Description

The Market and Future Potential for Molecular Point of Care (POC), 2022 provides market sizing, forecasting, trend mapping and competitive analysis for point of care tests using PCR or other molecular technology with fast turnaround times and usability in near-patient settings. Major IVD companies such as Abbott and Roche and Quidel compete, but there are many other and new entrants since our last reporting.

Molecular point of care or mPOC systems are designed to be faster than lab-based tests while more accurate than existing point of care systems. Development of new systems and menu expansion on existing lines is constant. Kalorama Information defines molecular point of care or mPOC as consisting of devices marketed to customers outside the reference lab that run PCR or other DNA and RNA testing on a device with a small footprint. mPOC systems tend to have a result time fast enough for an office visit or bedside consultation. These systems feature cartridges or reduced preparation steps and limited interpretation of test results.

This was a subset of the testing industry still proving its merit to customers early last year, but certainly the ongoing COVID-19 pandemic has been an influence on the market, as we covered in recent reports. The ability to deliver rapid PCR results has put them in the right place with the right function at the right time. This report features a complete update on mPOC and COVID-19. It also discusses other growth areas.

The data in The Market and Future Potential for Molecular Point of Care (POC), 2022 includes information on systems and competitor analysis, as well as data on the size and growth of the market:

- Current Molecular POC Systems

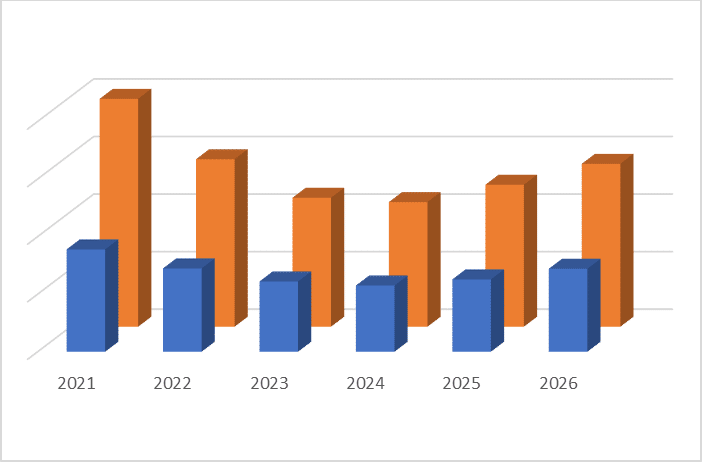

- Molecular Point of Care Market: 2021-2026

- COVID mPOC Market

- Molecular Point of Care Market Share by Vendor, 2021 ($M, %)

- Small-Footprint Molecular Point of Care Market, 2021 (%)

- Geographic Breakout of the Molecular Point of Care Market, 2021 (N. America, Europe, APAC, RoW)

- Segment Breakout of Molecular Point of Care Market, 2021 (Respiratory vs. Other)

- Breakout of Molecular Point of Care Market, 2021 (%; Respiratory, Other)

- Respiratory Segment Breakout, 2021 (Flu, RSV, Strep, Other)

- Breakout of mPOC Respiratory, 2021 (%; Flu, Strep, RSV, Other)

- Near Patient Molecular IVD Market: 2021-2026

- Near Patient Molecular Market Share by Vendor, 2021

- Company Profiles

Many trends are covered in the report, including menu expansion, disease statistics, the COVID-19 crisis, immunoassay competition and enhancement of those competitive POC systems, emerging markets, new journal studies about the efficacy of mPOC and other trends.

Companies profiled include:

- Abbott Laboratories

- Aidian Oy

- Akonni Biosystems

- binx health, inc.

- Biocartis NV

- bioMérieux SA

- Cepheid

- Credo Bioscience

- Curetis NV

- DiaSorin S.p.A

- GenMark Diagnostics

- Greiner Bio-One GmbH

- Meridian Bioscience, Inc.

- Mesa Biotech, Inc.

- QIAGEN NV

- QuantuMDx Group

- Quidel Corporation

- Roche

- Sekisui Diagnostics LLC

- T2 Biosystems