Description

“A 38 Billion Dollar Market for COVID-19 Test Products: Molecular, Antigen, and Antibody Tests”

- Overview of disease progress, trends, developments

- Mutations: What to Expect

- The Arrival and Potential of Home Testing

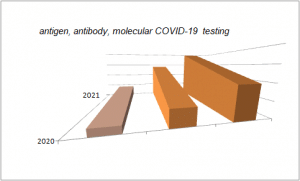

- Markets for COVID-19 Antigen Tests, 2020 and 2021

- Markets for COVID-19 Molecular Test, 2020 and 2021

- Markets for COVID-19 Antibody Tests, 2020 and 2021

- Markets by Geography (US, Europe, Asia, ROW)

- Antigen Products on the Market

- PCR and Other Molecular Products on the Market

- Vaccine Impact on Market

- FDA Emergency Authorized Tests: Molecular, Antigen and Antibody

- Leading Vendors

Key Trends Examined in the Report

Biden Administration Plans – Already billions of dollars in spending are, and laboratory associations are asking for more. What impact will this have no test markets.

Home Testing – Once a rarely thought of possibility in major IVD markets [outside of glucose, ovulation and a few infectious tests of low volume], COVID-19 has brought the idea of testing at home to reality, and manufacturers are developing systems and considering plans that may extend beyond this disease alone. Government financing is fueling this trend as well.

Mutations – changes to SARS-COV-2 may change the diagnostic response. We examine that in a special section on variants and mutations. COVID-19 like any virus has some variants and mutations. These can affect testing results in various way. Currently there is no widespread emergency necessitating changes in major tests. But of note is that the U.S. is setting up protocols. On Monday, February 22, 2021 the FDA issued new guidance for SARS-CoV-2 test developers. The agency made it clear they are to consider the impact of mutations on their tests using sequencing to determine any impact.

Vaccines – As millions are vaccinated, where does that leave testing companies. IVD companies have weighed in, and we review their predictions and assess the impact vaccines have had on testing markets for other conditions such as cervical cancer and influenza.

Endemic Status – There are increasing predictions of a possible endemic status of COVID-19. That is to say, a disease with recurring outbreaks in humans. After all the endemic betacoronavirus that causes mild respiratory illness generally sees immunity last only a year.

Supply Shortages -The global pandemic demonstrated that molecular testing methods have particular supply needs that can be challenged in large-scale use. Supply shortages have plagued the U.S. response to COVID-19 testing, and the federal government is open to new ideas for solutions. The former head of COVID-19 testing response described the U.S. supply chain at the start of the pandemic as a “wreck.” What are the implications for future testing?

Companies Adjust to COVID-19

Just in the last two months, COVID-19 has affected considerable change at diagnostic companies. One comapny has acquisitions, fortified with cash from increased sales of test kits. Others launched home testing kits. One cash-negative company was made cash-postive, while another doubled its test capacity and yet another tripled sales of instruments. Companies not in infectious disease testing are quickly pivoting to it. The first test for asymptomatic patients was approved, and new innovative features such as saliva sampling or ultra-high throughput even CRISPR are being added to tests.

- Roche

- Abbott

- Quidel

- Becton Dickinson

- Bio-Rad

- Hologic

- Thermo Fisher

- Ellume

- Qiagen

- Seegene

- GenMark

- Quest

- LabCorp

- OraSure

- Agilent/Dako

- Visby

- Illumina

- Cue Health

- Sherlock Biosciences