IVDBO: Blood Screening Diagnostics 2024 Market Insights

Welcome to our latest blog, created in collaboration with The Scott Partnership Ltd., a renowned UK-based global marketing and communications agency specializing in the life sciences, healthcare, and technology sectors. Originally published on their platform, this blog marks the beginning of an exciting ongoing partnership with more blogs to come.

In Vitro Diagnostics Business Outlook’s (IVD BO) latest issue contains a special feature on the blood screening diagnostics market which provides in-depth market updates by segment and region.

This blog will highlight the key takeaways from this report, using data provided by Kalorama Information. IVD BO and Kalorama Information are part of the Science and Medicine Group, a leading research and advisory firm serving the life science, analytical instrument, diagnostic, healthcare, radiology, and dental industries.

Market summary

Blood screening for diseases such as HIV and syphilis is essential to ensure that blood transfusions are safe and effective, and ultimately saves lives. The global blood diagnostics market is driven by three main factors:

- Aging of developed markets

- New test applications

- Emerging markets

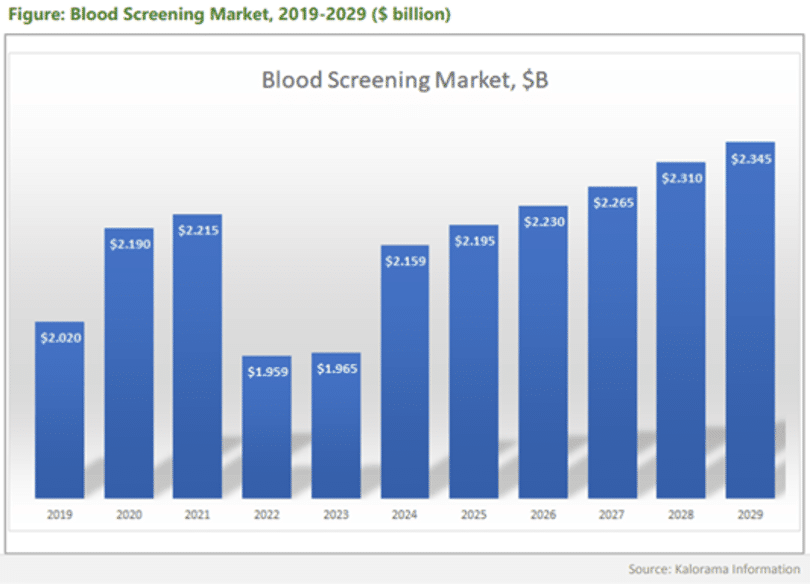

Currently, the market is valued at $2.16 billion. While it experienced a decline in 2022 and 2023 due to a decrease in both Zika virus and COVID-19 testing, growth is now forecast at a rate of 1.7% with the market expected to be worth $2.34 billion by 2029. HIV and hepatitis testing account for 63% of the market.

Regional markets

The World Health Organisation (WHO) reports that the Americas and Europe contribute 46% of the WHO region’s total blood donations. In line with this figure, North America and Europe dominate the global blood screening diagnostics market, generating around 56% of its market value. Their prominence can be explained by the:

- Strength of the donation market

- Price per test value

- Government regulations for blood screening.

The Asia Pacific market represents roughly 29% of the global market and is largely driven by Japan and China. In 2024, the US, Japan and Germany have emerged as global market leaders.

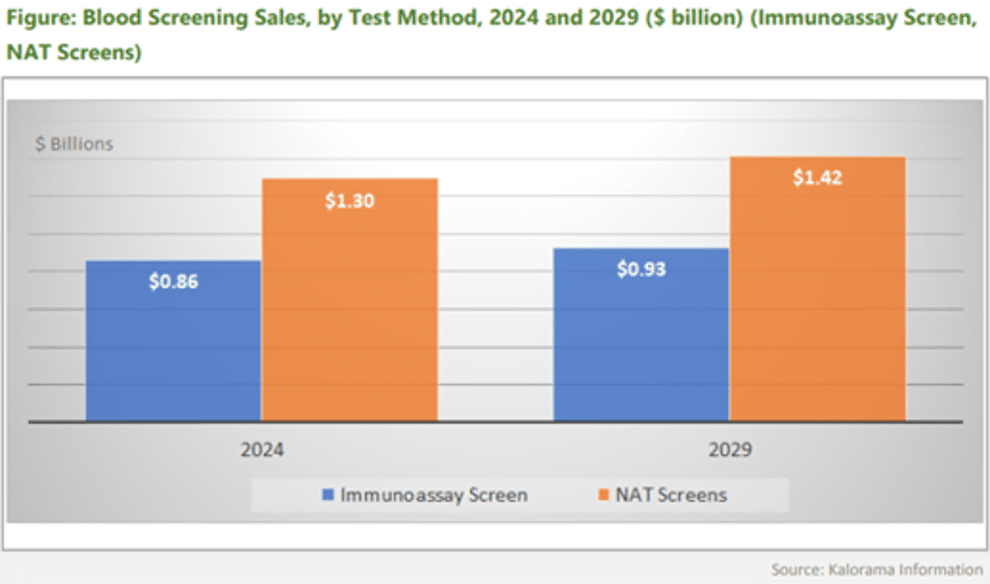

Immunoassays:

- Immunoassays are a routine method used to test for blood-borne infectious diseases, such as HIV, hepatitis B and malaria

- Blood screening immunoassays comprise 40% of the global blood diagnostics market

- Asia Pacific and North America dominate this segment with a combined market share of 58%

- Growth is driven by emerging markets.

NAT (Nuclear acid test) screening:

- NAT testing is used to screen for pathogenic agents, including HBV DNA and WNVRNA

- It is the most advanced method for directly detecting infections in blood and as a result is being adopted across the globe by countries such as Australia and South Africa

- NAT testing makes up the other 60% of the market, primarily due to the cost per test

- North America, Europe and Asia Pacific all currently occupy around 30% of the market

- Advanced technologies and consistent testing results have accelerated growth in this sector

- NAT testing is playing an important role in the increased blood safety measures being implemented by developing nations and will consequently drive growth in the global market.

Thank you to Daniel Granderson at IVD BO for these valuable insights. Kalorama Information’s IVD BO is a new bi-monthly subscription publication which provides a comprehensive view of the IVD market including company briefs and market data and forecasts. Learn more about IVD BO here.

The Scott Partnership supports clients operating in the IVD arena across the globe, helping them navigate challenges within the industry. Please get in touch to discuss tailored solutions for your company, or browse our list of services.

Kalorama Information shares updates on the latest developments and tools needed to stay ahead in the IVD industry.