What In Vitro Diagnostic Companies Need From Contract Manufacturing Now

The contract manufacturing market is up, and it’s not just a result of excess production needs for COVID-19 trends. It’s reflective of a trend that was present even in the last decade, finds Kalorama Information’s latest report The Market for Contract Manufacturing in In Vitro Diagnostics (IVD) https://kaloramainformation.com/product/the-market-for-contract-manufacturing-in-in-vitro-diagnostics-ivd/

The contract manufacturing market for IVD products is expected to grow from 15.6 billion in 2021 to 16.1 Billion in 2022. That growth is slightly higher (+1%) than the IVD market itself, and is reflective even of some decline in contracting for COVID-19 in vitro diagnostic tests. Contract manufacturing also enables new and smaller IVD producers to build up product lines and increase competitiveness in the marketplace.

Moreover, the segment is the major source of private label tests, instruments, and accessories sold by medical supply and device distributors, home healthcare outlets, and drug stores. Private label applications have expanded considerably over the past few years largely due to the impact of the COVID-19 pandemic.

“Market growth is not just about COVID-based PCR test demand. 69% of contract manufacturing demand is for two non-molecular markets: chemistry and immunoassay tests.”

Kalorama information The Market for Contract Manufacturing in In Vitro Diagnostics

Evolving trends in IVD contract manufacturing will result in the developed economies retaining more than three-fourths of the total global demand. However, led by China and India, the developing countries will account for much faster growth in revenues, or 7.5% annually through 2026. The developing world will provide opportunities for an increasing level of contract IVD manufacturing business based on anticipated improvements in patient testing capabilities and the pursuit of expanded product lines by local IVD companies.

Unlike other medical device segments, the IVD industry has been slow to transfer manufacturing responsibilities to outside contractors in the developing countries. In spite of offering lower overall costs, contractors in these locations were often unable to produce quality products on a consistent basis.

Moreover, in some developing countries, including China and India, contract manufacturers failed to protect the intellectual property of their clients, leading to widespread piracy of instrument designs and reagent formulations.

Rather than risk the loss of prospect of product recalls and the loss of intellectual property, IVD companies historically have relied on developed world firms for contract manufacturing services. This trend is changing gradually as suppliers in China, India, and various other developing countries are upgrading production capabilities and expertise and establishing tighter security measures to protect patents and other intellectual property.

Among the developing world contract IVD manufacturers now able to meet the quality and security requirements of their developed world clients are Advy Chemical, BIT Group (through subsidiaries), Biokit, Fapon Biotech, Guilin Royalyze Medical Instrument, Invetech, and Tulip Diagnostics.

Through 2026 and beyond, the advanced, diversified IVD industries of the United States, Western Europe, and Japan, along with the emerging IVD industries of China and India, account for more than 87% of global contract IVD manufacturing revenues.

In developed markets, outside contractors are assuming an increasing role in the commercialization and production of both specialty and commodity products for major IVD producers such as Abbott Diagnostics, Danaher, Roche Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific. Contract IVD companies in China, India, and other emerging markets focus on manufacturing high volume reagents, instruments, and OEM components through outsourcing agreements with domestic and foreign-based clients. However, many of these contractors are pursuing diversification into higher value-added applications, including the development of molecular assays and POC immunoassays.

The principal deterrent inhibiting growth in contract IVD services will involve a gradual decline in the volume of COVID-19 testing procedures. This trend will weaken growth in the value of immunoassay applications met by outside contractors and lead to a decrease in the value of demand posted by contract molecular assays. Excluding COVID-19 testing, most contract IVD services will fare well in the global marketplace

More than 500 competitors are active in global contract IVD manufacturing markets. Most participants are small- to medium-sized concerns that provide related products or services to other customers. Affinity Life Sciences, Biokit, Calbiotech, Celestica, Cenogenics, Cone Bioproducts, Coris BioConcept, DiaCarta, Fapon Biotech, IDxDI, In Vitro Diagnostic Solutions, InBios International, Invetech, Jabil, KMC Systems, LRE Medical, Maxim Biomedical, Meridian Bioscience, MilliporeSigma, Nova Biomedical, Phillips-Medisize, Plexus, Promega, Randox Laboratories, ReAgent Chemical Services, Sanmina, Savyon Diagnostics, STRATEC, TCS Biosciences, Thermo Fisher Scientific, Tulip Diagnostics, and Ximedica are among the notable companies involved the business.

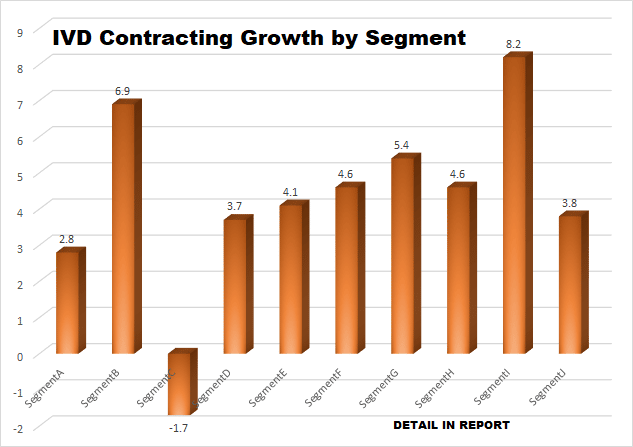

These are among some of the products where Kalorama projects that market demand in the next five years will be higher than the overall market for contract manufacturing for IVD. This does not mean other areas will not provide market opportunity, but these areas will grow faster than the rest of the market:

- Immunoassay Reagents

- Chemistry Reagents

- Glucose Enzymes

- Chemistry Tests

- Microbiology Media

- Histology Molecular Probes

- Hematology Reagents

- Coagulation Tests

- Blood Bank Test Instrument Components

- Mass Spectrometry Systems