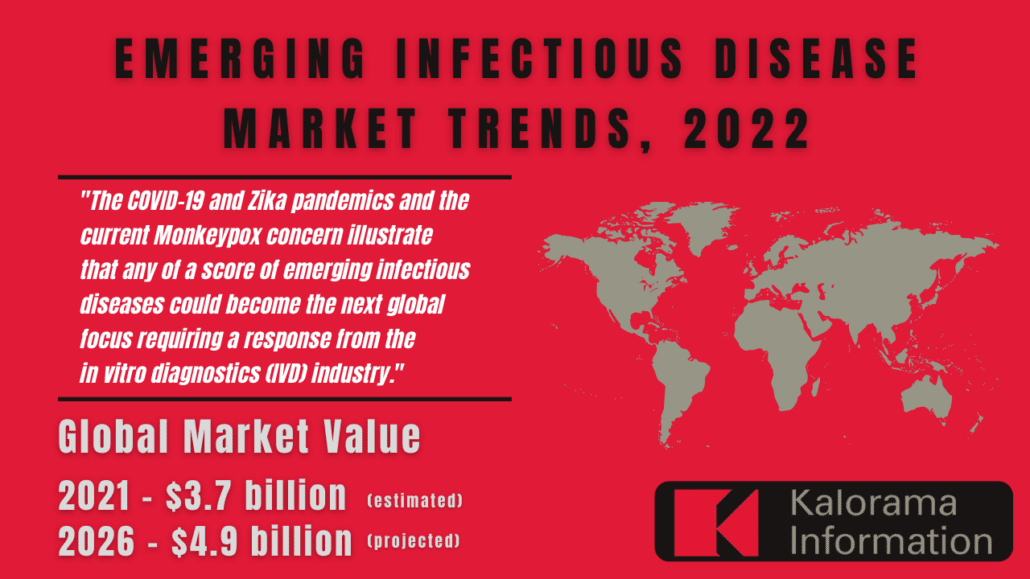

What Will Be the Next Emerging Disease Requiring IVDs?

Kalorama estimates a $3.7 billion market for emerging diseases. This market is expected to grow to $4.9 billion in 2026. This is based on it’s latest report: Emerging Infectious Disease Market, released August 2022: https://kaloramainformation.com/product/emerging-infectious-disease-diagnostics-markets-and-trends-2022/

In 2015 the World Health Organization held a workshop on prioritization of pathogens “for accelerated R&D for severe emerging diseases with potential to generate a public health emergency, and for which no, or insufficient, preventive and curative solutions exist.” The list was updated in 2018 and again in 2021. Among these are Ebola, Zika, MERS, Nipah Lassa Fever and others. Human transmissibility (including population immunity, behavioral factors, etc.), Severity or case fatality rate, Spillover potential, Evolutionary potential, Available countermeasures, Difficulty of detection or control, Public health context of the affected area(s), Potential scope of outbreak (risk of international spread), Potential societal impacts.

This is a high competitor-involvement IVD market. That’s because although most markets today are small, outside of TB and malaria, the the opportunity is great for finding the most effective test for Disease X.

Kalorama Information

A particular concern is mosquito borne diseases, because of the speed by which they can spread and recent trends of ‘island-hopping’ diseases into the United States via the Carribean. For many mosquito-borne illnesses, there is no vaccine and little in the way of treatment as the infections are viral. Thus preventing the illness is key. Malaria, Chikungunya, Yellow Fever, Dengue, West Nile Virus and Zika are among these diseases.

Disease prevention is dependent on local governments and even homeowners in some cases. Local mosquito control departments ascertain the numbers and types of mosquitoes in an area and the infections they may be spreading. Professionals share prevention information with the public and use multiple methods at the same time to kill mosquito larvae and adult mosquitoes. Professionals from local government departments or mosquito control districts develop mosquito control plans, perform tasks to control mosquito larvae and adult mosquitoes, and evaluate the effectiveness of actions taken. Methods can include eliminating mosquito larval habitats, applying larvicides to kill mosquito larvae, or spraying insecticides from trucks or aircraft to kill adult mosquitoes.

Mosquitos have natural predators that collectively can exert some influence on reducing mosquito populations. However, with a very few exceptions, predators generally have little effect on reducing the mosquito population over a large area. Predators of mosquitos include: Bats , Birds, Goldfish, guppies, bass, bluegill and catfish prey on mosquito larvae. Frogs and Tadpoles, Turtles, Dragonflies, Damselflies and Spiders.

Non mosquito-spred diseases of concern include: Tuberculosis, Chagas, Lyme Disease Marburg virus, Rift Valley Fever,Ebola, Ross River Virus, CCHF, Nipah and Lassa Fever. Scores more are detailed in the report.

This is a company with high competitor involvement. Large IVD concerns are involved in developing and marketing tests for emerging diseases. So are smaller companies with innovative tests. Companies with products in this market include: Roche, Abbott, OraSure, Cepheid, Bruker, Thermo Fisher, Siemens Healthineers, ELITechGroup, Arkray Healthcare, Zeus Scientific , Ortho Clinical Diagnostics, Alpha Diagnostics, Altona DiagnosticsSavyon Diagnostics, Oxford Immunotec, Avioq, Biocartis, Biomeme, Qiagen, Fujirebio, Hologic, InBios, Becton Dickinson, BGI, bioMerieux, SD Biosensor NovaTec , Seegene, Vela Diagnostics , Trinity Biotech and many other companies.