Molecular Point of Care Market Reaches 3.5 Billion

The molecular point of care market reached 3,555 million in 2021, according to Kalorama Information’s latest report. The Market and Potential for Molecular Point-of-Care. COVID-19 sales were the main driver.

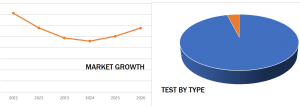

That is 10x growth in revenues from 2019. The COVID-19 pandemic and consistent arrival of variants are the determining factor, and the continued presence of COVID will be a factor in the market.

Growth At the End of Near-Term Downward Trend, and Domination by a Few Categories. Specific Market Data Can Be Found in Kalorama’s Report

Molecular point-of-care (mPOC) diagnostic solutions offer improvements in the sensitivity and specificity of existing near-patient and rapid tests while expanding the diagnostic capabilities at points of care such as hospital critical care units, physician offices, outpatient clinics, and community health posts in the developing world, and are used to assess conditions or admit patients. The concept of molecular point of care is to mix the accessibility of POC testing with the accuracy of molecular technology. Kalorama has covered molecular point-of-care on a yearly or biyearly basis since 2013.

Most common models are GeneExpert by Cepheid, IDNOW by Abbott and BioFire by Biomerieux. Specifically, Kalorama Information defines Molecular Point of Care or mPOC devices as those that run PCR or other DNA and RNA testing on a portable device; features include:

• DNA or RNA test technology

• Small footprint and reasonably portable

• Result time fast enough for office visit or bedside consultation

• Use possible outside of a reference lab

• Uses cartridges

• Limited or no sample preparation

• Is either running CLIA-waived tests or moderate complexity tests with potential for CLIA-waiver approval.

This does mean that some test run on even mPOC systems are not in the true mPOC market. Kalorama defines this in the report.

While some mPOC systems may be used in labs that find their speed beneficial, that is not always their one purpose.

As market watchers, we occasionally face changes in markets as we report them. Kalorama issued a special H1N1 “Swine Flu” Testing report in 2009 to accommodate developments. Now COVID-19 has created an even more serious situation. As we examine what is already a novel market segment, there is now a much greater-than-expected impact. What that ultimate impact will turn out to be is difficult to assess; a successful outcome for mPOC products would depend on a careful ballet of regulatory approvals, provider adoptions and fast-paced development. Yet the potential is there; molecular POC systems are in a unique, and perhaps timely position.

mPOC Positioned for COVID-19

In a note on our blog in 2020, we predicted that molecular point of care was uniquely qualified to respond to a pandemic such as COVID-19, and that has proven true. Along with the spread of COVID-2019 has arisen the issue of making diagnostic tests available on a large scale. There have been a range of challenges related to supply chain management, which relate primarily to laboratory tests. In addition, there has arisen the need for small or portable systems to support testing in more remote areas.

At the height of COVID’s peaks, regional hospitals, cruise ships, airports, hotels and other locations were being overwhelmed and the requirement to send samples to a reference laboratory for testing, which takes two or more days, was not always meeting timely demand. mPOC tests can enable care providers to obtain laboratory-quality results in 30 minutes or less, facilitating more immediate response to the spread of the coronavirus.

The mPOC products have been slower to arrive, and in a lower amount, largely due to the technological challenges compared to lab tests. The following provides the tests that have been given EUA by the FDA:

Near Patient Market Also Defined

A much larger market can be estimated for molecular systems that can be brought near patient, but which do not meet a true point of care criteria. This market is almost $8 billion, however near patient designation includes tests that could be several hours in turnaround and systems that are not usually marketed to physician offices and clinics, and may not have a reasonable chance of a CLIA-waiver in the forecast period. Kalorama defines this in its report.