Lab-Developed Test Market Exceeds 12 Billion: What You Need to Know

What is a Lab-Developed Test?

In vitro diagnostic (IVD) tests are manufactured and sold by diagnostic companies following approval (or clearance) by the appropriate regulatory agencies. IVD tests are then distributed and used by many different clinical laboratories. In contrast, a laboratory developed test (LDTs) is developed by a clinical laboratory for use specifically in that laboratory.

There are thousands of FDA cleared or approved diagnostic tests, especially when you consider the large numbers of tests that are available for each analyte. So, why would clinical laboratories develop their own tests? The answer is simple. Despite the large number of FDA-cleared or -approved tests and CE-IVD marked tests, there remain many tests that are simply not available commercially for clinical labs to purchase. If a clinical laboratory wants to offer one of these tests, the lab must develop its own test.

Laboratory developed tests (LDTs) are not a recent phenomenon but due to the urgent need for testing of SARS-CoV-2, there has been a flood of new tests and the regulatory guidance has changed dramatically. Historically, these tests were low-volume, simple and well characterized for low-risk diagnostic applications. Today, high-risk, complex tests have been developed as LDTs, and are being used to provide clinical results to physicians and their patients.

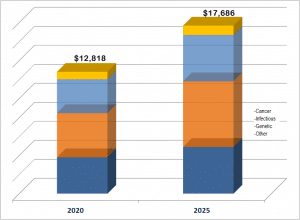

Kalorama’s Report Estimates a 12 Billion Dollar Market for LDTs

he market for LDTs offered as services is worth over $12 billion, as indicated in this sample below from tbe Kalorama Information’s newest report:

The LDT clinical services market is a large field that covers a wide range of activities, and this is reflected in the topics covered in this report. This report includes discussions of:

- Overview of laboratory developed tests (LDTs), including technologies used in LDTs and products sold to laboratories developing and performing LDTs

- Clinical applications for which LDTs are used

- Market drivers and challenges in the LDT market

- Sales for 2020 and projected to 2025 – LDT clinical diagnostic test services

- Sales for 2020 and projected to 2025 – Products sold to laboratories offering LDTs

- Profiles of companies in the LDT market

Information used to calculate the market sizes for the LDT clinical diagnostic service market were derived from a wide range of sources including public information about company sales; interviews with market participants including executives, marketing managers and product managers; Kalorama’s databases; and other industry sources.

This Market is Driven by Regulation and Changes in Regulation

The FDA has indicated that it would like to increase oversight of laboratory develop tests for many years. In July 2014, the FDA notified Congress that it plans to issue a draft guidance entitled “Framework for Regulatory Oversight of Laboratory Developed Tests (LDTs). On September 30, 2014, the FDA posted two draft guidances to its web site: “Draft Guidance for Industry, Food and Drug Administration Staff, and Clinical Laboratories: Framework for Regulatory Oversight of Laboratory Developed Tests (LDTs)” and “Draft Guidance for Industry, Food and Drug Administration Staff, and Clinical Laboratories: FDA Notification and Medical Device Reporting for Laboratory Developed Tests (LDTs).” The comment period for both of these documents lasted until February 2, 2015.

This has created considerable uncertainty. While has not been possible to know what the final guidance documents would say, it was clear that the FDA wants to increase oversight of LDTs, and to require 510(k) clearance or PMA approval of many LDTs.

The future of regulation of LDTs is even more uncertain now. In November 2016, in the wake of uncertainty following the presidential election, the FDA indicated that it would delay finalizing the draft guidance on LDTs. On January 13, 2017, the FDA issued a “Discussion Paper on Laboratory Developed Tests (LDTs).” This discussion paper synthesizes feedback that the FDA received on the 2014 draft guidance and proposes a prospective oversight framework. Some of the proposals in the discussion paper include “grandfathering” LDTs (except when required to protect public health), exempting certain categories of new or significantly modified LDTs, reduced time-frame for phasing in regulation of LDTs with risk-based and phased-in oversight, evidence standards, third-party review, clinical collaboratives, transparency, quality system requirements, and post-market surveillance.

Due to the need for coronavirus testing discussed above, the regulatory process is again being scrutinized. It has been planned that the FDA would step up oversight of LDTs after the 2016 election. However, that is not happen. The regulatory boat was stagnant.

At the start of the pandemic, FDA stressed the need for availability of coronavirus tests developed by laboratories and commercial manufacturers to meet the testing needs.

In March 2020, a bipartisan-backed bill called the Verifying Accurate, Leading-edge IVCT Development (VALID) Act was introduced to Congress. The VALID Act would create a new risk-based oversight framework for in vitro clinical tests, a category that was owned by LDTs and test kits. That was followed by a bill introduced later in the month by Senator Rand Paul called the Verified Innovative Testing in America Laboratories (VITAL) Act which would take regulation of LDTs out of the FDA’s hands.

In September 2020, the FDA was directed by the U.S. Department of Health and Human Services (HHS) to drop its pursuit of regulation of LDTs. Both the ACLA and the Association for Molecular Pathology backed the move of HHS. HHS stated that the move is a part of their ongoing department wide review of regulatory flexibilities enacted since the start of COVID-19. There continues to be mixed responses to the latest HHS move. Critics are concerned that this could negatively impact the accuracy of individual labs’ tests, allowing unreliable tests to come to market. This is probably not the last that we will hear about this controversy.

This a Unique Market to Quantify

Estimating revenues for products sold to these laboratories is more challenging as a result of many factors. For example, a laboratory may purchase an instrument with the intention of using that instrument to perform FDA cleared or approved tests and also LDTs on that instrument. Alternatively, a laboratory may purchase a research instrument, and then validate and use LDTs on that instrument as well as potentially performing some studies. Also, clinical laboratories may use consumable reagents for applications that were not intended by the manufacturer. For example, a clinical laboratory may use an FDA cleared or approved test on a non-approved type of specimen after the required validations have been completed for the LDT. In this example, the reagents used by the clinical lab for the LDT may be reported by the diagnostic company as an IVD product, and not as a component of an LDT. These are just a few of the challenges to be faced when estimating the size of the market for products sold to clinical laboratories for use in LDTs.

Oncology LDTs Lead

Much of the focus and attention in recent years has been on the emergence and growing use of complex LDTs based on technologies such as polymerase chain reaction (PCR), microarrays, and next generation sequencing. To generate test results that were not previously possible, LDTs are being developed and used in many different applications. The largest segments of this market are oncology, genetic (inherited) disorders, and infectious disease, but laboratory developed tests can be developed and used for virtually all disorders.