What’s Driving and Restricting Out-of-Pocket Healthcare Spending in the U.S.

Over the next five years, projections indicate a continued increase in total consumer out-of-pocket expenditures for healthcare, maintaining the upward trajectory observed in recent years. Despite a temporary slowdown during the COVID-19 pandemic of 2020 and 2021, the historical trend resumed in 2022 and persisted through 2023, with expectations for ongoing growth. These insights stem from the analysis provided in Out-of-Pocket Spending in Healthcare, 6th Edition by Kalorama Information, a leading medical market research firm.

From 2018 to 2023, total U.S. consumer out-of-pocket healthcare expenditures grew by an annual rate of 7%, and this growth is anticipated to remain steady over the next five years, with an expected annual increase of 10%. This expansion will be fueled by various factors, including the escalating usage of direct-to-consumer (DTC) laboratory tests.

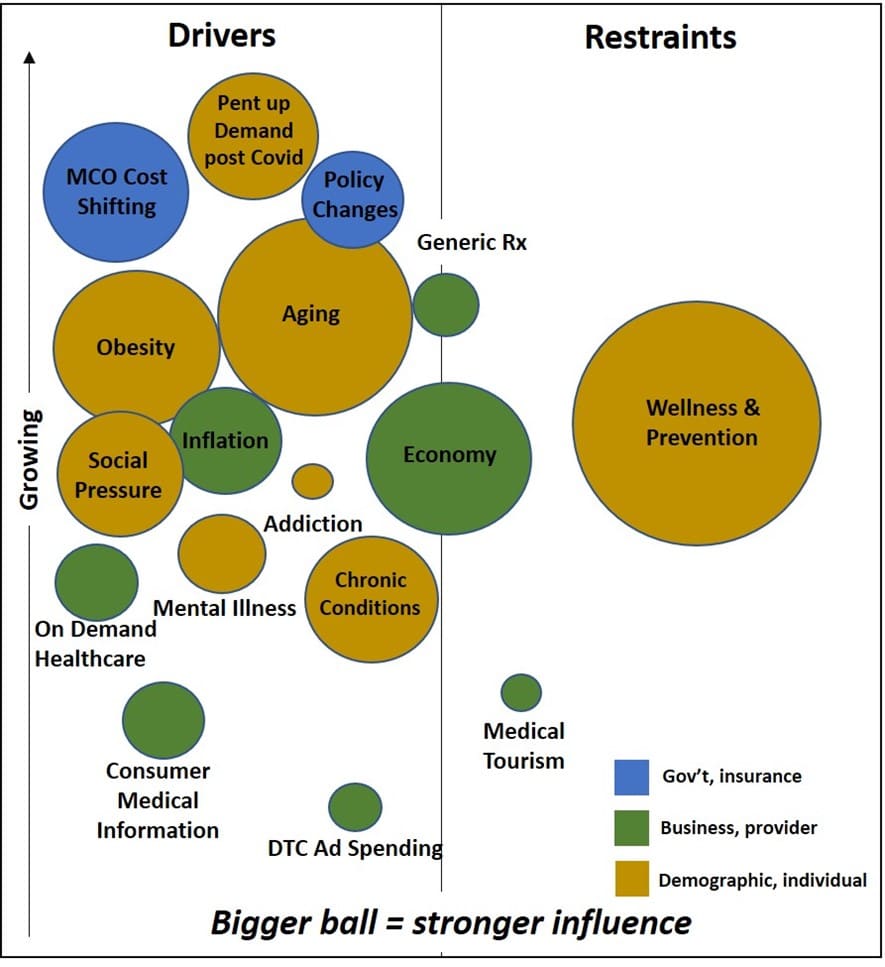

Several drivers underpin the significant growth in out-of-pocket spending, encompassing governmental, regulatory, and insurance/payer actions such as Managed Care Organization cost shifting and policy changes amplifying healthcare costs. Additionally, business and economic trends, heightened recent inflation, pent-up demand for medical products and services post-Covid lockdowns, social pressures relating to attractiveness standards, and demographic shifts including obesity, aging, and chronic conditions all contribute to this upward trajectory. Notably, government spending during the pandemic has exacerbated inflation, further influencing healthcare costs.

Of these drivers, governmental and economic factors wield the greatest influence on out-of-pocket expenditures.

However, efforts aimed at wellness and prevention serve as countermeasures to mitigate the escalation of out-of-pocket spending. These initiatives encompass disease management programs initiated by healthcare payers, employers, and other stakeholders, along with individual endeavors to enhance self-care and overall well-being.

Indeed, individual efforts, often influenced by societal trends, cultural shifts, and the introduction of innovative products and services, can frequently yield more significant impacts than initiatives implemented by large organizations.

It’s crucial to acknowledge that certain factors, such as the state of the economy, can both stimulate and hinder out-of-pocket spending, contingent upon prevailing conditions. In periods of economic strength, characterized by low unemployment rates, individuals typically experience:

- Increased discretionary income, enabling them to allocate more funds towards healthcare expenses.

- Greater propensity to purchase elective healthcare products and undergo procedures.

- Ability to invest in wellness and preventive measures.

Simultaneously, during these times, individuals tend to:

- Enjoy better health, necessitating fewer healthcare products and services.

- Benefit from employer-provided coverage, resulting in lower personal expenditure.

Conversely, during economic downturns marked by higher unemployment rates:

- Individuals often defer non-essential healthcare expenditures.

- Investment in wellness and preventive measures tends to decline.

However, it’s notable that during such periods, individuals may require heightened healthcare services due to increased stress levels and associated health challenges.

For more information, purchase Out-of-Pocket Spending in Healthcare, 6th Edition. Click HERE for more information.

About the Report

The 6th edition of Out-of-Pocket Spending in Healthcare delves into the historical, present, and projected levels of out-of-pocket healthcare costs in the United States. It analyzes both overall expenditures and specific sub-groups, such as by type, payment method, and elective versus non-elective procedures. This report meticulously examines significant trends, with a particular emphasis on the financial dynamics driving the growth of out-of-pocket spending. Additionally, it provides forecasts for total expenditures and specialized healthcare financing, offering valuable insights into the future landscape of healthcare expenses.

About Kalorama Information

Kalorama Information, part of Science and Medicine Group, is the leading publisher of market research in healthcare areas, including in vitro diagnostics (IVD), biotechnology, medical devices, and pharmaceuticals. Kalorama Information produces dozens of reports a year. The firm offers a Knowledge Center, which provides access to all published reports.

Kalorama Information’s studies feature independent primary research conducted by experienced analysts. Researchers build their market analysis independently from published databases, validating data with inside industry contacts and extensive secondary research, so you can have confidence that you’re getting your information from the most trusted source in the industry.