Food Animal Diagnostics Market: Spotlight on Disease Testing Amid Bird Flu Surge

The global veterinary diagnostics market is set to experience a 6% compound annual growth rate (CAGR) over the next five years. This growth is driven by low barriers to market entry, a competitive landscape that allows for substantial advancements in various segments, a continued surge in pet ownership, and growing concerns over the emergence of various zoonotic diseases affecting food animal health and safety, according to The World Market for Veterinary Diagnostics, 8th Edition, a new report by Kalorama Information.

Veterinary diagnostics have seen extensive application of in vitro diagnostic instrumentation and products, transitioning from clinical settings to veterinary clinics and laboratories. This market supports a wide array of tests for animal-specific diseases (e.g., bluetongue disease, classical swine fever, feline leukemia) and zoonotic diseases (e.g., influenza, transmissible spongiform encephalopathies, brucellosis).

Veterinary diagnostics play a crucial role in:

- Routine testing during clinical visits or check-ups for companion animals.

- Diagnosing diseases in symptomatic companion animals.

- Conducting zoonotic disease surveillance in wildlife populations.

- Screening and confirmatory testing in livestock and production animals as part of disease control efforts.

Effective and specialized veterinary diagnostics are essential for international trade, public health, agricultural productivity, consumer confidence, and the relationships between companion animals and their owners. Expertise in molecular diagnostics, virology, and bacteriology is particularly vital in the food animal diagnostics space, where emergent threats and outbreaks require the development of new assays.

The veterinary diagnostics market is divided into two primary segments: food animal (livestock and production animal) and companion animal (pets and domestic animals, including horses) diagnostics. These segments differ significantly in terms of demand, drivers, and primary product groups.

Food Animal Diagnostics

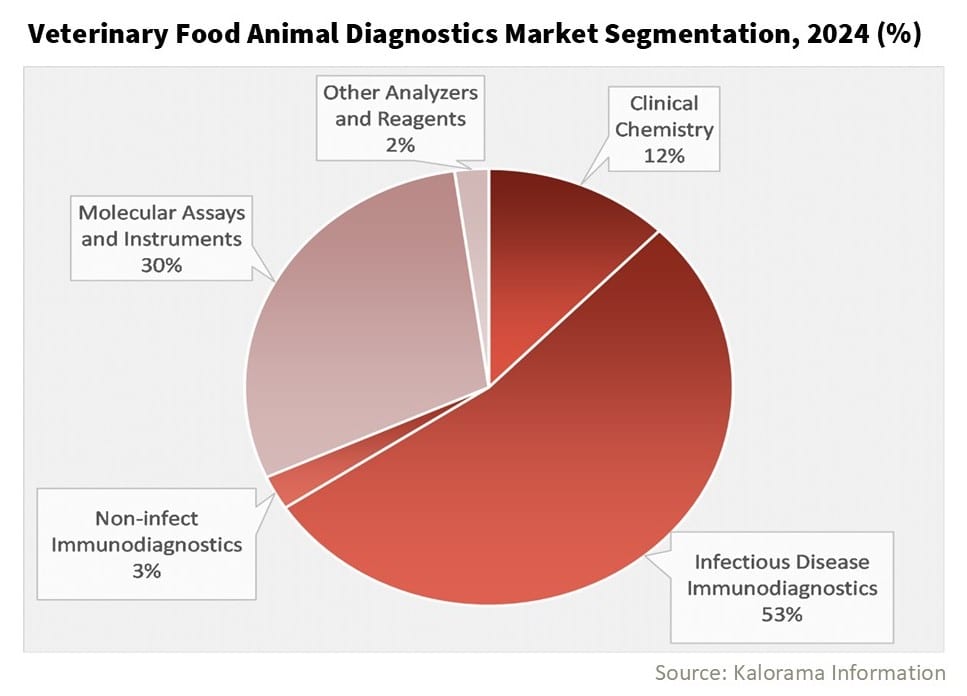

The World Market for Veterinary Diagnostics, 8th Edition reveals that the global food animal diagnostics market segment was valued at more than a $1 billion in 2024. Infectious disease immunodiagnostic instruments, test kits, reagents, and other supplies make up over half (53%) of the segment’s sales [see chart]. The food animal diagnostics market is forecast to have a CAGR of 3.5% through 2029.

Food animals, raised for meat consumption, are subject to diagnostics primarily for infectious disease testing. This testing is crucial for mitigating production loss by preventing disease spread. This market is vital not only for industry productivity but also for public safety, particularly in the case of zoonotic diseases that can spread to human populations.

The food animal diagnostics market is characterized by:

- High centralization with high test volumes.

- Predominantly immunodiagnostic and molecular infectious disease tests performed by reference laboratories.

- Active surveillance programs testing millions of individual food animals annually.

Active surveillance programs may test millions of individual food animals a year. Infected food animals are destroyed rather than treated, and statistically, few food animals will receive core lab testing (e.g., hematology, chemistry, etc.) as part of treatment, which is typically limited to vaccination.

Avian Influenza Outbreak

In 2024, over 100 animal diseases, infections, and infestations were identified across various species. Avian influenza remains a significant concern that has had a significant economic impact in the United States in the early months of 2025.

Since January 2022, over 134.5 million birds have been affected across all 50 states and Puerto Rico. The ongoing bird flu outbreak has led to record-high egg prices and widespread economic impact.

In February 2025, egg prices hit a record high as the U.S. contended with an ongoing bird flu outbreak. According to the Associated Press, the average price of a dozen Grade A eggs in U.S. cities reached $4.95 in January, eclipsing the previous record of $4.82 set two years earlier and more than double the low of $2.04 recorded in August 2023. This spike in egg prices was the biggest since the nation’s last bird flu outbreak in 2015 and accounted for roughly two-thirds of the total increase in food costs in January 2025.

Conclusion

The recent nationwide focus on bird flu underscores a vital truth: the food animal diagnostics market is a dynamic and indispensable part of the veterinary diagnostics industry. With continuous advancements and an increasing demand for specialized testing, this market is poised to play a pivotal role in safeguarding the health and safety of both animals and humans.

For more information, purchase The World Market for Veterinary Diagnostics, 8th Edition.

About the Report

The veterinary diagnostics industry is undergoing a period of rapid expansion, driven by advancements in in vitro diagnostic (IVD) technology, increasing pet ownership, and the growing need for disease control in livestock. Kalorama Information’s January 2025 market research report, The World Market for Veterinary Diagnostics, 8th Edition, provides a deep dive into this evolving sector, offering strategic insights, market sizing, and forecasts that highlight key growth opportunities for industry stakeholders from 2024-2029.