support from hospital IT personnel. The IT solution allows laboratories to standardize and automate workflows across Beckman Coulter’s chemistry, immunoassay and hematology platforms. The DxONE Workflow Manager builds upon Beckman Coulter’s middleware solutions, which include REMISOL Advance for higher volume laboratories. |

| Ortho Clinical Diagnostics offers the VITROS Automation Solutions an open platform that is both expandable and flexible. The company’s Open Connectivity strategy enables labs to connect to third-party analyzers that complement VITROS clinical chemistry and immunoassay instrumentation in disciplines such as coagulation and hematology, as well as to select immunoassay platforms that broaden the test menu. Flexible Data Management using Instrument Manager allows small and mid-sized labs to configure solutions that address their specific needs in pre-analytical, analytical and post-analytical test processes.

On the drawing board is the enGen Laboratory Automation system, used in combination with the VITROS Systems and informatics solutions. enGen Automation helps streamline sample handling by eliminating operator interventions, reduce time spent searching for samples with automated Sample Tracking, optimize workflow with results-based routing, and eliminate barcode reading errors. Beckman Coulter /Danaher and Ortho Clinical Diagnostics have a partnership whereby Beckman Coulter will place Ortho’s VITROS 3600 System running HIV and hepatitis assays in labs that currently run Beckman’s Power Processor Sample Handling Systems, automation solution, and in certain very high-volume laboratories. The companies also collaborated to obtain FDA market to connect the VITROS 3600 System to the Power Processor to run infectious disease tests. |

| Roche Diagnostics is the largest diagnostics company with products for every lab discipline and as such markets automation solutions across the board including blood donor screening, molecular tests and the core lab. Roche Diagnostics and Hitachi High Technologies have maintained an alliance with an extended 10-year agreement for the joint development and manufacture of the next generation of instruments and workflow automation solutions under the Cobas brand name.

The cobas 8100 automated workflow solution is the result of 35 years of partnership between Roche and Hitachi High Technologies. Combined with Roche’s sample archiving solutions, cobas 8100 provides connectivity, simplifying and speeding up routines for analysis, archiving and on-demand retrieval of blood samples. Roche’s MODULAR PRE-ANALYTICS (MPA) system is a turnkey automation solution that also includes the cobas 6500 analyzer series fully automated solution for urinalysis testing. Roche offers the cobas p 480 instrument for automated preanalytic processing of primary vial molecular diagnostic samples. The instrument provides automated uncapping and recapping of primary sample vials used for liquid-based cytology (LBC) and molecular assays run on the cobas 4800 System. For assays such as the cobas HPV and cobas CT/NG 4800 Test, the instrument allows primary vials to be loaded directly onto the cobas 4800 System without a need to aliquot into a secondary vial. Roche commented: “For the first time, laboratories now have an option to directly load LBC primary vials for preanalytical and analytical processing through a combination of cobas systems that support molecular testing.” The cobas 4800 System offers walk-away automation of nucleic acid purification, PCR set-up and real-time PCR amplification and detection. The system menu in the U.S. currently includes the cobas CT/NG Test (Chlamydia trachomatis/Neisseria gonorrhoeae), cobas HPV Test, cobas MRSA/SA Test, cobas Cdiff Test, cobas BRAF V600 Mutation Test, cobas EGFR Mutation Test and cobas KRAS Mutation Test. |

| In the area of central laboratory automation Siemens Healthineers reports it is the only single-source provider able to connect all four key laboratory disciplines—chemistry, immunoassay, hematology, and coagulation — to the automation track. Siemens’ Aptio Automation solution connects with the company’s Advia Centaur XP system, Immulite systems, and Dimension integrated systems. Siemens’ CentraLink Data Management System provides lab process management capabilities for Aptio Automation, thus managing patient and quality control data from multiple instruments, and providing centralized control over lab processes.

Siemens Healthineers recently introduced Atellica, a new automation system. Siemens claims the system features patented bidirectional magnetic sample-transport technology that is 10 times faster than conventional conveyors. The system can be fit into hundreds of configurations to make the product appealing to mid-size labs with limited space. Siemens demonstrated the system connected to a clinical chemistry analyzer and an immunoanalyzer; however, the system is designed so that it can be customized and use with many different types of analyzers. |

| Becton Dickinson Diagnostics’ BD Totalys MultiProcessor is an automated instrument for cytology and molecular testing that integrates the pre-processing for the BD SurePath Liquid-based Pap Test with a molecular aliquot, maintaining sample integrity while improving efficiency in the lab. |

| Qiagen has introduced the QIAensemble Decapper for liquid cytology vials. While this new instrument is intended for cytology labs that process Pap smears from liquid cervical fluid samples, it opens the door for a host of sexually transmitted disease tests and assays for gynecological cancers to be run on immunoanalyzers and eventually on the new breed of molecular instruments, all of which have made their way into the core lab. |

| Hologic is taking this one step farther with the development of a system to present liquid based cytology samples for molecular HPV and sexually transmitted tests on the company’s TIGRIS and PANTHER instruments. |

Hematology Automation

Hematology is the study of peripheral blood and bone marrow cells in order to diagnose various diseases of the blood including leukemias, anemia and autoimmune diseases. The basis of hematology testing is the complete blood count (CBC) that provides information on blood components: hemoglobin, hematocrit, red blood cells, white blood cells, reticulocytes, platelets. Samples that have abnormal levels of any of these components have a microscopic examination of the cell contents performed, called a blood cell differential. A drop of blood is placed on a microscope slide and stained. The slide is then examined under a microscope and the red and white blood cells are analyzed.

Today and over the past 60 years, the CBC has made an enormous impact on patient care. A CBC is run on every hospitalized patient and it is a vital part of a yearly annual checkup. The information clinicians derive from the CBC is used in the evaluation of just about every medical condition.

In the late 60’s and early 70’s instrumentation began to replace manually preparing a blood cell stain and counting each cell under a microscope, a process that typically took at least 20-30 min. This instrumentation is known as the Coulter Counter that is based on the Coulter Principle that was developed by Wallace H. Coulter in 1947 and was commercialized by Coulter Electronics (now Beckman Coulter Diagnostics. and part of Danaher). The Coulter instruments were revolutionary and just about every lab used a Coulter Counter that provided cell counts and a 3-part differential (lymphocytes, eosinophiles and basophiles. This blood cell morphologic information was achieved by maintaining the blood cells in a liquid flow and by using the Coulter impedance-based cell-sizing gateway combined with laser-based cytometry.

Since their invention in the 1950s, automated hematology analyzers have become increasingly sophisticated, allowing more precise and accurate CBC and WBC differential test results. Hematology instrumentation is now offered by more than 15 companies including the major vendors: Beckman Coulter/Danaher, Sysmex Corp/Partec, Abbott/Cell-Dyn, Siemens Healthineers, and Horiba Medical/ABX. Coulter dominated hematology automation for at least 30 years.

Until the 1980s, hematology instruments automated only the previously manual cell counting and analysis activities. Operators opened the blood tubes in order to present the sample to the instrument for testing. Sysmex revolutionized CBC automation with the introduction of needle through the stopper technology, an extended 5-part cell differential for cell morphology and instrumentation that combined cell analysis with integrated slide-making staining technologies. These advances permitted hematology to be included in track-based lab automation since they eliminated operator intervention. The major vendors followed Sysmex’s lead. They offer high end instrumentation with the same features and have also expanded the menu of blood cell-based tests available on the instruments.

Hematology analyzer product differentiation is accomplished by adding new parameters to a basic instrument – such as platelet counting, reticulocyte counting and CD4/CD8 analysis. The second approach is expansion into body fluids other than blood. The third avenue for differentiation is in automation strategies that include integration onto a core lab automation track, the addition of an automated slide maker and stainer, cell imaging technology and bioinformatic software. Abbott Diagnostics, Beckman Coulter/Danaher, Siemens Healthineers and Horiba Medical offer specialized platelet, red blood cell and white blood cell analysis and automatic slide makers/stainers.

Horiba Medical has further differentiated itself from the other vendors with the introduction of the Yumizen H500 hematology analyzer, a compact hematology analyzer that offers 27 CBC parameters including a 6-part differential, an artificial intelligence system with automatic startup and shutdown, and volume cytochemistry based flow-cytometry.

The slide making/staining feature functioned when the instrument signaled n abnormality in any of the CBC analytes. This reduced the number of patient samples that were then further analyzed by a manual cell differential count by a technologist. The process is labor intensive and requires considerable expertise. Thus the next frontier in hematology automation is the introduction of digital analysis of a stained blood smear slide.

Hematology lab managers and hematologists look to technology that can reduce costs and shorten turnaround time while maintaining or increasing quality. They now have digital technology options designed for the hematology lab. Facilitating digital hematology is automated consistent slide staining that optimizes quality and enables standardization to help ensure accurate identification of white blood cells, red blood cell morphology and platelet assessment. Digital imaging is a technology by which a camera, combined with appropriate optics and illumination, creates a numerical representation of a physical object, in this case blood cells. Once in a digital format, the image can be analyzed, displayed, printed, or manipulated in ways that might not otherwise be possible.

The lead company in this area is CellaVision (Lund, Sweden). The company’s major products are the CellaVision DM series of cell imaging and analysis systems were introduced in 2000. The major hematology vendors market CellaVision’s digital cell analysis systems along with their high end instruments.

Fully digital hematology received a boost in July 2013 when Roche Diagnostics acquired Constitution Medical, Inc. (CMI, Westborough, MA). Constitution Medical has developed the Bloodhound Integrated Hematology Analyzer, a totally digital concept. The instrument addresses the entire core lab hematology station workflow – slide making; slide staining; complete blood count; differentials; and streamlined, software-assisted manual review of slided, stained and imaged cells. The Bloodhound System combines a digital image-based cell locator, cell classifier and cell counter with its own slide maker and stainer. It produces a CBC and 5-part differential and automatically analyzes reticulocytes. Following processing, a comprehensive set of results are provided to medical technologists through the Bloodhound Viewing Station, an integrated, interactive display that features cell galleries that sort white blood cells, red blood cells and platelets. The system also isolates unclassified cells of interest and presents them for classification.

June 2015, Roche introduced the cobas m 511 integrated hematology analyzer. Featuring Bloodhound technology, the cobas m 511 combines a digital morphology analyzer, cell counter and classifier into one streamlined instrument preparing, staining and analyzing microscopy blood slides. The analyzer counts, identifies, isolates and categorizes white blood cells, red blood cells and platelets and presents the digital images of all these cell types on the viewing station including a standard CBC and 5 part differential.

Microbiology Lab Automation

The goal of microbiology and virology testing (further referred to as microbiology) is to detect pathogens in humans and determine a course of antimicrobial and viral treatment that is the most appropriate for the patient. Microbiology tests are super time sensitive tests—an infection detected and treated early can sometime make a difference between life and death or severe morbidity.

One of the most important aspects of microbiology testing is the regular need for detecting bacterial and viral infections. Infectious disease testing is always evolving because new pathogen strains develop each year, such as in seasonal influenza, Lyme disease, West Nile, malaria and most recently the novel coronavirus (COVID-19) pandemic. Additionally, hospital acquired infections, such as Methicillin-resistant Staphylococcus aureus (MRSA), necessitate increased testing.

For most of the 1900s clinical microbiology relied on standard culture techniques, and little automation. In the last 20-25 years there has been a shift to automated systems in microbiology. The net result is that microbiology, faced with the added weight of current and emerging pathogens, has had to join the crowd and look for cost effective solutions. Part of the new toolbox is the automation of routine tests such as sample processing and plating and urine culture that makes up some 80% of the microbiology workload. With the commercialization of automated urine testing, cytology vial decappers and automated plate streakers, it is not farfetched to one day see microbiology join the track in the core lab. In fact this type of automation now available the leading microbiology vendors including bioMérieux, Becton Dickinson, Beckman Coulter Thermo Fisher Scientific and Siemens Healthineers are making this possible, should a lab decide to do so.

The backbone of microbiology testing is organism identification and antimicrobial sensitivity testing, known as ID/AST (identification/antibiotic sensitivity test). Identification systems are utilized to obtain the identification (genus and species) of an organism. These systems contain fluorogenic and chromogenic substrates. When the organism comes into contact with the substrates, the organism either reacts with the substrate (positive reaction) or there is no reaction (negative reaction). When the positive and negative reactions are combined, the identification of the organism is determined.

Susceptibility systems are utilized to determine which antimicrobials will be most effective in treating an organism. The organism is tested against various concentrations of drugs, determining the organism’s resistance (ineffective) or susceptibility (effective) to the antimicrobial. The complete manual ID/AST test process usually took 1 day for negative specimens and 2-4 days for those that showed bacterial colony growth.

Approximately 60% of microbiology specimens originate from what are expected to be sterile sites – urines, blood cultures and cerebrospinal fluid (CSF) and other biological fluids. It has been estimated that 80% of urines, 99% of CSFs and 95% of blood cultures test negative, thus consuming a considerable amount of resources – materials and labor. The answer is expected to be quick universal screens for these specimens that would add up to enormous savings.

Bacteria detected using ID/AST reagents and systems include those originating from blood, wounds, post-surgical dressings and sutures, urogenital, urine, joint and respiratory samples. The most time sensitive ID/AST work-ups are done on hospitalized patient samples that include screens and workups for hospital acquired infections, urines, wound swabs, aspirates and blood cultures. Outpatient samples, which make up some 85% of the workload, include respiratory samples for throat and lung infections, urogenital samples for STDs, and urines for urinary tract infections.

Since the mid 1990s ID/AST vendors have responded to the need for quicker test systems, and in fact for many sample types these systems can have a definitive test result in 6 hours versus 1-2 days with non-automated systems. A differentiating factor among these system is the reagent mix contained in the panels and bioinformatics that provides more specific analysis if bacterial identification to the genus/species level.

Microbiology leader, bioMérieux got the automation ball rolling with the 1990s launch of the Vitek instrumentation combined with the extensive API database of bacterial reagent reactions. The first version was developed to process urine samples directly without culture. August 2010, bioMérieux introduced the FDA cleared and CE marked VITEK 2, a compact, bench top completely automated system providing same-day identification and antibiotic susceptibility results.

Following this bioMérieux and microbiology product vendors including: Siemens Healthineers, Trek Diagnostic Systems (now part of Thermo Fisher Scientific) and Becton Dickinson invested in automation to speed up the test process, especially the pre-analytical sample preparation steps. This has been significantly more difficult than other core lab test segments. They all use blood tubes of some sort that have been highly standardized. In microbiology there is a more diversified sample mix that includes swabs, blood, feces, sputum, pus, and urine, all of which arrive at the lab in different types of containers. Therefore a system that would automate sample processing for ID/AST required a bit more innovation.

The leader in this regard that has absolutely revolutionized ID/AST automation is Copan Diagnostics. The company had a vested interest in the development of devices and technologies essential for quantitative diagnostics and automated microbiology laboratory workflow. Copan is the leading vendor of sample collection and transport products. Copan began building the pieces needed for what the company anticipated was the future for microbiology – Liquid Based Microbiology (LBM). According to Copan LBM opens the door to specimen standardization and streamlined processing, similar to that available in chemistry and hematology. This being a prerequisite to microbiology joining the core lab and improved test turnaround time.

Copan’s LBM technology can be integrated with compatible robotic planting and streaking instrumentation such as Copan’s Walk-Away Specimen Processor (WASP), or other automated specimen processing platforms, including those for molecular biology applications and bacterial analysis of liquid cytology samples collected for the Pap smear. Thus bringing more diverse automated multitasking to the core lab.

The critical step was to automate all the pre-analytical steps: open the vial; remove liquid containing microorganism; transfer the liquid to solid and or liquid growth media that is dictated by the type of sample and analysis required; incubate the media; process positive samples for ID/AST analysis.

Copan’s automation strategy began in 2008 when Copan launched the WASP: Walk-Away Specimen Processing system for automatic planting and streaking of all microbiology samples. Combined with ESwab flocked swabs WASP offered fully automated liquid based microbiology. WASP automatically de-caps, plants, streaks, and recaps specimens in seconds. The system interfaces with the institution’s LIS system or acts as a standalone instrument. WASP was designed as an open modular platform that is able to interface with major microbiology ID/AST systems.

After the WASP processes specimens, plates are moved automatically from the WASP using a conveyor system to the WASPLab Incubator. The WASPLab Incubator scans the plates’ barcodes and automatically inverts each plate. Unlike traditional incubators that simply store plates in piles or stacks within racks, the WASPLab Incubator has a unique incubator design comprising of a 2 meter tall rotating spindle with removable easy to clean circular stainless steel shelves. Each circular shelf has 14 positions, each individual location intended for one plate. The incubator has a storage capacity of 770 plates and handles one plate every 10 seconds.

In 2010, Copan introduced a WASP module that includes the ability to automatically inoculate enrichment broths, and the Gram SlidePrep, which automatically prepares Gram slides prior to staining. Gram SlidePrep prepares a Gram slide after the sample has been inoculated onto culture plates. It makes a smear, with a customizable amount of sample volume, spreading the specimen within a defined area of the slide. Patient information is then immediately printed onto the slide using an inkjet printer. Slides will then pass along a conveyor belt, where they are gently air dried until they are ready for unloading and fixing with Methanol or processing by the operator.

April 2011, Copan launched WASPLab, a barcode driven and conveyor-connected specimen processing system, which utilizes robotic plate management to automate specimen workflow in Microbiology. WASPLab can manage various aspects of specimen processing and workup including planting and streaking, Gram slide preparation, enrichment broth inoculation, robotic incubation and storage, plate image analysis, AST/ID inoculum preparation, Kirby-Bauer disk application, and even MALDI-TOF Target Plate Seeding.

In the last step Copan is developing WASPLab image acquisition and analysis that offers the ability to view, workup, and report cultures remotely from anywhere with internet access.

The major microbiology companies have recognized the potential of full microbiology automation and liquid microbiology. Some have partnered with Copan and others have gone their own route. In all cases, the net result is faster, more standardized ID/AST testing.

At this time, the major vendors of automated ID/AST instruments and test panels are bioMérieux’s Vitek systems, Siemens Healthineers MicroScan systems, Trek Diagnostic Systems’ Sensititre systems (now part of Thermo Fisher Scientific) and Becton Dickinson Diagnostics’ Phoenix. These systems have reduced the test time for some specimens to as little as 5-6 hours versus days using non-automated procedures.

Healthcare Diagnostics and Copan have entered into a partnership whereby U.S. laboratories can add Copan’s Walk-Away Specimen Processor (WASP) to the Siemens MicroScan system.

Becton Dickinson completed its microbiology lab product menu with the acquisition of Dynacon’s (Toronto, ON) Lab Systems business, which offers microbiology specimen-processing technologies. The purchase gave BD Diagnostics two new products, the InocuLab system for processing microbial specimens and the Innova Preanalytical Automated Microbiology Specimen Processor, which is a higher-throughput, automated version of the InocuLab. BD reported that the Innova System accommodates the “full range of microbiology specimen containers, streak patterns, protocols, and workflows.” BD Diagnostics later introduced the BD Innova Preanalytical Automated Microbiology Specimen Processor.

The BD Kiestra Total Lab Automation (TLA) system offers standardized and scalable automated solutions for inoculation, incubation, plate imaging, culture reading and result reporting. The BD Kiestra Work Cell Automation (WCA) system automates specimen processing, plate incubation and digital imaging in a compact footprint for labs of any size. The Kiestra ReadA Compact intelligent incubation and imaging system. The system combines automatic dynamic digital imaging and individual plate storage. It uses a high resolution industrial camera and three different LED light sources, ensuring an optimal image is created for all sample and media types.

bioMérieux introduced FMLA (Full Microbiology Lab Automation) in 2008 with an aim to streamline the workflow of the microbiology laboratory, from sample reception and distribution, organism identification and antimicrobial resistance analysis, to result management and interpretation. bioMérieux also developed Myla, a middleware solution to improve connectivity, laboratory workflow and information management. Part of bioMérieux’s FMLA solution, Myla is a browser-based application that consolidates and manages microbiology data generated from a variety of sources and converts these data into actionable information for treatment decisions.

bioMérieux also markets the Previ Isola automated plate streaker that is part of bioMérieux’s Full Microbiology Lab Automation strategy.

Siemens Healthineers expanded its post-analytical workflow functionally with expansion of the MicroScan LabPro Information Management System. LabPro 4.0 and LabPro Connect give laboratories access to Siemens Healthineers most updated microbiology information management tools. The system provides management of microbiology test results from order to lab information system transmission using intuitive, customizable features to enable faster workflow and delivery of important test results. Siemens Healthineers also offers the LabPro Information Manager, a single database and interface connection for multi-user access, this system expands microbiology data analysis and reporting capabilities.

Trek Diagnostic Systems (now part of Thermo Fisher) received FDA clearance for a next generation ID/AST system. The Vizion System adds digital-imaging capability to the company’s ARIS 2X automated Sensititre System with SWIN (Sensititre for Windows) software. The system offers on-screen display of large, easy-to-read digital images with quantitative minimum inhibitory concentration and color-coded qualitative results. Trek also developed the Sensititre AIM Automated Inoculation Delivery System for use with all Sensititre dried plates. The system doses microtitre plates for antibiotic-susceptibility testing (AST).

Emerging is nucleic acid testing and pathogen analysis with immunoassays, mass spectrometry and whole genome sequencing. These technologies have decreased test turnaround times from as long as a week to days and in other cases from days to hours. In addition they provide specific genus/species information for pathogens necessary in epidemiological studies and for therapy decisions. Immunoassays and molecular tests are gaining importance in microbiology specially for sepsis, urogenital testing for sexually transmissible diseases and human papilloma virus for (cervical cancer) because these organisms are notoriously difficult to culture and for respiratory disease testing on throat swabs and sputa because these are time sensitive tests and can be used in physicians’ decisions for antibiotic use.

On the horizon is mass spectrometry for microbiological analyses that is on its way to make a significant contribution to routine pathogen testing in terms of test speed and accuracy. Although microbiologic culture is a standard method for detecting pathogens, this technique may take days to weeks. Specific PCR and serological assays are used to confirm the presence of a pathogen. Real-time PCR assays offer a rapid, sensitive, and specific method for the detection and differentiation of pathogens. But these test modalities can only go so far; they do not drill down into the genetics of a pathogen to discover elements of virulence and antibiotic resistance.

Mass spectrometry (mass spec) applications are quite common in immunoassays for therapeutic drug monitoring of organ transplant immune suppression drugs, toxicology screening and confirmation, steroid and thyroid proteins, and vitamin D analyses.

Mass spectrometry is quickly emerging as one of the most significant developments in bacterial detection. Mass spec uses a molecular approach based on specific proteomic fingerprints from bacterial and fungal strains and published studies have highlighted the greater accuracy offered, as well as the typically much faster time-to-result. Invasive fungal infections are associated with high morbidity and mortality while prompt diagnosis can result in more optimized therapy reducing both mortality and costs of treatment. Current methods for identification of fungi include biochemical, phenotypic, microscopic and molecular methods. In addition to microbial identification, mass spec is increasingly being used for functional resistance mechanism detection, mass spectrometry allows for an exact determination of the molecular weight of a broad range of antibiotics.

Microbial identification with mass spec is done using a proteomic fingerprint. This unique species-specific pattern is automatically compared with proteomic fingerprints of reference spectra. Matrix-assisted laser desorption/ionization time of flight mass spectrometry (MALDI-TOF) has made mass spec applicable to bacterial testing. In MALDI-TOF, microbes are identified by matching the protein profiles of sample organisms generated via the procedure to profiles contained in a proprietary database. Like molecular methods, MALDI-TOF is used on positive blood culture bottles or other cultured bacteria. However, since it does not require an amplification step, it is even more rapid, returning results for each sample in minutes. Other advantages of MALDI-TOF MS are that it is not necessary to predetermine whether an organism is gram-positive or gram-negative and it has the potential for future susceptibility testing.

Launched in Europe in 2010, leading the mass spec evolution in microbiology is Bruker Biosciences’ (Billerica, MA) MALDI Biotyper that is CE Marked and FDA cleared. To add power to the system the MALDI Biotyper reference library holds information on more than 2100 species in the MALDI Bioptyper library has broader coverage of microbial species. Bruker also markets the MALDI Sepsityper kit, a set of consumables that enables a rapid and easy identification workflow after a blood culture bottle has tested positive.

Bruker’s system is barely on the market and there are already moves to automate the process. Bruker has struck a partnership with KIESTRA Lab Automation (Netherlands and now part of Becton Dickinson). The companies have signed a research and development agreement to integrate Bruker’s mass spec-based MALDI Biotyper and Kiestra’s MalditofA, an automatic colony picker that allows the automatic transfer of a colony to the target plate and also creates the suspension fluid at. e.g. 0.5 McFarland. Bruker and KIESTRA Lab Automation have worked with a number of customers applying both technologies in their laboratories.

All the major microbiology companies have joined the mass spec revolution. Microbiology market leader, bioMérieux markets the CE Marked and FDA cleared VITEK MS, ID/AST application on the Shimadzu mass spec system. Becton Dickinson and Bruker market the BD Bruker MALDI Biotyper System a blood culture system that integrates the MALDI Biotyper with BD’s Phoenix ID/AST system. The major reference labs and large hospital-based microbiology labs have also launched services using Bruker’s Maldi Biotyper.

The microbiology field is undergoing radical change, with new automation technologies improving the accuracy and response time of test results. These enhancements enable more appropriate use of antibiotics, overall better individualized patient management, and more efficient epidemiological and public health surveillance.

Automated Molecular Testing

The roots of clinical analyses using molecular methodologies were established in the 1960s but the birth of modern molecular testing is the development of PCR by Dr. Chary B. Mullis while working as a chemist for Cetus Corp. in Emeryville, CA. In 1991, Cetus sold the PCR intellectual property to F. Hoffmann-La Roche Ltd. for $300 million. Interestingly, at that time it was generally thought that Roche overpaid. However, PCR proved to be the major building block of modern molecular testing and is the catalyst for the beginning of modern molecular testing.

At some point thereafter the Roche LightCycler and Amplicore families of PCR-based molecular instrumentation were ubiquitous in molecular test labs. At this time Roche continues its dominance of the molecular test discipline with a battery of cobas brand fully automated PCR systems that concentrate primarily on infectious disease testing and blood transfusion donor screening. This table presents a selection of automated molecular test instrumentation.

Selected Automated Molecular Test Instrument Platforms

| Company | Location | Technology | Details |

| Abbott Diagnostics | U.S. | PCR | Alinity m molecular |

| Abbott Diagnostics | U.S. | PCR | Plex-ID platform |

| Abbott Diagnostics | U.S. | PCR | Abbott m2000 RealTime System |

| Becton Dickinson | U.S. | SDA | BD ProbeTec ET System and Viper |

| Biocartis | Switzerland | PCR | Fast-Track oncology assays on Idylla |

| bioMérieux/BioFire | U.S. | PCR | FilmArray Torch platform, random access multiplex PCR |

| Cepheid | U.S. | PCR | SmartCycler and GeneXpert |

| DiaSorin | Italy | PCR | LIAISON MDX disc platform |

| Fast-Track Diagnostics/Siemens Healthineers | Luxembourg | PCR | multiplex PCR kits for infectious diseases, open system |

| GeneSTAT Molecular Diagnostics | U.S. | PCR | RT-PCR GeneSTAT platform, RNA, DNA |

| GenMark Diagnostics | U.S. | PCR | ePlex sample-to-answer system, PCR |

| Genomica | Spain | platform | CLART (Clinical Array Technology) platform |

| Great Basin Scientific | U.S. | chip | Portrait Analyzer, biochip-based multiplexed molecular tests |

| Great Basin Scientific | U.S. | PCR | GB550 molecular diagnostic analyzer |

| Hologic | U.S. | TMA | Aptima reagents on Tigris and Panther instruments |

| Luminex/Nanosphere | U.S. | PCR | Verigene SP System, automated inf dis testing |

| Meridian Bioscience | U.S. | PCR | Revogene infectious diseases |

| Meridian Bioscience | U.S. | LAMP | Alethia (illumigene) |

| PerkinElmer | U.S. | platform | Applied Biocode’s multiplexed, BioCode MDx 3000 system |

| Qiagen | Netherlands | PCR | QIAsymphony RGQ MDx system for clinical labs |

| Quidel | U.S. | HDA | Solana molecular system |

| Roche Diagnostics | U.S. | PCR | cobas 6800 system |

| Roche Diagnostics | U.S. | PCR | cobas Liat PCR system, CLIA waived |

| Siemens Healthineers | U.S. | PCR | VERSANT kPCR Molecular System |

| Siemens Healthineers | U.S. | PCR | Atellica MDX 160 Molecular System |

| Thermo Fisher Scientific | U.S. | PCR | Ion Torrent line |

Source: Kalorama Information, company reports

The ultimate goal is total hands free molecular automated testing that has been termed sample to result molecular testing. Qiagen N.V. entered the then fledgling molecular testing market in 1984 and slowly developed to become the leading company in pre-analytical sample preparation in molecular diagnostics. The company’s QIAsymphony instrumentation set the stage for automated DNA and RNA extraction from blood and other body fluids that later were integrated into just about every modern automated molecular test platform.

Molecular technology is making a valuable contribution to clinical diagnostics on many fronts. Commercially available kits are used for a variety of conditions including: infectious diseases, primarily hospital acquired infections, tuberculosis, hepatitis, gonorrhea, HIV, and chlamydia; coagulation gene mutations; HLA tissue typing; hereditary and chronic diseases; and a slew of cancers. In most cases the information provided by these tests will affect the choice of therapy and the aggressiveness of the therapeutic strategy to be taken.

In light of the extraordinary times we are now living as a result of the novel coronavirus (COVID-19) pandemic and other infectious disease epidemics, the remainder of this report will focus on molecular testing for microbiology and virology. Molecular diagnostic tests directly target infectious agents, such as bacteria and viruses, by utilizing DNA and RNA probes that recognize the genetic signature of the bacterial and viral agents.

The menu of molecular diagnostics has expanded since the 1990’s introduction of PCR tests for tuberculosis, HIV and Chlamydia Trachomatis/Neisseria Gonorrhoeae (CT/NG) by Roche Diagnostics, Gen-Probe (now part of Hologic) and Becton Dickinson.

The first PCR-based instruments performed tests as unique entities. Now molecular platforms from companies such as Abbott Diagnostics, Luminex, bioMérieux/BioFire’s Film Array, Roche Diagnostics and others can run panels of up to 30 targets, and in less than 1 hour in some cases. They also are leading the way to random access rather than batch testing, which, while commonplace with immunoassays has been slower coming to microbiology. This is because traditional microbiology has a history of treating each sample in a unique process.

In 2020, molecular diagnostics tests are widely being adopted for testing infectious diseases (HIV, HCV, HPV, HAI and others), respiratory disease pathogens, and emerging infectious diseases including: chagas, chikungunya, dengue, Ebola, leishmaniasis, leptospirosis, malaria, onchocerciasis, yellow fever, and Zika.

Many of these tests have been released as EUA (Emergency Use Authorization) that make available diagnostic and therapeutic medical devices to diagnose and respond to public health emergencies. A list of tests that have this designation can be found at https://www.fda.gov/medical-devices/emergency-situations-medical-devices/emergency-use-authorizations. This page lists current and terminated FDA declared Emergency Use Authorizations including those for the novel coronavirus.

The anticipated demand for molecular infectious disease tests has encouraged the commercialization of molecular instrumentation for microbiology and virology testing. Thus microbiology companies continue to expand their product menu and upgrade their systems, primarily in the automation of microbiology test procedures for all areas of the test segment. The result is the development of a variety of new platforms that bypass the traditional ID/AST first step with direct testing from blood, urine, nasal swabs, sputum, etc. Note that mass spectrometry analysis is performed on a bacterial culture colony.

In an era of rapid automated test results microbiology still has a lot to do. The imperative for the 21st century is to determine as quickly as possible if a person has an infection, decide to treat or not to treat and then select a method of treatment. All too often patients have been given antibiotics when not required. This has contributed to the present problem of bacterial antibiotic resistance. It can be argued that efficient rapid tests in hospitals, clinics, physician offices and other care sites would have solved many issues related to infectious disease diagnostics.

Yet challenges remain in seeing the new methods developed completely, past regulatory hurdles, and integrated successfully in clinical practice. Further, The main advantages culture has over newer methods are its comparatively low cost and proven antimicrobial susceptibility testing.

Several trends are evident as the field of molecular infectious diseases evolves:

- integrated sample to answer test systems respond to the need for easy to use molecular tests for all size labs

- random access sample processing on instrumentation

- direct tests from sample without time consuming sample pretreatment for DNA extraction

- tests for high demand pathogens are coming to market including: C. difficile, TB, respiratory infections, and STDs

- companies are beginning to develop sequencing systems for a wide variety of targets

- CLIA moderate molecular test instruments provide smaller labs the opportunity to run molecular tests in-lab without having to send them out

This is but the beginning, the wholesale and routine use of molecular tests is yet to be realized. Most smaller laboratories are only beginning to establish molecular test departments. There are almost 100 companies preparing to help them out in this regard. The recent coronavirus pandemic has spurred more and more devices that can provide rapid test results. At least 40 user-friendly, tabletop and lab-based automated molecular tests have recently been commercialized for this coronavirus under the EUA directive.

IVD Mergers and Acquisitions on the Increase

As companies in in vitro diagnostics seek to reach additional markets, new partners and technologies are needed. There were more than 60 recent mergers and acquisitions in IVD in the past year, and there have been hundreds in the last five years. These are covered in detail in our report, IVD Mergers and Acquisitions

Roche

Roche remains the world’s largest biotech company, with truly differentiated medicines in oncology, immunology, infectious diseases, ophthalmology and diseases of the central nervous system. Roche is also the world leader in in vitro diagnostics and tissue-based cancer diagnostics, and a frontrunner in diabetes management. One of the ways Roche drives business growth is through mergers & acquisitions (M&A), so the company seems perpetually active in this area. Roche’s recent acquisitions include the following:

• In June 2018, it was announced that Roche would be buying complete control in Foundation Medicine for $2.4 billion; Roche had already owned a majority stake in the company, valued at $5.3 billion. Roche appears to be interested primarily in the company’s genomic data, as this is the second data-related acquisition Roche has made in 2018, having picked up Flatiron Health. The merger will seek to accelerate broad availability of comprehensive genomic (CGP) profiling in oncology, with the companies leveraging expertise in genomics and molecular information to enhance the development of personalized medicines and care for patients with cancer. Foundation will continue to operate independently, as part of the deal.

• Roche in April 2018, for $1.9 billion, completed the acquisition of Flatiron Health – a maker of oncology-focused electronic health records – to help accelerate industry-wide development and delivery of breakthrough medicines for patients with cancer. The addition of Flatiron, a healthcare technology and services company whose offerings are designed to support cancer care providers and life science companies, expands Roche’s presence in personalized medicine and oncology. Roche, reinforcing its capabilities in information technology, is partnering with Flatiron Health for the development of oncology-focused electronic health records. Flatiron Health will continue its operations as a separate legal entity.

• Roche completed in February 2018 the acquisition of biotech Ignyta for $1.7 billion, giving Roche rights to a drug, entrectinib, currently in testing for cancers that contain specific types of genetic mutations — NTRK or ROS1 fusions. Ignyta develops potentially life-saving, precisely targeted therapeutics (Rx) guided by diagnostic (Dx) tests to patients with cancer.

• Roche acquired Viewics, Inc. in November 2017, allowing Roche to expand its leading position in the integrated core laboratory with business analytics capabilities. The Viewics solution allows for efficient integration of Big Data from a variety of IT systems in the laboratory and beyond, pioneering a new way in extracting, cleansing, transforming, and augmenting data. This cloud-based solution is secure, infrastructure-agnostic, interactive, and accessible from multiple devices (e.g., smart phones, tablets, desktop computers).

Abbott’s Molecular Diagnostics Business Post-Acquisition of Alere

The acquisition of Alere was finally completed in October 2017 after the deal went through many ups and downs since the initial announcement was made in February 2016. After the $5.3 billion acquisition, Alere became a subsidiary of Abbott. In 2017 Alere generated revenues of approximately $2.3 billion of which the divested cardiovascular and toxicology product sales were approximately $1,200 million. Therefore Abbott inherited potential Alere revenues of approximately $1,100 million and reported Alere revenue of $540 million in Q4 2017.

Selected Acquisitions of Diagnostic Companies – More Mergers and Acquisitions available in our report IVD Mergers and Acquisitions:

| July -19 | Exact Sciences | Genome Health | Gain access to oncology sales force |

| July-19 | Invitae | Singular Bio | cfDNA prenatal testing |

| Jun-19 | Eurofins | Transplant Genomics Inc. | Eurofins expands its transplantation testing footprint |

| Jun-19 | Invitae | Singular Bio | For $55M; acquires Singular Bio’s single-molecule, cell-free DNA analysis technology, enables lower cost NIPS testing |

| Jun-19 | Meridian Bioscience | GenePOC | GenePOC purchase completed with an eye towards a syndromic testing strategy |

| Jun-19 | Thermo Fisher | HighChem | HighChem is a provider of mass spectrometry software |

| Jun-19 | Beckman Coulter Life Sciences | Cytobank | Cytobank, a single cell data analysis, SaaS company |

| May-19 | Bio-Rad | Undisclosed company | Disclosed during an earnings call that it had acquired an undisclosed company that will expand its genomic reagents product portfolio |

| May-19 | Caris Life Sciences | Pharmatech | The goal: to redefine how pharma and biotech companies identify and rapidly enroll patients in precision oncology trials |

| May-19 | Ginkgo Bioworks | Warp Drive Bio’s bioinformatics platform | To advance efforts against drug-resistant bacterial infections |

| May-19 | Thermo Fisher | Brammer Bio | For $1.7 billion, completed acquisition of Brammer Bio, involved in viral vector manufacturing for gene and cell therapies |

| May-19 | QIAGEN | U.K.-based organizations | Launched APIS Assay Technologies Ltd., a company that aims to improve the success rate of biomarker commercialization |

| Apr-19 | PerkinElmer | Cisbio Bioassays | Cisbio develops and manufactures kits and reagents for life sciences and diagnostics |

| Apr-19 | Charles River Labs | Citoxlab | Completes acquisition of preclinical services firm Citoxlab for $510 million |

| Apr-19 | CareDx | OTTR Complete Transplant Management | For $16M; CareDx to integrate the EMRs of patients at transplant centers with longitudinal patient surveillance data |

| Apr-19 | Canopy Biosciences | Zellkraftwerk | To use Zellkraftwerk’s microfluidic cell-capture technology to further develop drug-development research and biomarker discovery |

| Apr-19 | Caprion Biosciences | Serametrix Corporation | Immune monitoring and biomarker services to biopharma |

| Apr-19 | Prescient Medicine | AutoGenomics | To further development and commercialization of the Infiniti Neural Response Panel to identify patients who may be at risk for opioid use disorder |

| Apr-19 | Caprion Biosciences | Serametrix | Caprion expands its biomarker and immune monitoring franchise |

| Apr-19 | Yourgene Health | Elucigene Diagnostics | Mol Dx group Yourgene Health’s first commercialized CE-IVD products are non-invasive prenatal screening solutions for Down’s Syndrome and other genetic disorders |

| Apr-19 | Co-Diagnostics Inc. | Synbiotics Pvt Ltd | Launch CoSara Diagnostics Pvt Ltd JV |

| Mar-19 | Guardant | Bellwether Bio | To further advance Guardant’s early detection cancer Dx product pipeline |

| Mar-19 | Precision for Medicine | SimplicityBio | Adds AI to Precision’s QuartzBio multiomic data integration and informatics platform |

| Mar-19 | Grifols | Shanghai RAAS | Grifols acquired $1.9B Stake in Shanghai RAAS; to become Grifols’ exclusive distributor of plasma-derived products and transfusion diagnostic solutions in China |

| Mar-19 | Bruker | Arxspan | Cloud software firm to better provide software tools for customers |

| Mar-19 | Summa Equity | Olink Proteomics | Olink Proteomics has developed a unique technology for human biomarker discovery |

| Mar-19 | Guardant Health | Bellwether Bio | To advance Guardant’s LUNAR early cancer detection and monitoring assays |

| Mar-19 | Discovery Life Sciences | HudsonAlpha’s Genomic Services Lab | The new HudsonAlpha Discovery division will provide a range of services to the pharma, biotech, and diagnostics industries |

| Feb-19 | Danaher Corp. | GE Biopharma | For $21.4 billion; GE Biopharma, part of GE Life Sciences, supports research, development and manufacturing of biopharmaceutical drugs |

| Feb-19 | bioMérieux | Invisible Sentinel | Invisible Sentinel, a US-based company specialized in food and beverage molecular testing |

| Feb-19 | ICON plc | MolecularMD | Expands ICON’s capabilities in MDx and also adds expanded testing platforms, including NGS and immunohistochemistry |

| Jan-19 | QIAGEN | N-of-One, Inc. | N-of-One is a pioneer in molecular oncology decision support services |

| Jan-19 | Eli Lilly | Loxo Oncology | $8 billion purchase broadens Lilly’s oncology portfolio into precision medicines |

| Jan-19 | Luminex | MilliporeSigma’s flow cytometry unit | Luminex completed $75M purchase to expands its offering of flow-based detection systems |

| Jan-19 | Beckman Coulter Life Sciences | Labcyte | Labcyte acquired to expand laboratory automation business |

| Jan-19 | PHC Holdings | Anatomical Pathology business from Thermo Fisher Scientific | Part of Thermo Fisher’s Specialty Diagnostics Segment |

| Jan-19 | ArcherDx | Baby Genes | ArcherDx expands further into assay development |

| Jan-19 | OraSure Technologies | CoreBiome | CoreBiome (St. Paul, MN) is an early-stage microbiome services provider |

| Jan-19 | OraSure Technologies | Novosanis | Novosanis (Antwerp, Belgium), urine sample collection devices targeted primarily at liquid biopsy, STI screening, urological cancer |

| Dec-18 | 10x Genomics | Spatial Transcriptomics | Spatial Transcriptomics is a pioneer in the emerging field of spatial genomics |

| Nov-18 | Illumina | Pacific Biosciences | Acquired for $1.2 billion; expected to close mid-2019, to broaden Illumina’s access to long-read sequencing |

| Nov-18 | bioMérieux | Suzhou Hybiome Biomedical Engineering Suzhou | Hybiome, an automated immunoassay manufacturer based in China |

| Nov-18 | Agilent | ACEA Biosciences | For $250 million; ACEA has developed two platforms that are complementary to Agilent’s current portfolio |

| Nov-18 | LGC | SeraCare | LGC strengthens its position in clinical quality control tools |

| Nov-18 | Illumina Ventures | Stilla Technologies | Led a €16 million ($18 million) series A round for Stilla, a Paris-based developer of digital PCR solutions for genetic analysis |

| Nov-18 | Quest Diagnostics | Oxford Immunotec U.S. Lab Services Business | Includes Oxford’s T-SPOT.TB tuberculosis and Accutix tick-borne disease testing services |

| Oct-18 | Bruker Corporation | 80% majority interest in Hain Lifescience | Completed the acquisition of MDx infectious disease specialist Hain |

| Oct-18 | NeoGenomics | Genoptix | For $140M; Genoptix is a clinical oncology laboratory, specializing in hematology and solid tumor testing |

| Oct-18 | Luminex | Merck’s flow cytometry business | For $75 million; gives Luminex access to an adjacent flow-based technology |

| Oct-18 | Precision for Medicine | ApoCell | Adds ApoCell’s ApoStream liquid biopsy technology |

| Oct-18 | Grifols | 25% share in Mecwins Capital | EUR 2 million in Mecwins’ capital increase through Progenika Biopharma; allows Grifols to take positions in the diagnostic nanotechnology field |