Kalorama’s latest report reports that more than 9 billion will be earned by IVD companies selling both molecular and immunoassay tests. 9,040 million dollars. The worldwide COVID-19 crisis has spawned hundreds of diagnostic testing kits and daily announcements. How do you sort out the significant tests with large distribution and market share from promising startups or low volume companies? This Kalorama COVID-19 IVD Test Tracker will update on new EUAs with information and analysis from Kalorama analysts, updated on a regular basis. Kalorama Information has covered diagnostics for 2 decades.

Antigen Tests on the Market or in Development

Antigen tests, most of which are performed rapidly at the point of care, detect viral particles rather than antibodies in the patient. They can offer some major benefits in the effort to control the SARS-CoV-2 pandemic.

The decision to apply antigen tests in certain situations as opposed to others is complicated and is still being completely sorted out. Variables can include:

- Sensitivity and specificity of the test

- Prevalence/outbreak of COVID-19 in the given population

- Remote location, availability of laboratories/hospitals

- Turnaround time of the test

- Cost of the test

- Ability to perform serial testing

Following are a list of antigen tests on the market or in development. Most are rapid test designed for a point-of care setting, but increasingly lab-based tests are in development and being employed in CE mark-accepting countries.

| Abbott Laboratories | BinaxNow COVID-19 Ag Card & Navica app |

| Abbott Laboratories | Panbio COVID-19 Ag Rapid Test Device |

| Access Bio | CareStart COVID-19 Antigen |

| BD | BD Veritor System for Rapid Detection of SARS-CoV-2 |

| Celltrion | Sampinute COVID-19 Antigen MIA |

| Genomic Vision | Coronadiag Ag |

| LumiraDx | SARS-CoV-2 Ag Test |

| Menarini Diagnostics (excl Europe distr for Boditech Med) | iChroma COVID-19 |

| Menarini Diagnostics (excl Europe distr for Boditech Med) | AFIAS COVID-19 AG |

| OraSure Technologies | at-home test |

| Quidel | Sofia SARS Antigen FIA |

| Quidel | Sofia 2 Flu + SARS Antigen FIA |

| Roche | SARS-CoV-2 Rapid Antigen Test |

| Roche | Elecsys Anti-SARS-CoV-2 Antigen Test |

| DiaSorin | Liaison SARS-CoV-2 Ag test |

| Abace Biology | COVID-19 Viral Antigen Test Kit |

| Abace Biology | COVID-19 Viral Antigen Test Kit |

| Abwiz Bio | RabWiz Ultra Sensitive COIV-19 Viral Antigen Test Kit |

| Alfa Scientific Designs | Instant-view PLUS COVID-19 Antigen Test |

| AllTest Biotech | COVID-19 Antigen Rapid Test |

| AllTest Biotech | COVID-19 Antigen Rapid Test |

| AllTest Biotech | COVID-19 Antigen Rapid Test cassette |

| AllTest Biotech | COVID-19 and Influenza A+B Antigen Combo Rapid Test with Reader |

| AMEDA Labordiagnostik GmbH | AMP Rapid Test SARS-CoV-2 Ag |

| AmonMed Biotechnology | COVID-19/Influenza A virus/Influenza B virus test kit |

| AmonMed Biotechnology | COVID-19 Antigen Test Kit |

| AmonMed Biotechnology | COVID-19 Antigen Rapid Test Kit |

| Apollo Biomedical LLC [New Gene (Hangzhou) Bioengineering ??] | Novel SARS-CoV-2 Coronavirus Spike Glycoprotein Detection Kit (S Protein-ACE2 receptor) |

| Apollo Biomedical LLC | Novel SARS-CoV-2 Coronavirus/MERS-CoV/Influenza Virus A/B Multiple Antigen Detection Kit |

| Aptamer Group | ADx SARS CoV-2 Virus Antigen Rapid Point of Care Test |

| ArcDia International | mariPOC COVID-19 test |

| Assure Tech (Hangzhou) | COVID-19 Antigen Rapid Test Device |

| Beckman Coulter | Test Announced |

| Bioeasy Biotechnology | 2019-nCoV Ag Fluorescence Rapid Test Kit |

| BIOHIT HealthCare | SARS-CoV-2 Antigen assay kit |

| BIOHIT HealthCare | SARS-CoV-2 Antigen Rapid Test Kit |

| BIOHIT HealthCare | SARS-CoV-2 Antigen quantitative assay kit |

| Bionote | NowCheck COVID-19 Ag Test |

| Bioperfectus Technologies | PerfectPOC Novel Corona Virus (SARS-CoV-2) Ag Rapid Test Kit |

| Bioss | SARS-CoV-2 Nucleoprotein ELISA Kit |

| Biosynex Swiss SA | BIOSYNEX COVID-19 Ag BSS |

| CerTest Biotec | CerTest SARS-CoV-2 card test |

| CerTest Biotec | CerTest SARS-CoV-2 + Flu A combo; CerTest SARS-CoV-2 + Flu A+B combo; CerTest SARS-CoV-2 + Flu A+B + RSV |

| Confirm BioSciences | Verasure COVID-19 Antigen Rapid Swab Test |

| CorisBioConcept | COVID-19 Ag Respi-Strip |

| Creative Biolabs | SARS-CoV-2 Antigen ELISA Kit |

| Deangel Biological Engineering | Novel Coronavirus S Glycoprotein Detection Kit |

| Denka Seiken | QuickNavi-COVID19 |

| Diagreat Biotechnologies | 2019-nCoV Antigen Rapid Test Kit |

| Dynamiker Biotechnology | Dynamiker SARS-CoV-2 Ag Rapid Test |

| Edinburgh Genetics | ActivXpress+ COVID-19 Antigen Complete Testing Kit |

| FenHe Technology | reOpenTest COVID-19 Rapid Antigen Test |

| GaDia Diagnostics | COVIDia – Antigen |

| GenBody | GenBody COVID-19 Ag |

| Genesis Biodetection & Biocontrol | COVID-19 Antigen Rapid Test Device |

| Genspeed Biotech | Genspeed Ag xPOC |

| Genspeed Biotech | COVID19 COMPLETE – IgG/Ag Test |

| GenSure Biotech | COVID-19 Antigen Rapid Test Kit |

| Green Cross Medical Science Corp | GENEDIA W COVID-19 Ag |

| Hiwow Group | Novel Coronavirus(SARS-Cov-2) Antigen Rapid Test Cassette |

| Humasis | COVID-19 Ag Test |

| Humasis | COVID-19/Flu Ag Combo Test |

| Joinstar Biomedical Technology | COVID-19 Antigen Rapid Test |

| JOYSBIO Biotechnology | COVID-19 Antigen Rapid Test Kit (Colloidal Gold) |

| Kewei Clinical Diagnostic Reagent | Kewei COVID-19 Antigen Rapid Test Kit |

| Kewei Clinical Diagnostic Reagent | Kewei COVID-19 Antigen Rapid Test Kit |

| Koch Biotechnology (Beijing) | SARS-CoV-2 Antigen Lateral Flow Assay |

| KRISHGEN BioSystems | Human SARS-CoV-2 Spike Protein Antigen ELISA |

| KRISHGEN BioSystems | Human SARS-CoV-2 Nucleocapsid Protein Antigen ELISA |

| L&H Biotech | COVID-19/Flu A+B Antigen Combo Rapid Test Kit |

| LabNovation Technologies | SARS-CoV-2 Antigen Rapid Test Kit |

| Liming Bio-Products | StrongSep SARS-CoV-2 Antigen Rapid Test Kit |

| Liming Bio-Products | Dual Biosafety System Device for SARS-CoV-2 Antigen Rapid Test |

| Liming Bio-Products | StrongStep System Device for SARS-CoV-2 & Influenza A/B Combo Antigen Rapid Test |

| Luminostics | Clip COVID Rapid Antigen Test |

| LumiQuick Diagnostics | QuickProfile COVID-19 Antigen Test |

| LumiraDx | SARS-CoV-2 Ag Test |

| Medakit | Medakit Antigen Covid-19 Rapid Test |

| Medix Biochemica | Actim SARS-CoV-2 test |

| Mologic | COVID-19 Rapid Test |

| nal von minden | NADAL COVID-19 Ag |

| New Gene (Hangzhou) Bioengineering | COVID-19 Antigen Detection Kit |

| New Gene (Hangzhou) Bioengineering | Novel Coronavirus Spike Glycoprotein Detection Kit (Ligand-receptor Competitive Chromatography) |

| New Gene (Hangzhou) Bioengineering | Novel Coronavirus Antigen Detection Kit (Colloidal Gold) |

| New Gene (Hangzhou) Bioengineering | COVID-19 Antibody / Antigen Detection Kit |

| Orpheus Medica | CoviSafe |

| Pantest SA | Pantest Coronavirus Ag |

| PCL Inc. | PCL COVID-19 Ag Rapid FIA |

| Precision Biosensor | Exdia COVID-19 Ag |

| PRIME4DIA | P4DETECT COVID-19 Ag; P4DETECT COVID-19 SAg |

| Qiagen & Ellume | QIAreachSARS-CoV-2 Antigen Test |

| Quanterix | BARDA Funding for Ag Test |

| RapiGEN | BIOCREDIT COVID-19 Ag |

| Savant Biotechnology | New Coronavirus (SARS-CoV-2) N Protein Detection Kit |

| SD Biosensor | STANDARD Q COVID-19 Ag |

| SD Biosensor | STANDARD F COVID-19 Ag |

| Sensitest | Corona Antigen Rapid Test |

| Siemens Healthineers | CLINITEST Rapid COVID-19 Antigen Test |

| Sona Nanotech | Sona COVID-19 Rapid Antigen Test |

| Sugentech | SGTi-flex COVID-19 Ag |

| Sure Bio-Tech | 2019-nCoV Antigen Rapid Test (Colloidal Gold) |

| Sure Bio-Tech | Diagnostic Kit for SARS-CoV-2 Ag |

| Tigsun Diagnostics | COVID-19 Antigen Rapid Test |

| Tigsun Diagnostics | COVID-19 Antigen Rapid Test |

| Tigsun Diagnostics | COVID-19 Antigen Saliva Rapid Test |

| Willi Fox | Willi Fox COVID-19 Antigen rapid test |

| Xiamen Boson Biotech | Rapid SARS-CoV-2 Antigen Test Card |

| YHLO Biotech | iFlash-2019-nCoV AntigenTest |

| YHLO Biotech | UNICELL-2019-nCoV Rapid Antigen Test |

| Zalgen | ReSARS CoV-2 Antigen Rapid Test |

| Zalgen | ReSARS Pan-Corona Antigen ELISA Kit |

| Zalgen | ReSARS CoV-2 Antigen ELISA Kit |

| Zhuhai Lituo Biotechnology | COVID-19 Antigen Detection Kit |

| Zhuhai Lituo Biotechnology | COVID-19 Antigen Detection Kit |

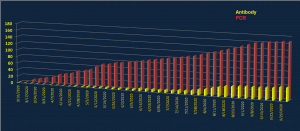

FDA Test Authorizations of IVD Products Over Time

There’s been a steady increase in IVD Test Product EUAs over time. Over a month ago, only the CDC’s own test was available. Roche’s cobas test approval became the first commercial test, and then many other EUAs followed.

Our major global IVD market report for global market estimates in infectious disease testing, molecular diagnostics, oncology testing, hematology, critical care testing and other areas is The Worldwide Market for In Vitro Diagnostic Tests, now in its 13th Edition

Significant new EUAs include Roche’s IL-6 Test, Quidel’s Direct Test (no RNA extraction kit required), Abbott’s Alinity m2000 Test, Everlywell’s Home Collection Kit (not a test in the purest sense but regulated by the FDA as one), Quidel’s Sofia Antigen Test, Sherlock CRISPR test, Biomerieux’s R-GENE 2 triplex PCR test (for covering possible COVID-19 mutations). Bio-Rad’s dPCR test, Roche and Abbott high-throughput Serology tests.

The United States is currently where most COVID-19 testing is occurring, thus tracking the IVD EUA is most important. This chart details FDA Emergency Use Authorization (EUA)s over time. This chart does not include lab-developed tests (LDT) at universities, hospital medical centers or states that may use the IVD products.

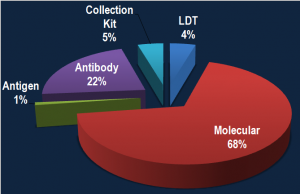

IVD Test Authorizations by Technology Type

RT-PCR is the gold standard and molecular tests are by their nature slightly faster to develop when a virus has a known genetic signature, as is the case with SARS-CoV-2. Therefore it’s not surprising to see most EUAs consist of PCR tests, though anti-body tests are increasingly netting authorizations:

For More Information

N O W P U B L I S H E D

Kalorama COVID-19 Update: Impact on Molecular Diagnostics, Serology, Critical Care Tests, Vaccines and Telehealth Markets

The current COVID-19 crisis affecting the United States and the world has caused hundreds of thousands of deaths and countless economic costs. This has brought forth an array of solutions that could contribute to detecting, containing and possibly treating the disease. Kalorama Information has covered the fields of molecular diagnostics, vaccines and telehealth for decades. These important industries, already growing in revenues and number of competitors, now find themselves part of the current crisis. Kalorama COVID-19 Update provides trending developments, company announcements and analysis from the Kalorama analysis team on fast-breaking events in the COVID-19 pandemic.

Early COVID-19 IVD Market Estimates – Moderate Case, Best Case, Worst Case

Molecular Diagnostics

Testing for viruses is normally conducted using RT-PCR, a form of molecular testing. To a lesser degree, antibody tests are used. Both types of testing have been present in the COVID-19 crisis. The report takes a particular interest in molecular diagnostics, the segment in in vitro diagnostics directly affected by COVID-19. Topics explored include the following:

- Early COVD-19 Related Financial Results at Molecular Test Companies

- Smaller, Mid-Size MDx Companies See Double Digit Boosts

- Life Science Company Revenues Down

- Molecular Testing: A Learning Curve

- EUA Authorizations

- Kalorama Survey of Clinical Diagnostic Labs

- Reopening Plans

- Supply Issues

- Marketed Molecular Tests (EUA, CE Other)

- Potential Market Impact

FOR MORE INFORMATION OR TO ORDER: https://kaloramainformation.com/product/kalorama-covid-19-update-impact-on-molecular-diagnostics-serology-critical-care-tests-vaccines-and-telehealth-markets/

Antigen and Serology Tests

Vaccines, Remote Patient Monitoring and Other Impacted Markets

COVID-19’s influence is being felt across the healthcare spectrum. The report examines the virus’ impact on the vaccines market, non-COVID testing, remote patient monitoring/telehealth and lab automation, including:

- Select Vaccines in Development for COVID-19

- Selected Automated Molecular Test Instrument Platforms

- Non-COVID Testing: Magnitude of Pandemic Impact

- Remote Patient Monitoring: Companies to Watch

Companies discussed in Kalorama COVID-19 Update: Impact on Molecular Diagnostics, Serology, Critical Care Tests, Vaccines and Telehealth Markets include:

- Abbott

- AMD Global Telemedicine

- American Well (Amwell)

- Becton Dickinson (BD)

- bioMérieux

- Bio-Rad

- BioTelemetry, Inc.

- Bruker

- CanSino Biologics

- Cepheid

- Doctor on Demand

- Eko Devices

- Fluidigm

- GD (General Devices)

- GlobalMed

- Glooko

- Inovio Pharmaceuticals

- Masimo

- MediOrbis

- Medtronic

- Meridian Bioscience

- Moderna

- Myriad Genetics

- Natera

- Qiagen

- Quidel

- Rheonix, Inc.

- Roche

- SD Biosensor

- Seegene

- Teladoc Health

- Thermo Fisher Scientific

- Thinklabs

- Twist Bioscience

- TytoCare