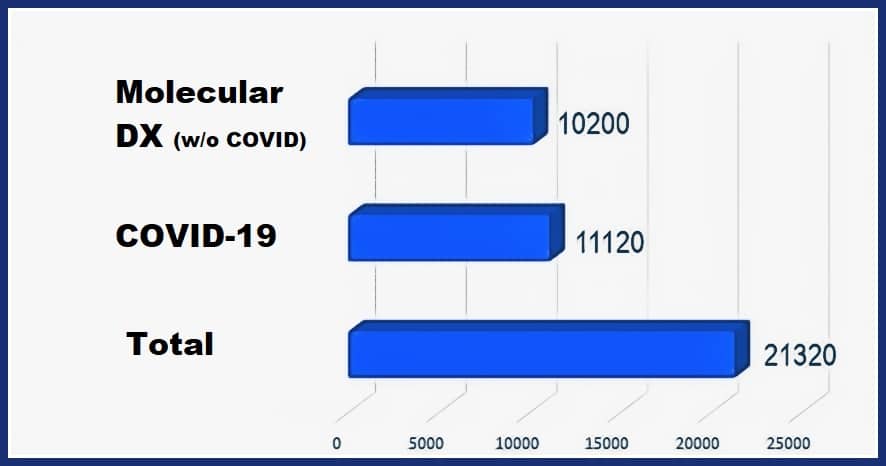

There is a market in excess of $21 billion for molecular testing technologies. For comparison purposes, this is nearly the size of the IVD market two decades ago. The majority of the market is COVID-19, but there remains a sizable market for other molecular IVD applications, from cancer to transplant typing to infectious diseases. It is notable that the first category where molecular diagnostics earned their place was infectious disease. In this category, specific results were needed for treatment decisions.

The pioneers in the molecular diagnostics field include Roche Diagnostics, Gen-Probe, and Becton Dickinson. In some form these players are all active today. And there are new entrants. The main focus of the initial molecular diagnostics products was infectious disease including HIV, Chlamydia Trachomatis/Neisseria Gonorrhoea (CT/NG), and TB. These diseases are still critical components of the market. Recently growth in molecular diagnostics methods has also been coming from inherited diseases, cancer, coagulation, and other areas.

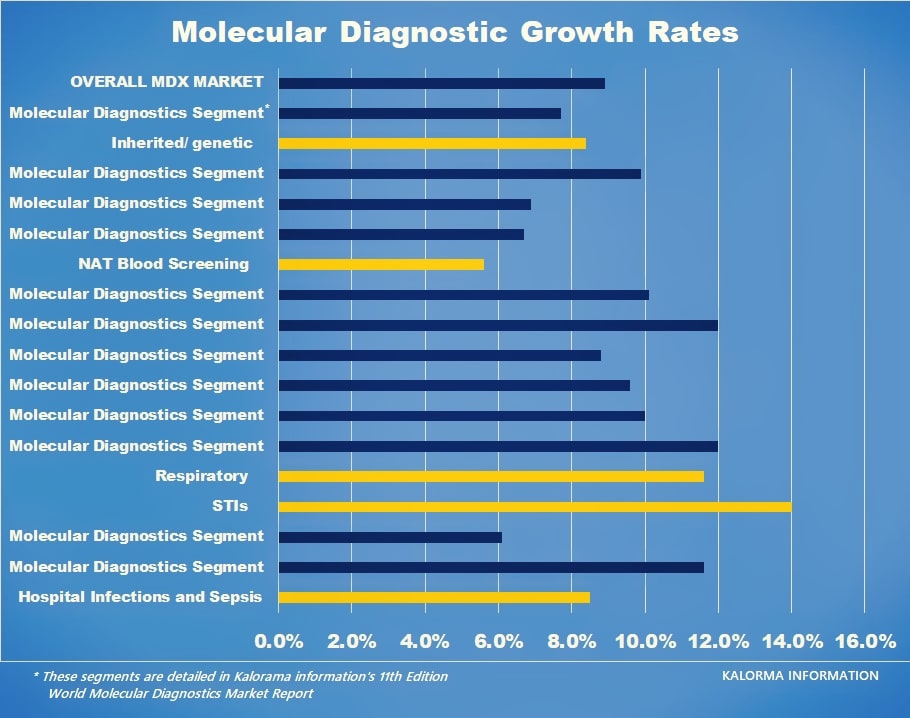

The following chart indicates growth areas (in red) by percentage revenue increase expected in the next five years. Leading the list is sexually transmitted infection testing.

COVID-19 reached the United States at the same time that a demographic shift was already underway, with older Americans requiring more services and more complex tests. Bureau of Labor statistics show that while most professions will need 5% more labor than they have, on average, with medical lab technologists that figure is 11%. There simply are not enough lab personnel to provide demanded test volumes. Similar industry trade group studies have shown that the influx of employees into the industry is insufficient and unsustainably low. And those that are working are stressed – an ASCP survey showed that most respondents reported feeling overwhelmed (varying degrees) by their workload (slightly overwhelmed, 37.6%; moderately overwhelmed, 29.5%; and very overwhelmed, 17.9%). Only 14.7% reported not feeling overwhelmed. More automation is needed. A new pipetting robot, flowbot ONE, is automating COVID-19 testing processes in European hospitals, thereby significantly reducing the time taken by laboratories to generate results. The robot is developed by Denmark-based Flow Robotics.

As molecular diagnostics manufacturers seek post-COVID-10 growth, we note that there is a roughly 10 billion-dollar market for sales of other types of molecular testing.

The company says its intuitive user interface can be mastered in just one hour. The company has termed flowbot ONE a liquid handling “cobot” as it collaborates with the user in the lab, assisting in workflows to provide accurate and consistent pipetting and results, saving time as well as increasing safety by minimizing manual handling of pathogenic strains.

Automation: In August 2022. Becton Dickinson (BD) launched a robotics-based, high-throughput molecular diagnostic system called BD Cor that will be available to labs in the U.S. that perform infectious disease testing. The BD Cor system uses robotics and sample management software algorithms. It is modular, scalable, and designed to address multiple needs within clinical labs for expanding molecular testing and increasing testing volumes.

Figure 1-2: Non-COVID-19 Growth Applications by Revenue Growth %