Description

What is the Market for Urgent Care Centers? What Services are they Selling? Who is Selling Testing and Vaccine Products to Urgent Care?

Kalorama’s comprehensive report answers these questions, and more.

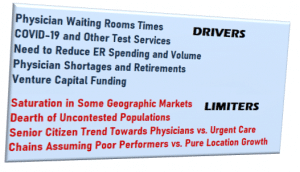

With approximately 10,000 locations across the country, urgent care clinics (UCCs), are an increasingly important of the U.S. health care marketplace. They offer walk-in care and a range of services, expanded hours and limited wait times. Urgent care centers are not new. There are many urgent care centers in operation 30 years or more. There are urgent care centers operating longer than the primary practices surrounding them. But in a sense, urgent care as it exists now is new in that the awareness and utilization of these centers increased greatly.

This has created a 20 billion-plus dollar market for urgent care in the U.S. The urgent care business model involves providing a full range of services of nonemergency acute care. UCCs differ from traditional physicians’ offices with procedure rooms for lacerations and fractures, a radiology department for x-ray services, and a laboratory.

What distinguishes urgent care centers is that they are a walk in clinic offering extended hour access for acute illness and injury care that is either beyond the scope or availability of the typical primary care practice but offer less services than an emergency room would.

Kalorama has covered the urgent care trend with estimates of its impact on IVD and imaging for a decade. This report includes projections of POC and other test sales as well as revenues earned by clinics themselves.

The urgent care clinic concept has shown potential to provide affordable, accessible and quality medical care to consumers who otherwise would have to wait hours, days, or even weeks for care. They also provide an alternative to costly, time-consuming emergency room care for sicknesses that could have been prevented if basic health care services had been available. For example, a 2010 Health Affairs report pointed to cost saving potential, finding that up to 27% of emergency department cases could be seen in urgent care; such a transition would generate up to $4.4 billion in annual cost savings. A more recent white paper from the Urgent Care Association of America estimated that the cost savings of using urgent care centers versus emergency departments could amount to as high as about $18.5 billion per year.

Market Sizing and Projections, Important Trends

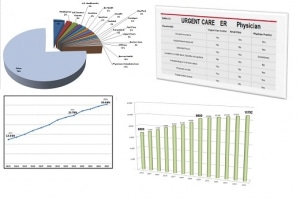

This Kalorama Information report, The Market for Urgent Care Centers, is a detailed look at the current state of these healthcare outlets, including the number of locations, expected growth and revenues. Revenues in this report are segmented by the reason for visit to the UCC and are forecasted to 2025.

Profiles of operators and market share is provided. As urgent care centers are an important target market for pharmaceutical and IVD companies, the market opportunity for these supplier companies is provided.

As part of its coverage, this report provides:

- COVID-19 Impact on Urgent Care

- COVID-19 Test Revenues to Urgent Care Centers and IVD Companies

- The Urgent Care Center Concept: Startup Costs, Staffing, Ownership

- Current Healthcare and Insurance Trends

- Number of Locations and Forecasts

- Key Trends in Urgent Care 2020

- Revenue Per Patient

- Competition and Saturation

- Seniors and Urgent Care

- COVID-19 Vaccines?

- Competition from New Venues

- Urgent Care Market Size by Type of Visit and Forecasts

- Supplier Sales to Urgent Care Centers

- Point-of-Care Tests

- Immunoassays and Clinical Chemistry

- Imaging Equipment

- Vaccines Sales to Urgent Care

- Company Profiling

- Major Players by Locations

Profiles for the following companies are provided:

- American Family Care

- Aurora Urgent Care

- Bellin Health

- Care Now

- Carespot

- CityMD

- Concentra

- Doctors Care

- FastMed

- Fast Pace Urgent Care

- GoHealth Urgent Care

- MD Now

- MedExpress Urgent Care

- MedPost Urgent Care

- NextCare

- Patient First

- Physicians Immediate Care