Diagnostics Market to Exceed 80 Billion Dollars in 2020 as Volume of COVID-19 Testing Continues

The world market for in vitro diagnostics will reach 83.3 billion dollars in 2020, when the molecular and antibody sales of COVID-19 testing is considered. This is according to our latest report, The Worldwide Market for In Vitro Diagnostics, 13th Edition, due out August 26th.

Molecular diagnostics, for the first time in Kalorama Information’s two-decade history of covering the market, will represent more than 15% of the market, double where the category fell in 2019. This reflects not only PCR tests for the virus, but also the continued use of molecular for new purposes such as prenatal testing and cancer marker detection.

Under any circumstances IVD was set to grow in 2020. Testing had been making headway over the last decade. New product introductions, investments and mergers were brisk. Tests for cancer and infectious disease detection, transplant success, pharmaceutical selection have added healthcare value and improved outcomes. Genetic tests for rare diseases and prenatal assessment are increasingly utilized.

On top of these developments, the COVID-19 pandemic has highlighted how important testing is in a way that could not be imagined.

Kalorama’s report, published for two decades, is the result of careful study of company filings and releases, government information and modeling by seasoned market analysts. Instruments, reagents and associated purchases are included. The report breaks out the market by category -from standard clinical chemistry tests to immunoassays, to advanced molecular testing and histology tests for cancer detection and treatment selection.

The report said that growth areas outside of COVID-19 testing were tests for other respiratory pathogens, critical care tests such as blood gas and sepsis markers, immunoassays for infectious diseases and point of care tests. Areas affected by COVID-19 and resulting social distancing were diabestes tests, cancer tests and inherited disease, though the report indicates that some catch up revenues will be experienced by in vitro diagnostic companies later in the year.

COVID-19 has affected every diagnsotic company. This had dominated the activities of players such as Roche and Abbott, specialists in respiratory testing such as BD and Quidel, and international testing companies such as Seegene, SD Biosensor and DiaSorin. Life Science companies with diagnostic offerings such as Thermo Fisher Scientific and Illuminia have also developed test kits and have seen changes from the pandemic. Some test categories that are not related to COVID-19 have suffered as the pandemic closed hospitals to surgeries and decreased in-person visits with physicians greatly. All of these factors have been considered in Kalorama Information’s analysis.

While this is happening, various worldwide payor schemes are pressuring prices. The response is consolidation of lab operations and facilities. Same with IVD vendors. Consolidation remains the rule in the industry among both customers and vendors. The majority of the market is from a score of companies. Part of this development is related to organic company growth but also to strategic acquisitions that add revenue streams and product innovations.

Still, the report details, there is a multi-billion-dollar opportunity for other entities. Beyond the market numbers, the pace of mergers and acquisitions is brisk. Investor interest in IVDs is high. Their role as a gateway to pharmaceutical markets and healthcare provision markets is significant. And IVDs tie with stents as the most frequent type of medical device submitted to the FDA for new product registration. All of these suggest a dynamism in the market.

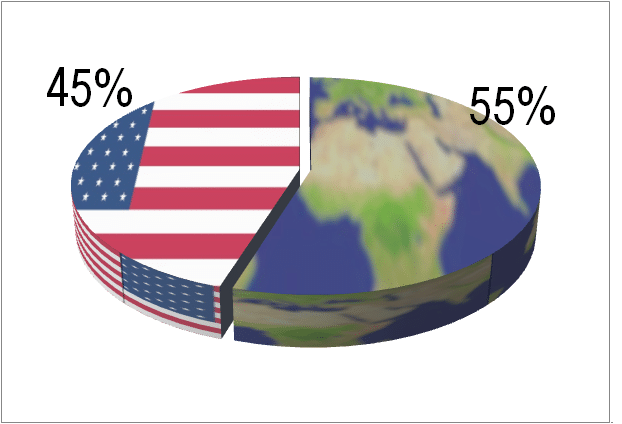

IVD is a global market this year as much as anything else. The regional figures in the report have not yet been published, but last year Kalorama said 58% of the market is now outside of US. Developed markets (N. America/Europe/Japan) still make up the bulk of IVD sales but growth is dependent on developing nation IVD markets. Among these markets are China, India, Korea, Turkey, and Brazil but IVD vendors are finding new emergent nations, like the Philippines at 9% revenue growth or Malaysia, with 8% growth. With COVID-19, more testing volume has returned to the United States, at least near-term. Wed now project that ratio to be 55% non-US, 45% US.

US vs. Non-US Share

Growth areas outside of COVID-19 testing were tests for other respiratory pathogens, critical care tests such as blood gas and sepsis markers, immunoassays for infectious diseases and point of care tests. Areas affected by COVID-19 and resulting social distancing were diabetes tests, cancer tests and inherited disease, though the report indicates that some catch up revenues will be experienced by in vitro diagnostic companies later in the year. Despite some loss in volume due to social distancing, areas like liquid biopsy and automated histology remain promising technologies long term.

Leading companies in IVD include Abbott, Siemens Healthineers, Roche, Danaher (notably Cepheid and Beckman Coulter), bioMerieux, Ortho Clinical Diagnositcs, Bio-Rad, Sysmex and Hologic. The COVID-19 crisis has focused attention on firms such as Quidel, Seegene, DiaSorin, BGI and several other firms that were already competing in the market but launched competitive tests for COVID-19 and related areas.

The Worldwide Market for In Vitro Diagnostics, 13th Edition is now availalble for pre-orders: https://kaloramainformation.com/product/the-worldwide-market-for-in-vitro-diagnostics-13th-edition/