Pandemic Pushes Rx To OTC Switches

The U.S. Rx-to-OTC market has grown into a $13,807 million ($13.8 billion) market, according to 2021 estimates by leading medical market researcher Kalorama Information in the new report The Market for Rx-to-OTC Switches, 8th Edition. This has mainly been due to factors such as patent expirations, increasing competitiveness with the pharmaceutical environment, the FDA willingness to work with industry, brand re-invention, consumer demand, and cost containment strategies. The U.S. market for Rx-to-OTC switches encompasses a wide variety of products that have been determined safe and effective as over-the-counter products, once available only by prescription.

The growing market increased by 14.5% from 2019 to 2020 as a result of effects from the COVID-19 pandemic. During the pandemic, the increase in COVID-19 cases, continued incidence of allergy, gastrointestinal and pain symptoms and a reduction the available in-person health visits increased the demand for OTC treatments during this time-period. This continued, at a slightly lower level, during 2021.

Kalorama estimates that more than 700 products have made the switch from Rx to OTC over the past several decades. Aging populations, many of which are taking greater interest in their health, have created a growing Rx-to-OTC industry in America. It is anticipated that Rx-to-OTC switch products will continue to grow as interest from both consumers and developers continue to expand.

“The market is fueled by several factors including the graying of America, steadily increased incidences of conditions and diseases, new drug classes switched to OTC, product demand, financial factors, and economic conditions to name a few,” reports Kalorama Information.

Many of the new products that are on the market may be potential candidates after standing the test of time as a prescription product. Also, the demand for OTC products is not likely to diminish, giving rise to more possibilities in the switched categories. Over one third of American consumers use an OTC medication at least every other day and the numbers are increasing on a regular basis as more products appear on the OTC market.

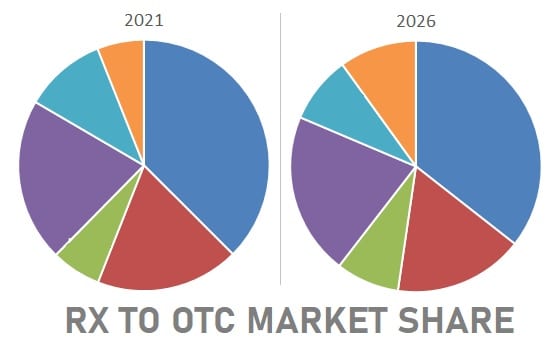

The U.S. market for Rx-to-OTC switches is comprised of manufacturer’s revenues in the following segments:

- Allergy, Cough, Cold, and Sinus Products

- Analgesics, NSAIDs, and Other Drugs

- Anti-Infectives

- Gastrointestinal Drugs

- Smoking Cessation

- Other Drug Classifications (including contraceptives, dental rinses and fluorides, hair growth products, rectal ointments, overactive bladder treatments, sleep aids and weight management products)

All areas contribute to the growth and development of the OTC market; however, new product development and additional regulatory review and approval of new OTC drug classifications, specifically in areas such as gastrointestinal drugs, analgesics, allergy treatments, hair growth products, cholesterol-reducing drugs, urinary disorder treatments, contraceptives and sexual dysfunction treatments will be major forces in the future market. Some of these segments will experience growth due to new introductions during the forecast period, while other segments may not achieve market approvals until after the forecast period.

Kalorama’s report, The Market for Rx-to-OTC Switches, 8th Edition, can be found at: https://kaloramainformation.com/product/the-market-for-rx-to-otc-switches-8th-edition/\