Table of Contents

CHAPTER ONE: EXECUTIVE SUMMARY

• Figure 1-1: The Worldwide IVD Market, 2018, 2023 and 2028 ($billions)

• Figure 1-2: COVID-19 IVD Market Share, by Segment (Immunoassay Lab-Based, Molecular Dx Lab-Based, Point-of-Care), 2022

SCOPE AND METHODOLOGY

SIZE AND GROWTH OF THE MARKET

• Table 1-1: Global In Vitro Diagnostic Sales by Product Market, 2023-2028 ($ million) (Clinical Chemistry; Immunoassays- Infectious disease, Other immunoassays, Blood bank screening, Drugs of Abuse, Diabetes HbA1c – lab; Hematology – Core Lab; Microbiology (ID/AST); Microbiology (molecular); Coagulation; Histology/cytology; HPV, molecular; Nucleic acid assays; Blood grouping/typing; Blood bank molecular -NAT Screens; Circulating tumor cells; POC, OTC diabetes; Continuous Glucose, POC, OTC other; POC, professional/hospital; Mass Spectrometry) and COVID-19 Dx

MARKET HIGHLIGHTS

COMPETITIVE PICTURE IN IVD

• Figure 1-3: IVD Leaders, by Company (Abbott, Danaher, Roche, Siemens Healthineers)

WHAT TO WATCH LONG-TERM

China

Emerging Market Growth

Globalization, Climate Change

FINDING WHAT YOU ARE LOOKING FOR IN THE 16TH EDITION

• Table 1-2: Finding What You Are Looking For in the 16th Edition

CHAPTER TWO: INTRODUCTION

IVD LANDSCAPE

REPORT DESIGN

Changes Between 15th and 16th Editions

PAMA AND CMS

MARKET ANALYSIS OF IVD MARKET SEGMENTS

• Table 2-1: Global In Vitro Diagnostic Sales by Product Market, 2023-2028 ($ million) (Clinical Chemistry; Immunoassays- Infectious disease, Other immunoassays, Blood bank screening, Drugs of Abuse, Diabetes HbA1c – lab; Hematology – Core Lab; Microbiology (ID/AST); Microbiology (molecular); Coagulation; Histology/cytology; HPV, molecular; Nucleic acid assays; Blood grouping/typing; Blood bank molecular -NAT Screens; Circulating tumor cells; POC, OTC diabetes; Continuous Glucose, POC, OTC other; POC, professional/hospital; Mass Spectrometry) and COVID-19 Dx

• Figure 2-1: Developed vs. Developing IVD Market Shares, 2023 and projected 2028 (%)

TOP SUPPLIERS AND NICHE PLAYERS

Introduction

Overview of the Top Tier Companies

• Table 2-2: Clinical Diagnostic Revenues of Selected Top 20 IVD Companies, 2022 and estimated 2023 ($ million)

• Abbott Diagnostics

• Roche Diagnostics

• Ventana Medical Systems/ Roche Tissue Diagnostics

• Danaher Corporation

• Cepheid

• Radiometer

• Beckman Coulter

• Siemens Healthineers

• Thermo Fisher Scientific

• Illumina

• Becton Dickinson & Co

• Dexcom

• bioMérieux

• Sysmex Corporation

• QuidelOrtho Corporation

• Exact Sciences

• Werfen

• Instrumentation Laboratory

• Inova Diagnostics

• Hologic

• Bio-Rad Laboratories

• Agilent

• DiaSorin Group

• QIAGEN N.V.

• Mindray

• Natera

Overview of Selected Second Tier Companies

• Table 2-3: Revenues of Selected Top 20 Niche Players, 2022 and estimated 2023 ($ million, estimated)

• Bruker/CALID Group

• PerkinElmer (Revvity)

• Myriad Genetics

• Grifols S.A.

• BGI Genomics

• Guardant Health

• Sekisui Diagnostics

• Invitae

• Diagnostica Stago

• Fujirebio

• OraSure Technologies

• Eiken Chemical Co

• Nihon Kohden

• Fulgent Genetics

• Meridian

• Horiba/ABX

• Menarini Diagnostics

• Masimo

• Veracyte

• BioCartis

THE IMPACT OF COVID FOR THE TOP TIER COMPANIES

• Figure 2-2: Top Tier Market Distribution, 2022 and 2023, estimated (%)

IVD COMPANIES MERGERS & ACQUISITIONS

• Table 2-4: Selected IVD Mergers and Acquisitions 2019-2023 (first half)

COLLABORATION, PARTNERSHIP, ALLIANCE AGREEMENTS

• Table 2-5: Selected IVD Partnerships/Collaborations/Alliance Agreements, 2016-2019

TEST SERVICES

• Table 2-6: Selected Test Services, Sales, by Company (Exact Sciences Corp. Myriad Genetics, NeoGenomics), 2017-2022 ($ millions, estimated where applicable)

• Table 2-7: Global Lab Market Segmentation, by Segment (Hospital and Acute Care Labs, Independent Labs, Physician Office Labs), 2022 ($ billions)

• Table 2-8: Clinical Laboratory Revenues for Selected of U.S.-based Reference Labs, by Company (Bio-Reference Lab/OPKO, Labcorp, Quest Diagnostics), 2017-2022 ($ million, estimated)

• Table 2-9: Estimated Clinical Test Volume, by Select Independent Laboratory (Bio-Reference Lab/Opko, Eurofins Scientific, Labcorp, Medicover, NeoGenomics, Quest Diagnostic, Sonic Healthcare, Unilabs), 2022 (millions of units)

• Table 2-10: Estimated COVID-19 Test Volume, by Select Independent Laboratory (Bio-Reference Lab/Opko, Eurofins Scientific, Labcorp, Medicover, Medicover, NeoGenomics, Quest Diagnostic, Sonic Healthcare, SynLab, Unilabs), 2022 (millions of units)

HISTORICAL IVD MARKET VS TODAY

In the Beginning to Now

• Figure 2-3: Share of IVD Market by Segment, Percentage, 2000 and 2023 Compared (Clinical Chemistry, Hematology, Coagulation, Immunoassays, Microbiology (ID/AST), POC Diabetes, POC – Other, Histology/Cytology, Molecular, Blood Banking [imm & typing], Others)

Future

• Next-Generation Sequencing

• Cancer Testing (Liquid Biopsy)

• Companion Diagnostics

POINT OF VIEW

• Figure 2-4: IVD Market, by Segment (Clinical Chemistry; Immunoassays- non isotopic: Infectious disease, immunoassays, Blood bank screening, Drugs of Abuse, Diabetes HbA1c – lab; Hematology – Core Lab; Microbiology (ID/AST); Microbiology [molecular]; Microbiology – Mass Spectrometry; Coagulation [PT/INR]; Coagulation, molecular; Histology/cytology; HPV, molecular; Nucleic acid assays; Blood grouping/typing; Blood bank molecular – NAT Screens; Circulating tumor cells; POC, OTC diabetes; POC, OTC other; POC, professional/hospital; Mass Spectrometry), 2019 Compared to 2023 (%)

COVID-19 IMPACT AND SUMMARY

• Figure: 2-5: Combined Performance in COVID-19 and non-COVID-19 IVD Market Segments, 2020-2028 ($ million)

COVID-19 Market Value

• Table 2-11: COVID-19 Market Share, by Segment (Immunoassay, Molecular, Rapid – POC), 2023 (%)

• Figure 2-6: IVD COVID-19 Market, Distribution by Region (North America, Europe, Asia Pacific, RoW), 2023 (%)

CHAPTER THREE: THE GLOBAL PICTURE FOR IN VITRO DIAGNOSTIC MARKETS

BACKGROUND

Simultaneous Threats: Chronic and Acute

Expected World IVD Market Developments

GLOBAL POPULATION AND AGING

• Figure 3-1: Global Fertility Rate vs. Population Size, 1950-2050 (billions)

• Figure 3-2: Global Population Distribution, 2022

• Table 3-1: Elderly Support Ratio in Various Countries (Australia; Brazil; Canada; China; China, Hong Kong SAR; France; Germany; India; Italy; Japan; Mexico; Saudi Arabia; Singapore; South Africa; Spain; Turkey; United Kingdom; United States; World), 2010 vs. 2050

Workforce Reduction

• Table 3-2: Age Under 15 and Over 65, by Continent (Africa, L. America/Caribbean, Asia, Oceania, N. America, Europe, World) 2020

WHO ESSENTIAL IVD LIST

• Table 3-3: WHO Model List of Essential In Vitro Diagnostics (EDL)

Increase in Chronic Diseases

• Figure 3-3: Leading Causes of Death Globally, 2019

COVID-19

• Table 3-4: Selected Molecular EUA Tests for COVID-19

• Table 3-5: Selected Antigen Immunoassay Tests for SARS-CoV-2

• Table 3-6: Individual EUAs for Serology Tests for SARS-CoV-2

• Table 3-7: Individual EUAs For IVDs for Management of COVID-19 Patients

EMERGING AND EMERGED MARKETS

• Table 3-8: Market Potential by Total Population, and Percent Urban 2020 (China, India, United States, Brazil, Russia, Mexico, Nigeria, Turkey, S. Korea, S. Africa, Vietnam, Poland, Saudi Arabia, Canada, Colombia, Ukraine, Egypt, Malaysia)

SIZE AND FORECAST FOR THE GLOBAL IVD MARKET

• Table 3-9: Global In Vitro Diagnostic Market; Major Country/Region Markets, 2023 and 2028 ($ millions) (United States, EU 15, W. Europe, Japan, China, Canada, India, Eastern Europe, Brazil, Peru, Mexico, Saudi Arabia, Turkey, UAE, Vietnam, Russia, South Africa, South Korea, Australia, ROW)

• Table 3-10: Global In Vitro Diagnostic Market; Regional Markets, 2023 and 2028 ($ millions) (Africa, North America, Europe, Asia Pacific, Latin America, Middle East)

• Table 3-11: Global In Vitro Diagnostic Market – YOY Growth, 2022-2023

• Table 3-12: Global In Vitro Diagnostic Market; Regional Markets, 2022-2023 YOY Change (North America, Europe, Asia Pacific, Latin America, Middle East, Africa)

THE IVD MARKET IN THE UNITED STATES

• Table 3-13: United States IVD Market Share by Segment, 2023 (%) (Clinical Chemistry, Microbiology ID/AST, Microbiology Molecular, POC Diabetes, POC Other, Immunoassay Infectious Disease, Immunoassay Other, Nucleic Acid Assays, Coagulation, Histology, Hematology, Blood Grouping, Others), ($ millions)

PAMA and Reimbursement Changes

• Impact of CARES Act on PAMA

• Table 3-14: Proposed Clinical Diagnostic Laboratory Test Rates, 2020-2026

LDT Update

• Changes Resulting from COVID-19 Pandemic

Precision Medicine and NGS

IVD MARKET IN EUROPE: GROWING MARKETS

• Table 3-15: Economic Indicators (GDP Growth, Inflation Growth), by Select European Country (Germany, France, Italy, Spain), 2020-2023 (%)

• Figure 3-4: International Monetary Fund Inflation Map, Global 2023

• Table 3-16: Western European IVD Market by Country, 2023 ($ millions, estimated) (Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, UK)

EU Regulation

• Table 3-17: IVD Market Per Capita, Europe, 2021/2022 Estimates (Switzerland, Germany, Netherlands, Sweden, France, Slovenia, United Kingdom, Italy, Spain, Slovakia, Greece, Croatia, Czech Republic, Hungary, Poland, Romania, Bulgaria, Russia, Ukraine)

Precision Medicine in Europe

Brexit

JAPAN

• Table 3-18: Japan IVD Market by Segment, 2023 (%) (Clinical Chemistry, Microbiology ID/AST, Microbiology Molecular, POC Diabetes, POC Other, Immunoassay Infectious Disease, Immunoassay Other, Coagulation, Histology, Hematology, Others)

EASTERN EUROPE: GROWTH REGION

• Table 3-19: Eastern European IVD Market, by Country, 2023 ($ millions) (Bulgaria, Croatia, Czech Republic, Hungary, Poland, Romania, Slovakia, Slovenia, Ukraine, Other)

• Figure 3-5: Eastern Europe IVD Market, by Country, 2023 ($ millions) (Bulgaria, Croatia, Czech Republic, Hungary, Poland, Romania, Slovakia, Slovenia, Ukraine)

CHINA: CURRENT IVD MARKET

• Table 3-20: China IVD Market by Segment, 2023 (%) (Clinical Chemistry, Microbiology ID/AST, Microbiology Molecular, POC Diabetes, POC Other, Immunoassay Infectious Disease, Immunoassay Other, Coagulation, Histology, Hematology, Others)

• Table 3-21: Total Midyear Population, by Broad Age Group: China (million persons), 2010-2050

Clinical Laboratory Market in China

IVD Distribution in China

INDIA: POPULATION AND OPPORTUNITY

• Table 3-22: India IVD Market by Segment, 2023 (%) (Clinical Chemistry, Hematology, Coagulation; Microbiology; POC Diabetes; POC Other; Immunoassay; Histology; Others)

Clinical Laboratory Market in India

IVD Regulation

REST OF ASIA

• Table 3-23: Asia Pacific IVD Market by Country, 2023 ($ millions) (Australia, South Korea, Indonesia, Thailand, Philippines, Malaysia, Singapore, Vietnam)

BRAZIL

• Table 3-24: Brazil IVD Market by Broad Segment, 2023 (%) (Clinical Chemistry, Microbiology, POC Diabetes, POC Other, Immunoassay, Histology, Others)

Disease Trends

Clinical Laboratory Market in Brazil

IVD Regulation

MEXICO

• Table 3-25: Mexico IVD Market by Broad Segment, 2023 (%) (Clinical Chemistry, Microbiology, POC, Immunoassay, Histology, Others)

THE RUSSIAN FEDERATION

CANADA

EMERGING MARKETS

Saudi Arabia IVD Market

South Africa IVD Market

South Korea IVD Market

Turkey IVD Market

United Arab Emirates (UAE) IVD Market

Other Markets to Watch

IVD MARKET OPPORTUNITY BY COUNTRY

• Table 3-26: IVD Market Opportunity by Country, 2023 Market Rank, Country CAGR 2023-2028 (China, Philippines, Brazil, Israel, Malaysia, India, Mexico, Indonesia, Chile, Poland, Saudi Arabia, South Korea, Romania, Colombia, United Arab Emirates, Argentina, Hungary, Vietnam, Iraq, Peru, Japan, France, Turkey, Egypt, Singapore, Luxembourg, Croatia, Jordan, U.S., Germany, United Kingdom, Canada, Spain, Russia, Netherlands, Switzerland, Belgium, Sweden, Austria, Denmark, Ireland, Finland, Iran, Thailand, Venezuela, Italy, Australia, Portugal, Greece, Czech Republic, South Africa, Norway, Bulgaria, Slovakia, Slovenia)

• Figure 3-6: IVD Market Opportunity by Country: Top 20 Markets (Country Market Value in $millions), Country CAGR 2023-2028 (%) (United States, Germany, Japan, France, United Kingdom, Italy, Canada, Spain, Australia, Brazil, Russia, India, Switzerland, Netherlands, Poland, Turkey, Sweden, Belgium, Mexico)

CHAPTER FOUR: COMPANY AND INDUSTRY TRENDS

INTRODUCTION

Advanced Medicine Without Borders

• Table 4-1: Key Emerging IVD Markets, by Country (Brazil, Russia, India, China, South Korea, Mexico, Turkey, Vietnam) 2018-2023 ($millions)

China Market Information

Direct to Consumer Genetic Test Services

Future Trends

GENE EDITING

• Table 4-2: Selected Gene Editing / CRISPR Innovations

CRISPR as a Diagnostic Tool

CRISPR and the Food Industry

MICROBIOME

• Table 4-3: Selected Microbiome Test Innovations

NEXT GENERATION SEQUENCING

• Table 4-4: Selected Clinical NGS Platforms on the Market

Liquid Biopsy

Quality Assurance

Product News

Market Cleared Products

Liquid Biopsy in Microbiology

Liquid Biopsy Companies in 2021-2023

The Future for Liquid Biopsy

INFORMATION TECHNOLOGY ADVANCES AND ARTIFICIAL INTELLIGENCE

AI in Clinical Practice

• Table 4-5: Selected AI Market Cleared Tests

The Regulatory Pathway

Product Initiatives

• Table 4-6: Selected AI Product Initiatives in Development and Collaborations

AI IN LIQUID BIOPSY

• Table 4-7: Selected AI/Liquid Biopsy Initiatives

Future Trends

EXOSOME SEQUENCING

BIOTIN INTERFERENCE IN IMMUNOASSAY DETECTION ERRORS

• Table 4-8: Biotin-free Offerings Currently on the Market

TRAUMATIC BRAIN INJURY AND IVD

PERSONALIZED MEDICINE

TELEHEALTH

Telehealth eMed to Implement Home Test to Treat Program

BLOCKCHAIN

SUBSTANCE ABUSE

Opioid Epidemic

COVID-19 and Substance Abuse

Biomarkers and Substance Abuse

Clinical Laboratory Testing for Drugs of Abuse

• Table 4-9: Global Drug Abuse Statistics

Urine

Blood

Oral

Hair

• Table 4-10: Selected Opioid Test FDA Approvals

SALIVA TESTING

BREATH TEST ADVANCES

• Table 4-11: Selected Disease Markers in Exhaled Breath

MICRO-HOSPITAL OPPORTUNITIES

CLIMATE CHANGE AND INFECTIOUS DISEASE

KICKBACK SCHEMES

EARLY SEPSIS DETECTION

STAFFING SHORTAGES

CHAPTER FIVE: POINT-OF-CARE TESTS

OVERVIEW AND TRENDS

POC INDUSTRY DRIVERS

Patient focused drivers

Medical/Healthcare related drivers

Technology drivers

Economic drivers

Other drivers

POC INDUSTRY CHALLENGES

REGULATORY CHALLENGES

PROFESSIONAL POC

• Table 5-1: Professional POC Test Sales by Category, Worldwide 2023 -2028 ($million) (Glucose, Critical Care POC, Fertility, Infectious Diseases, Cardiac Markers, Cholesterol, Coagulation, HbA1c POC, Hematology, Fecal Occult Blood, Drugs of Abuse, Others)

• Table 5-2: Selected Professional POC Test Innovations (excluding COVID-19 testing)

OTC SELF TESTING

• Table 5-3: POC Self-Test Sales by Category, Worldwide, 2023-2028 ($million) (Glucose, Self; Glucose, Continuous; Pregnancy; Coagulation; Fecal Occult Blood; Drugs of Abuse; H. pylori; HIV; Cholesterol; Urinalysis; Other [TSH, Allergy, Autoimmune, etc.])

HOME COLLECTION TREND

• Table 5-4: Home Collection Test Market, 2022 and 2027 ($million), CAGR 2022-2027

• Table 5-5: Home Collection Test Kit Market by Category, Worldwide, 2022 (% Estimated Share)

• Table 5-6: Selected Molecular Tests EUAs for Home Collection SARS-CoV-2 Tests

PREGNANCY/FERTILITY TESTS

• Table 5-7: POC Pregnancy and Fertility Test Market Distribution by End User, 2023 (%) (OTC, PRO)

• Table 5-8: Pregnancy/Fertility POC Test Sales Distribution by Global Region, 2023 (United States, Europe, Japan, RoW)

COLON CANCER SCREENING

• Table 5-9: Selected POC Colon Cancer Tests

• Table 5-10: Colon Cancer POC Test Sales Distribution by Global Region, 2023 (%) (United States, Europe, Japan, RoW)

LIPID TESTING

• Table 5-11: Lipid POC Test Sales Distribution by Global Region, 2023 (%) (United States, Europe, Japan, RoW)

DRUGS OF ABUSE TESTING

• Table 5-12: POC Drugs of Abuse Test Sales Distribution by Setting, 2023 (%) (Employment Screening, Criminal Justice, Critical Care – Traditional POC)

• Products

• Table 5-13: Drugs of Abuse Tests on the Market

RAPID AND POC INFECTIOUS DISEASE TESTING

• Table 5-14: Innovations in Molecular POC Infectious Disease Diagnostics

Products

HIV and Hepatitis Testing and Monitoring

Tuberculosis

Tropical and Neglected Diseases

Respiratory Diseases

Sepsis and Nosocomial Disease

Sexual Health

Lyme Disease

• Table 5-15: Innovations in Molecular POC Infectious Disease Diagnostics

COVID-19

Market Size and Growth

• Table 5-16: Infectious Disease POC Test Demand by Type, 2023 (%) (Influenza, HIV, STD, Hepatitis, Malaria, C.Difficile, E.coli, H.pylori, Home Test/OTC, Others)

• Table 5-17: Infectious Disease POC Test Sales Distribution by Global Region, 2023 (%) (United States, Europe, Japan, RoW)

DIABETES TESTING – BLOOD GLUCOSE MONITORING

• Table 5-18: Glucose POC Test Sales Distribution by Global Region, 2023 (%) (United States, Europe, Japan, RoW)

• Figure 5-1: POC Glucose Testing Market Growth by Category, 2023-2028

IT to Aid Diabetes Management

• Table 5-19: Selected Apps and Glucose Management IT

Diabetes Market Analysis

• Table 5-20: Global Diabetes Sales by Test Category, 2023-2028 (Glucose, OTC; Glucose, professional; Glucose, continuous; HbA1c, POC; TOTAL; HbA1c, Lab) ($ millions)

POC Glucose Competitors

• Table 5-21: POC Test Revenues of Selected IVD Glucose Companies, 2023 ($ million, estimated)

Blood Glucose Self-Testing

• Table 5-22: Selected Glucose Self-Test Meter Innovations

Noninvasive Testing Devices

• Table 5-23: Selected Noninvasive Glucose Monitoring Devices

Continuous Glucose Monitoring

• Table 5-24: Selected Continuous Blood Glucose System Developments

Blood Glucose Testing by Professionals

• Table 5-25: Selected Innovations in Hospital-based Glucose Monitoring

Diabetes Testing – Glycated Hemoglobin

• Table 5-26: Global HbA1c Test Sales Market and Distribution by Setting, 2023-2028 ($ millions) (HbA1c POC, HbA1c Lab)

• Table 5-27: Selected POC HbA1c Devices

Genes and Other Markers of Diabetes

• Table 5-28: Selected POC Diabetes Monitoring Tests

THE MAJOR POC TEST PLAYERS

• Table 5-29: POC Test Revenues of Selected IVD Companies, 2023 ($ million, estimated)

CHAPTER SIX: THE CORE LAB

CORE LAB OVERVIEW AND TRENDS

• Table 6-1: Selected Analytes for the Core Lab

CONNECTIVITY

OVERVIEW OF CHEMISTRY TESTS

Lab Automation

MARKET ANALYSIS

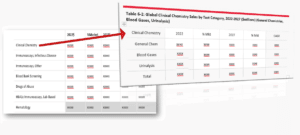

• Table 6-2: Global Clinical Chemistry Sales by Test Category, 2023-2028 ($millions) (General Chemistries, Blood Gases, Urinalysis)

• Table 6-3: Global Clinical Chemistry Sales Distribution by Region, 2023 (North America, Europe, Asia Pacific, RoW)

• Table 6-4: Major Clinical Chemistry Companies, 2023 ($millions) (Blood gas/electrolyte, general chemistries, UA)

• Table 6-5: Selected Clinical Chemistry Innovations

Rapid Response Systems

• Table 6-6: Selected Major Whole Blood Chemistry Analyzers

Critical Care Analysis

• Table 6-7: Blood Gas, Electrolyte and Critical Care Instrument Market by End User, 2023 and 2028 (Lab-based, POC-based) (in $ millions)

• Table 6-8: Blood Gas, Electrolyte, and Critical Care Market Leaders including POC, 2023 (percent distribution of total sales)

User Apps

• Table 6-9: Selected Apps, Critical Care and Urinalysis IT Innovations

Urinalysis

• Table 6-10: UA Market by End User, 2023 and 2028 (Lab-based, POC-based)

• Table 6-11: Urinalysis Systems (including POC) Market Leaders, 2023 (percent distribution of total sales) estimated

• Table 6-12: Selected Urinalysis Innovations

THE COMMERCIAL OUTLOOK FOR CHEMISTRY TESTS

CHAPTER SEVEN: IMMUNOASSAYS

OVERVIEW AND TRENDS

Immunoassay Technology Continues to Evolve

• Table 7-1: Selected Immunoassay Technologies

Mass Spectrometry

• Table 7-2: Selected Innovation in Mass Spectrometry for Routine Analyses

Radioimmunoassays

MARKET ANALYSIS

Leading Suppliers and Growth Potential

• Table 7-3: Global Lab-based Immunoassay (excluding infectious disease and blood screening) Sales, by Analyte Type, 2023-2028 ($millions) (Cardiac Markers, Tumor Markers, Autoimmune, Diabetes/HbA1c, Allergy, Thyroid, Proteins, Anemia, Fertility, Therapeutic Drugs, Drugs of Abuse, Vitamin D, Total; w/o HbA1c)

• Table 7-4: Global Immunoassay (excluding infectious disease and blood screening) Sales Distribution by Region, 2023 (%) (North America, Europe, Japan, Asia Pacific, RoW)

• Table 7-5: IVD Quality Control Market (estimated), 2023 ($millions)

• Table 7-6: Selected Immunoassay Quality Control Products

• Table 7-7: 2022-2023 Revenues of Leading Lab-based Immunoassay Vendors (in millions $), Estimated

MATURE ASSAY SEGMENT

Thyroid Function

Therapeutic Drug Monitoring

Vitamin D

• Table 7-8: Selected Vitamin D Immunoassays

Anemia

Toxicology/DAU

Allergy

MATURING IMMUNOASSAYS

Proteins

GROWTH IMMUNOASSAYS

Tumor Markers

• Table 7-9: Selected Tumor Marker Innovations

Cardiac Markers

• Table 7-10: Selected Cardiac Marker Innovations

Autoimmune

• Table 7-11: Selected Autoimmune Test Innovations

Rheumatoid Arthritis

• Table 7-12: Selected Arthritis Immunoassay Innovations

Gastrointestinal Disorders

• Table 7-13: Selected Inflammatory Bowel Disease Test Innovations

Transplant Management

• Table 7-14: Selected Immunoassays for Transplant Medicine

Women’s Health

• Table 7-15: Selected Women’s Health Innovations

Alzheimer’s Disease

• Table 7-16: Selected Innovations for Alzheimer’s Disease Immunoassays

Traumatic Brain Injury

Sleep Apnea

Miscellaneous

• Table 7-17: Selected Immunoassay Innovations

Point-of-Care OTC and Professional Use Immunoassays

• Table 7-18: Global POC Immunoassay Sales Distribution by Region, 2023 (United States, Europe, Japan, RoW)

• Table 7-19: Global POC Immunoassay Test Sales by Test Category, 2023-2028 (millions $) (OTC/Self Tests: Pregnancy/Ovulation, Drugs of Abuse, HIV, H. pylori, Infectious Disease/COVID-19, Other, OTC/Self Total; professional POC: Cardiac Markers, Drugs of Abuse, HbA1c, Pregnancy, Infectious Disease/COVID-19, Other, Professional Total)

• Table 7-20: Selected Self-Test Immunoassay Innovations

Pregnancy Testing

Cardiovascular Diagnostics

Drugs of Abuse/Therapeutic Drug Monitoring

INNOVATING POC

• Table 7-21: Selected POC Test Innovations

• Table 7-22: Selected POC Immunoassay Test Platforms

THE COMMERCIAL OUTLOOK FOR IMMUNOASSAYS

CHAPTER EIGHT: MOLECULAR ASSAYS

OVERVIEW

• Table 8-1: Common Next Generation Molecular Test Traits

SAMPLE PREPARATION AND QUALITY CONTROL

• Table 8-2: Selected Molecular Test Sample Preparation and QC Innovations

MOLECULAR EVOLUTION

Exosome Sequencing

• Table 8-3: Selected Exosome Test Innovations

Liquid Biopsy

• Table 8-4: Selected Liquid Biopsy Innovations

Metabolomic Profiling

Information Technology

• Table 8-5: Selected IT Innovations in Molecular Diagnostics

Artificial Intelligence AI

Forensic Studies – An Emerging Opportunity

• Table 8-6: Selected Innovations in Forensic DNA Testing

Test Platforms

• Table 8-7: Key Molecular Technologies and Major Players

• Table 8-8: Selected Molecular Test Platform Innovations

MAJOR PLAYERS

• Table 8-9: Molecular Test Revenues of Selected IVD Vendors, by Company (Agilent, bioMérieux, Cepheid, Exact Sciences, Hologic, Illumina, Myriad Genetics, QIAGEN, Roche, Thermo Fisher) 2018-2022, 2023 estimated (in millions $)

MARKET ANALYSIS

• Table 8-10: Global Genomic, HLA and Oncology Molecular Test Sales by Type with NIPT, 2023-2028 (in millions $)

Oncology

• Table 8-11: Global Molecular Cancer Test Sales Distribution by Region, 2023 (North America, Europe, Asia Pacific, RoW)

• Table 8-12: Selected Molecular Tumor Marker Test Innovations

Inherited Diseases and Thrombophilia SNPs

• Table 8-13: Most Frequently Requested Genetic Tests

• Table 8-14: Global Molecular Thrombophilia Assay Sales Distribution by Region, 2023 (North America, Europe, Asia Pacific, RoW)

• Table 8-15: Selected Genomic Tests for Inherited Diseases

Depression and Psychiatric Disorders

Prenatal and Newborn Testing

• Table 8-16: Global Prenatal Test Sales Distribution by Region, 2023 (North America, Europe, Asia Pacific, RoW)

• Table 8-17: Selected Prenatal Services Provided

• Table 8-18: Selected Molecular Tests for Prenatal Analysis

Transplant Diagnostics

• Table 8-19: Global Molecular HLA Testing Sales Distribution, by Region, 2023 (North America, Europe, Asia Pacific, RoW)

• Table 8-20: Selected Innovations of Molecular Transplant Diagnostics

THE COMMERCIAL OUTLOOK FOR MOLECULAR TESTS

CHAPTER NINE: HEMATOLOGY

OVERVIEW OF HEMATOLOGY AND TRENDS

• Table 9-1: Hematology Analyzer Distribution of Sales by Menu Capability, 2023 estimated

• Table 9-2: Lab-based Hematology Sales, by Analyte Average Annual Distribution (%)

Digital Image Analysis

• Table 9-3: Selected Hematology Image Analysis Innovations

Digital Evolution

Quality Control Measurement Programs

• Table 9-4: Selected Quality Control Hematology FDA Registrations, 2023

LABORATORY-BASED HEMATOLOGY TESTING

• Table 9-5: Selected Hematology Innovations, 2014-2023

• Table 9-6: Global Laboratory-based Hematology Test and Instrument Market, 2023 and 2028 ($ millions)

Regional Laboratory-based Hematology Test and Instrument Market

• Table 9-7: Global Laboratory-based Hematology Test and Instrument Market, by Region, 2023 (North America, Europe, Asia Pacific, RoW)

DECENTRALIZED HEMATOLOGY TESTING

Hemoglobin/Hematocrit at the POC

• Table 9-8: POC Hematology Distribution by Specialty (hematocrit/hemoglobin vs. other routine hematology (WBC, erythrocyte, platelet)

• Table 9-9: Selected POC Hemoglobin and Hematocrit Systems

• Table 9-10: Selected POC Hematology Analyzer Systems

• Table 9-11: Decentralized Hematology Test and Instrument Market, 2023 and 2028 ($ millions) (Instruments, lab-style; Handheld devices)

MARKET ANALYSIS: LEADING SUPPLIERS

• Table 9-12: Top Hematology Company Revenues (laboratory and POC), by Company (Abbott, Beckman Coultar/Danaher, Roche, Siemens, Sysmex), 2023 ($ millions)

• Table 9-13: Global Hematology (Laboratory-based and POC) Sales Distribution by Region, 2023 (North America, Europe, Asia Pacific, RoW)

THE COMMERCIAL OUTLOOK FOR HEMATOLOGY TESTS

CHAPTER TEN: COAGULATION

OVERVIEW AND TRENDS OF COAGULATION AND IMMUNOHEMATOLOGY TESTS

SPECIAL TOPICS

COVID-19

Direct Oral Anticoagulants (DOACs)

• Table 10-1: Select Major Anticoagulant Sales, by Drug (Apixaban, Rivaroxaban), 2022

D-dimer

• Table 10-2: Global D-dimer Sales Distribution by Region, 2023 (North America, Europe, Asia Pacific, RoW) (%)

MARKET ANALYSIS

• Table 10-3: Global Coagulation Sales by Segment, 2023-2028 ($millions) (PT/INR Labs, Molecular, Professional POC, Professional Self; D-dimer)

• Table 10-4: Global Coagulation Test and Instrument Market by Region, 2023 (North America, Europe, Asia Pacific, RoW)

LAB-BASED TESTING

• Table 10-5: Selected Lab-based Coagulation Innovations

Genetic Markers of Hypercoagulopathies

• Table 10-6: Related CMS Codes for Reimbursement National Limits, Molecular, 2022

• Table 10-7: Global Molecular – Thrombophilia SNP Sales Distribution by Region, 2023 (North America, Europe, Asia Pacific, RoW)

• Table 10-8: Selected Molecular Coagulation Test Innovations

LEADING SUPPLIERS: LABORATORY SYSTEMS

• Table 10-9: Top Coagulation Company Revenues, Laboratory-based, by Company (Diagnostica Stago, Instrumentation Laboratory [Werfen], Siemens Healthineers, Sysmex), 2023 ($ millions) est.

DECENTRALIZED COAGULATION TESTING – PROFESSIONAL USE

Decentralized Coagulation Testing – OTC

• Table 10-10: Selected POC Coagulation Test Innovations

Platelet Testing

• Table 10-11: Selected Platelet Activity Test Innovations

LEADING SUPPLIERS: POC SYSTEMS

• Table 10-12: Top Coagulation Company Revenues, POC, 2023 ($ millions) est.

THE COMMERCIAL MARKET FOR COAGULATION TESTS

• Table 10-13: Major Anticoagulants Uses and Tests

CHAPTER ELEVEN: MICROBIOLOGY AND VIROLOGY

THE REAL IMPACT OF INFECTIONS

Herpes and Alzheimer’s Disease

Ebola and Cancer

HIV and Cancer

H pylori and Cancer

Bacteria and Parkinson’s

HPV and Cancer

MICROBIAL ANTIBIOTIC RESISTANCE – THE ROLE OF CLINICAL TESTS

Fast Identification

• Table 11-1: Selected Companies Developing Faster Identification, Some Also with Antimicrobial Susceptibility/Resistance Tests

TRADITIONAL MICROBIOLOGY AND ITS LIMITS

THE NEW MICROBIOLOGY – INNOVATIONS

Liquid Based Microbiology and Automation Innovations

Post-Blood Culture Microbial ID

PCR and Other NAAT-Based Tests for Infectious Diseases

• Table 11-2: Selected Nucleic Acid Amplification Test and Other Molecular Companies in Microbiology

Microbiome-Related Microbiology Tests

• Illumina

• Bio-Rad

• QIAGEN

• Luminex (DiaSorin)

• inBiome BV

• DNA Genotek

• Abbott

• Thermo Fisher Scientific

• Table 11-3: Selected Microbiome-Based Tests

Next Generation Sequencing-Based Microbiology Approaches

• Table 11-4: Selected Companies Applying DNA/RNA Sequencing to Microbiology

Syndromic/Multiplex Testing

NEW INFECTIOUS DISEASE THREATS

• Table 11-5: Selected Companies Marketing Products Addressing Emerging Infectious Disease Threats

Tickborne Diseases (TBDs)

Zika

Chagas

Dengue

Ebola

Chikungunya

Middle East Respiratory Syndrome-Coronavirus (MERS-CoV)

Marburg

SARS-CoV-2 (COVID-19)

• Figure 11-1: Total COVID-19 Test Volume by Country, Average Estimates June-August 2023 (Thousands)

• Figure 11-2: Estimated Market Distribution, COVID-19 Test Value, 2023

Monkeypox

MARKET ANALYSIS

• Table 11-6: Global Microbiology Sales Distribution by Region, 2023 (North America, Europe, Asia Pacific, RoW)

MARKET ANALYSIS – TRADITIONAL MICROBIOLOGY ID/AST

• Table 11-7: Global Microbiology ID/AST Market, 2023-2028 (in millions USD) (ID/AST Auto, ID/AST Panels, Blood Culture, Chromogenic Media, Rapid Microbiology; ID/AST Supplies)

• Table 11-8: Global ID/AST Testing Sales Distribution by Region, 2023 (North America, Europe, Asia Pacific, RoW)

Traditional ID/AST

• Table 11-9: Global ID/AST Testing, Distribution by Systems, (%) (Panel, Auto)

Blood Culture

• Table 11-10: Selected Advanced Techniques in Positive Blood Culture

Chromogenic Media

Rapid Tests Performed on Colonies from Culture Media

Supplies

MARKET ANALYSIS – MICROBIOLOGY IMMUNOASSAYS

Improvements in Microbiology Immunoassays

• Table 11-11: Selected Infectious Disease Immunoassay Innovations

• Table 11-12: Global Clinical Laboratory-Based Microbiology/Infectious Disease Immunoassay Market by Pathogen, 2023 (in $ millions) (Hepatitis, HIV, STDs, ToRCH, Respiratory, HAIs/Sepsis, Parasitology, Mycology, Lyme disease, Other, COVID-19) est.

• Table 11-13: Global Laboratory-Based Microbiology/Infectious Disease Immunoassay Market Distribution (by %) by Region, 2023 (North America, Europe, Asia Pacific, RoW)

Hepatitis Testing

Sepsis

HIV Immunoassay Testing

• Table 11-14: Selected HIV Assays

Sexually Transmitted Diseases (STDs)

ToRCH

Lyme Disease

• TBD-Serochip (Roche associated)

Rapid Immunoassay Tests

• Table 11-15: Global Rapid Immunoassay Testing Market, Sales Distribution by Pathogen, 2023 (%) (Influenza, HIV, STD, Hepatitis, Malaria, C.Difficile, E.coli, H.pylori, Home Test/OTC, Others)

MARKET ANALYSIS – MOLECULAR MICROBIOLOGY

• Table 11-16: Global Molecular Microbiology Sales Distribution by Region, 2023 (%) (North America, Europe, Asia Pacific, RoW)

• Table 11-17: Global Molecular Microbiology Market, by Pathogen/Disease Indication, 2023-2028 (in $ millions) (HAI, HIV, Hepatitis, GC/Chlamydia, Respiratory, Organism ID, Mycobacteria/TB, Others, COVID-19; Blood Bank Screening)

Lab Automation and Molecular Diagnostics

• Table 11-18: Selected Automated Molecular Test Instrument Platforms

Molecular Respiratory Infection Testing

The Respiratory Trio – Flu, Strep, RSV

• Table 11-19: Selected COVID-19, Flu, RSV Tests

Molecular Testing for Sexually Transmitted Diseases

Molecular Hepatitis Testing

Molecular HIV Testing

• Table 11-20: Innovations in Molecular POC Diagnostics for HIV

Molecular Tests for Hospital-Acquired Infections (HAIs)

• Table 11-21: Frequency of the Most Common Nosocomial Infections

Assessing the Problem: Nosocomial Infection Statistics

Clostridium Difficile

MRSA

Molecular TB Testing

Limitations of Molecular Microbiology Testing

MASS SPECTROMETRY

• Table 11-22: Selected Companies Marketing Mass Spectrometers and/or Assays for the Clinical Laboratory [CE-Marked and/or 510(k) cleared]

THE FUTURE OUTLOOK FOR MICROBIOLOGY

CHAPTER TWELVE: BLOOD BANKING SERVICES

OVERVIEW

The Current Status of Global Blood Collection

GLOBAL BLOOD SAFETY

• Table 12-1: Laboratory Screening of Blood Donations for Transfusion-Transmissible Infections, Number of Countries (Syphilis, HCV, HBV, HIV, Chagas, Malaria, HTLV I/II)

• Table 12-2: Prevalence of TTIs in Blood Donations [Median (Interquartile range)], by Income Group

Zika Virus

Blood and Component Collection

• Table 12-3: Blood Component Usage for Selected Conditions

• Table 12-4: Red Blood Cell and Platelet Use by Hospital Services (%)

COVID-19 Impact on Plasma Collection

Reevaluating Blood Transfusions

• Table 12-5: Impact of Alloimmunization (% of Patients Screening Positive for One or More Antibodies)

BLOOD TYPING AND GROUPING MARKET

Manual Blood Typing Methods

Automated Blood Typing and Screening Methods

Molecular Methods

• Table 12-6: Selected Blood Typing and Grouping Innovations

Size and Growth of Typing Markets

• Table 12-7: Global Blood Typing Market, 2023-2028 (Typing) (in $ millions)

Blood Typing Market by Geography

• Table 12-8: Global Blood Typing Sales Distribution by Region, 2023 (%) (North America, Europe, Asia Pacific, RoW)

BLOOD TESTING MARKET

• Table 12-9: Selected Blood Testing Innovations

Preventing Bacterial Infections

Immunoassays

Nucleic Acid Testing (NAT)

Size and Growth of the Market

• Table 12-10: Global Blood Banking Diagnostics Market, 2023-2028 (Immunoassay Screen, NAT Screens) (in $ millions)

Blood Testing Market by Geography

• Table 12-11: Global Blood Testing Market by Geography, 2023 (%) (North America, Europe, Asia Pacific, RoW)

THE COMMERCIAL OUTLOOK FOR BLOOD BANKING TESTING

CHAPTER THIRTEEN: HISTOLOGY AND CYTOLOGY

OVERVIEW

SPECIAL TOPICS

Histology Automation

• Table 13-1: Selected Histology Lab Automation

• Table 13-2: Histology Information Technology Tools

Advanced Analysis Solutions

• Table 13-3: Selected Advanced Histology Techniques

HPV meets Core Lab

• Table 13-4: Global HPV Test Sales Distribution by Region, 2023 (%) (North America, Europe, Asia Pacific, RoW)

• Table 13-5: Selected HPV Test Innovations

MARKET ANALYSIS

Total Market

• Table 13-6: Global Histology/Cytology Sales by Type, 2023-2028 ($ millions) (Pap Tests, in situ hybridization, immunohistochemistry, traditional non-Pap stains, HPV, TOTAL; Digital Imaging, CTCs, Flow Cytometry)

Regional Market Analysis

• Table 13-7: Global Histology/Cytology Sales Distribution by Region, 2023 (%) (North America, Europe, Asia Pacific, RoW)

• Table 13-8: Revenues of the Major Histology Companies, 2018-2023 ($ millions, estimated)

• Traditional Stains

• Table 13-9: Selected Vendors of Traditional Histology Stains

Pap Testing

• Table 13-10: Primary and Secondary Prevention of Cervical Cancer, Screening Responses by Country, 2021

Immunohistochemistry and In Situ Hybridization

• Table 13-11: Selected In Situ Hybridization-based Tests

• Table 13-12: Selected IHC Test Innovations

Pharmacodiagnostic Histology

• Table 13-13: Major Pharmacodiagnostic Markers

• Table 13-14: Selected Pharmacodiagnostic Histology Tests

Digital Imaging and Computational Pathology

• Table 13-15: Selected Digital Pathology Image Capture and Viewing Solutions

COVID-19 and Digital Pathology

• Table 11-16: FDA Digital Pathology Device Review Classification During COVID-19

• Table 13-17: Selected Digital Imaging Innovations

Circulating Tumor Cells

• Table 13-18: Selected Innovations in CTC Technology

Flow Cytometry

THE COMMERCIAL OUTLOOK FOR HISTOLOGY AND CYTOLOGY TESTS

CHAPTER FOURTEEN: COMPANY PROFILES: THE TOP TIER

ABBOTT DIAGNOSTICS

• Table 14-1: Abbott Diagnostics Revenue History ($ million)

• Table 14-2: Abbott Diagnostic Revenues by Segment, 2017-2022 ($ million) est.

Core Lab

Hematology

Blood Banking

Infectious Diseases – Molecular

Diabetes

HIV Point of Care

i-STAT Business

Companion Diagnostic Testing

Liquid Biopsy

COVID-19

AGILENT TECHNOLOGIES

• Table 14-3: Agilent Revenue History Diagnostics and Genomics, 2017-2022 ($ million)

Genomics

Cytogenetic Analysis

Sequencing

CRISPR

Flow Cytometry

Companion Diagnostics – Dako

COVID-19

BECKMAN COULTER BECKMAN COULTER, INC. / DANAHER

• Table 14-4: Beckman Coulter Revenue History, 2017-2022 ($ million, estimated)

• Table 14-5: Beckman Coulter Diagnostic Revenues by Segment, 2019-2022 ($ million) est

Hematology

Hematology IT

Clinical Chemistry

Immunoassays

Microbiology

IT Clinical

Flow Cytometry

Blood Banking

Beckman Coulter Life Sciences

COVID-19

BECTON, DICKINSON AND COMPANY (BD)

• Table 14-6: BD Revenue History, 2017-2022 ($ million, estimated) FYE Sept 30

• Table 14-7: BD Diagnostic Revenues by Segment, 2017-2022 ($ million)

Cytology

Molecular Microbiology

Traditional Microbiology – ID/AST

Blood Culture

Hospital Acquired Infections

Blood Collection

Mass Spectrometry

Flow Cytometry

COVID-19

BIOMÉRIEUX INC.

• Table 14-8: bioMérieux Revenue History, 2017-2022 ($ million)

• Table 14-9: bioMérieux Diagnostic Revenues by Segment, 2017-2022 ($ million)

Traditional Microbiology

Blood Culture

Immunoassays

Mass Spectrometry

BIOFIRE Diagnostics Business

Expansion

COVID-19

BIO-RAD LABORATORIES, INC.

• Table 14-10: BioRad Revenue History, 2017-2022 ($ million, estimated)

• Table 14-11: Bio-Rad Diagnostic Revenues by Segment ($ million) est

Quality Control

Blood Bank

Diabetes

Immunoassays

Liquid Biopsy

Droplet Digital PCR

Sequencing

COVID-19

CEPHEID / DANAHER

• Table 14-12: Cepheid Revenue History, 2017-2022 ($ million, clinical product sales)

GeneXpert/ Xpress Line

Tuberculosis

Microbiology

POC Testing

Cancer

COVID-19

DANAHER CORPORATION

• Table 14-13: Danaher Revenue History, 2017-2022 ($ million, Diagnostics, estimated)

Acquisitions

DEXCOM

• Table 14-14: Dexcom Revenue History, 2017-2022 ($ million)

DIASORIN S.P.A

• Table 14-15: DiaSorin Revenue History, 2017-2022 ($ million)

Development Plan

Expansion

Immunoassays

Molecular

Molecular Oncology

COVID-19

EXACT SCIENCES

• Table 14-16: Exact Sciences Revenue History, 2017-2022 (in $ millions)

COVID-19

HOLOGIC, INC.

• Table 14-17: Hologic Revenue History estimated diagnostic product revenue, 2017-2022 ($ million, estimated)

• Table 14-18: Hologic Diagnostic Revenues by Segment, 2017-2022 ($ million)

Acquisitions

PANTHER Molecular System

HIV Testing

Sexually Transmitted Infections

Infectious Diseases

Panther Fusion

Cytology

COVID-19

ILLUMINA

• Table 14-19: Illumina Revenue History, 2017-2022 ($ million – not all revenues are for clinical products and services; estimated)

• Table 14-20: Illumina Diagnostic Revenues by Segment, 2017-2022 ($ million) est

China

COVID-19

INSTRUMENTATION LABORATORY (IL) / WERFEN

• Table 14-21: Recent Revenue History, 2017-2022 ($ million, estimated)

• Table 14-22: IL Diagnostic Revenues by Segment, 2017-2022 ($ million)

Expansion

Coagulation

Acute Care

Information Technology

LEICA BIOSYSTEMS/DANAHER

• Table 14-23: Leica Revenue History, 2017-2022 ($ millions) estimated

Digital Pathology

Companion Diagnostics

Stain Reagents

Lab Systems

Sample Handling

Circulating Tumor Cells (CTCs)

Artificial Intelligence

COVID-19

MINDRAY – SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

NATERA

• Table 14-24: Natera Revenue History, 2017-2022 ($ millions)

QIAGEN

• Table 14-25: QIAGEN Revenue History, 2017-2022 ($ million)

• Table 14-26: QIAGEN Diagnostic Revenues by Segment, 2017-2022 ($ million) est

Tuberculosis

Molecular Expansion

Precision Medicine / Companion Diagnostics

Molecular Microbiology

Prenatal Testing

Next Generation Sequencing

Sample Prep, Informatics

Digital PCR

Liquid Biopsy

Cervical Cancer

Expansion

COVID-19

QUIDELORTHO CORPORATION

• Table 14-27: QuidelOrtho Revenue History, 2018-2022 ($ million)

• Table 14-28: QuidelOrtho Diagnostic Revenues by Segment, 2020-2022 ($ million) est

Immunoassays

Rapid Immunoassays

The Solana Business

Molecular – Savanna

Blood Bank

COVID-19

RADIOMETER A/S / DANAHER

• Table 14-29: Radiometer A/S Revenue History, 2017-2022 (estimated, $ million)

Critical Care

Immunoassays

HemoCue

Transcutaneous Monitoring

ROCHE DIAGNOSTICS

• Table 14-30: Roche Revenue History, 2017-2022 (in millions $)

• Table 14-31: Roche Diagnostic Revenues by Segment, 2017-2022 ($ million) est

Hematology

Immunoassays

HIV

Molecular Expansion

Core Molecular

Digital PCR

Diabetes Care

Coagulation

cobas Liat System – POC

HPV

Blood Bank

Transplant Medicine

Cancer Companion Testing

IT in Anatomical Pathology

Information Technology

COVID-19

SIEMENS HEALTHINEERS (SIEMENS)

• Table 14-32: Siemens Healthineers Revenue History, 2017-2022 ($ million, estimated)

• Table 14-33: Siemens Healthineers Diagnostic Revenues by Segment, 2021-2022 ($ million)

Core Lab

Lab Automation

Immunoassays

Hematology

Urinalysis

Molecular

Expansion to Support Molecular Diagnostics – Fast Track Diagnostics

Sequencing with Artificial Intelligence

Acute Care – POC

POC Connectivity

Business Expansion

COVID-19

SYSMEX CORPORATION

• Table 14-34: Sysmex Revenue History, 2018-2022 ($ million) FYE March 31

• Table 14-35: Sysmex Diagnostic Revenues by Segment, 2018-2022 ($ million) est

Hematology

Coagulation

Urinalysis and Infectious Disease

Immunoassays

Lab Information System

Information Technology

Flow Cytometry

Precision Medicine / Companion Test Diagnostics

Liquid Biopsy

Oncology

Sysmex Inostics

Forging New Markets

COVID-19

THERMO FISHER SCIENTIFIC INC.

• Table 14-36: Thermo Fisher Revenue History, 2017-2022 (clinical diagnostics, $ million)

• Table 14-37: Thermo Fisher Scientific Diagnostic Revenues by Segment, 2017-2022 ($ million)

Immunoassays

Microbiology

Molecular Test Business

Next Generation Sequencing

qPCR

Oncology Companion Diagnostics

Transplant Medicine

Microbiome

Mass Spectrometry

Collaborations

Gene Editing and Cell Therapy

China

COVID-19

VENTANA MEDICAL SYSTEMS INC. / ROCHE TISSUE DIAGNOSTICS

• Table 14-38: Ventana Medical Systems Revenue History, 2017-2022 ($ millions)

Immunohistochemistry – IHC

Cervical Cancer Screening

Companion Diagnostics

WERFEN

• Table 14-39: Werfen Recent Revenue History, 2017-2022 ($ million estimated)

CHAPTER FIFTEEN: COMPANY PROFILES: THE SECOND TIER

BGI GENOMICS (FORMERLY BEIJING GENOME INSTITUTE)

• Table 15-1: BGI Genomics Revenue History, 2017-2022 ($ millions)

PCR and Fluorescence

MGI Tech Co., Limited, China

Prenatal Testing

Test Services

Whole Genome Sequencing (WGS)

NGS Sequencing

Collaborations

COVID-19

BIOCARTIS

• Table 15-2: Biocartis Revenue History, 2017-2022 ($ million)

COVID-19

BRUKER CORPORATION

• Table 15-3: Bruker Revenue History Product revenue, 2017-2022 ($ million)

Acquisitions and Collaborations

Mass Spectrometry

Microbiology

Molecular PCR

COVID-19

DIAGNOSTICA STAGO S.A.S.

EIKEN CHEMICAL CO., LTD

• Table 15-4: Eiken Chemical Revenue History, 2017-2022 ($millions) FYE March 31

Product News

COVID-19

FULGENT GENETICS, INC

• Table 15-5: Fulgent Revenue History, 2017-2022 ($ million)

COVID-19

FUJIREBIO DIAGNOSTICS, INC.

• Table 15-6: Fujirebio Diagnostics Revenue History, 2017-2022 ($ millions) FYE March 31

GRIFOLS S.A.

• Table 15-7: Grifols Revenue History ($ million)

• Table 15-8: Grifols Diagnostic Revenues by Segment ($ million)

Blood Transfusion Business

ABO Blood Typing

Molecular ABO Blood Typing

Immunoassays

Market Expansion

Self-Testing

COVID-19

GUARDANT HEALTH, INC.

• Table 15-9: Guardant Health Revenue History, 2019-2022 ($ million)

HORIBA MEDICAL

• Table 15-10: Horiba Medical Revenue History, 2017-2022 (in millions USD) (medical diagnostic sales)

INVITAE

MASIMO CORPORATION

• Table 15-11: Masimo Revenues History, 2017-2022 ($ millions)

MENARINI DIAGNOSTICS

COVID-19

MERIDIAN BIOSCIENCE, INC.

• Table 15-12: Meridian Bioscience Revenue History, 2017-2022 ($ million, estimated) FYE Sept 30

Immunoassays

Molecular Tests

COVID-19

MYRIAD GENETICS, INC.

• Table 15-13: Myriad Genetics Revenue History, 2017-2022 ($ millions) FYE June 30

NIHON KOHDEN

• Table 15-14: Nihon Kohden Revenues History, 2017-2022 ($ millions)

ORASURE TECHNOLOGIES, INC.

• Table 15-15: OraSure Technologies Revenue History, 2017-2022 ($ million)

• Table 15-16: OraSure Technologies Product Revenue History, 2020-2022 ($ million)

COVID-19

PERKINELMER, INC. ( REVVITY)

• Table 15-17: PerkinElmer Revenue History, 2017-2022 ($ million, estimated)

• Table 15-18: PerkinElmer Diagnostic Revenues by Segment, 2017-2022 ($ million) est

Diagnostics

Sequencing /Genomics

Liquid Biopsy

Histology

Prenatal Business

Lab Services

Mass Spectrometry

COVID-19

SEKISUI DIAGNOSTICS LLC

COVID-19

VERACYTE, INC.

• Table 15-19: Veracyte Revenue History (in $ millions)

CHAPTER SIXTEEN: COMPANY PROFILES: BLOOD BANK SPECIALISTS

CERUS CORPORATION

• Table 16-1: Cerus Revenue History ($ million)

COVID-19

QUOTIENT LIMITED (ALIVEDX)

COVID-19

CHAPTER SEVENTEEN: COMPANY PROFILES: CORE LAB AND OTHER COMPANIES

AB SCIEX PTE LTD.

ARKRAY

Dry Chemistry / Immunoassays

Urinalysis

Diabetes

Molecular

EKF DIAGNOSTICS HOLDINGS PLC

• Table 17-1: EKF Diagnostics Revenue History ($ millions)

COVID-19

ELITECH GROUP S.A.S.

COVID-19

SHIMADZU SCIENTIFIC INSTRUMENTS

SNIBE CO. LTD., (SHENZHEN NEW INDUSTRIES BIOMEDICAL ENGINEERING CO. LTD.)

COVID-19

TOSOH BIOSCIENCE

COVID-19

TRINITY BIOTECH PLC

• Table 17-2: Trinity Biotech Revenue History, 2017-2022 ($ millions)

COVID-19

CHAPTER EIGHTEEN: COMPANY PROFILES: CTC & LIQUID BIOPSY TEST PROVIDERS

BIOCEPT, INC.

COVID-19

BIODESIX

COVID-19

EPIC SCIENCES

EPIGENOMICS AG

FOUNDATION MEDICINE, INC.

MENARINI-SILICON BIOSYSTEMS

COVID-19

NEOGENOMICS

CHAPTER NINETEEN: COMPANY PROFILES: SPECIALISTS

ASCENSIA DIABETES CARE HOLDINGS AG

BIGFOOT BIOMEDICAL INC.

DEBIOTECH SA

COVID-19

GLOOKO INC.

INSULET CORPORATION

• Table 19-1: Insulet Corp Revenue History ($ million)

INTEGRITY APPLICATIONS INC. (GLUCOTRACK)

LIFESCAN INC.

MEDTRONIC PLC

• Table 19-2: Medtronic Revenue History, 2017-2022 ($ million)

NEMAURA MEDICAL INC.

COVID-19

VERILY LIFE SCIENCES LLC

COVID-19

CHAPTER TWENTY: COMPANY PROFILES: HEMATOLOGY (CELL ANALYSIS) AND COAGULATION SPECIALISTS

CELLAVISION AB

NOVA BIOMEDICAL CORPORATION (NOVA)

CHAPTER TWENTY-ONE: COMPANY PROFILES: HISTOPATHOLOGY SPECIALISTS

AMOY DIAGNOSTICS CO. LTD.

APPLIED SPECTRAL IMAGING INC. (ASI)

BIOGENEX LABORATORIES, INC.

BIOVIEW LTD.

LEICA BIOSYSTEMS

COVID-19

MILLIPORESIGMA

VISIOPHARM

CHAPTER TWENTY-TWO: COMPANY PROFILES: IMMUNOASSAY SPECIALISTS

BIOHIT HEALTHCARE

BIOMERICA INC.

• Table 22-1: Biomerica Revenue History, 2017-2022 ($ million)

COVID-19

BIO-TECHNE CORPORATION

• Table 22-2: Bio-Techne Revenue History, 2017-2022 ($ million)

COVID-19

EUROBIO SCIENTIFIC

COVID-19

EUROIMMUN AG (REVVITY)

COVID-19

IMMUNODIAGNOSTIC SYSTEMS (IDS)

COVID-19

INOVA DIAGNOSTICS, INC.

COVID-19

ONE LAMBDA, INC

RESPONSE BIOMEDICAL CORP.

COVID-19

THERADIG

COVID-19

VOLITIONRX LIMITED

COVID-19

CHAPTER TWENTY-THREE: INFORMATION TECHNOLOGY SPECIALISTS IN IN VITRO DIAGNOSTICS

CERNER CORP. (ORACLE)

DELL TECHNOLOGIES INC.

EUFORMATICS OY

GENOMONCOLOGY LLC

GOOGLE LLC (VERILY LIFE SCIENCES)

INTEL CORPORATION

INTERNATIONAL BUSINESS MACHINES CORP. (IBM)

PHILIPS (ROYAL PHILIPS)

• Table 23.1: Philips Revenue History ($ millions)

Histology

Precision Medicine

Precision Medicine IT

Patient Monitoring

Point of Care

Wearable Self Monitor

PIERIANDX (VELSERA)

SOPHIA GENETICS SA

COVID-19

CHAPTER TWENTY-FOUR: COMPANY PROFILES: MICROBIOLOGY SPECIALISTS

ACCELERATE DIAGNOSTICS, INC.

• Table 24-1: Accelerate Diagnostics Revenue History, 2017-2022 ($ thousands)

COVID-19

ADVANCED BIOLOGICAL LABORATORIES, S.A. (ABL)

COVID-19

ALTONA DIAGNOSTICS

COVID-19

ARCDIA INTERNATIONAL OY LTD.

COVID-19

BIOFIRE DIAGNOSTICS, LLC. (ACQUIRED BY BIOMÉRIEUX)

COVID-19

COPAN ITALIA S.P.A. AND COPAN DIAGNOSTICS, INC.

COVID-19

CURETIS

COVID-19

GENETIC ANALYSIS AS

COVID-19

GREINER BIO-ONE INTERNATIONAL GMBH

MAST GROUP

COVID-19

MOBIDIAG

COVID-19

Q-LINEA AB

OPGEN, INC.

COVID-19

SEEGENE, INC.

COVID-19

T2 BIOSYSTEMS

COVID-19

CHAPTER TWENTY-FIVE: COMPANY PROFILES: MOLECULAR TEST SPECIALISTS

ENZO BIOCHEM INC.

• Table 25-1: Enzo Biochem Revenue History, 2017-2022 ($ million)

COVID-19

FLUIDIGM CORPORATION (STANDARD BIOTOOLS)

• Table 25-2: Standard BioTools Revenue History, 2017-2022 ($ million)

COVID-19

GENOME DIAGNOSTICS BV (GENDX)

NANOSTRING TECHNOLOGIES, INC.

• Table 25-3: NanoString Revenue History ($ million)

COVID-19

PACIFIC BIOSCIENCES OF CALIFORNIA, INC. (PACBIO)

• Table 25-4: PacBio Revenue History ($ million)

COVID-19

RANDOX LABORATORIES LTD.

Clinical Chemistries

POC

Controls

Evidence Series – Multistat Biochip Analyzers

Molecular

COVID-19

TAKARA BIO INC.

COVID-19

VELA DIAGNOSTICS

COVID-19

CHAPTER TWENTY-SIX: COMPANY PROFILES: POINT OF CARE TEST SPECIALISTS

ABINGDON HEALTH LTD.

COVID-19

BINX HEALTH

COVID-19

BIOMEME, INC.

COVID-19

CHEMBIO DIAGNOSTIC SYSTEMS, INC.

• Table 26-1: Chembio Diagnostics Revenue History, 2017-2022 ($ million)

COVID-19

CUE HEALTH

• Table 26-2: Cue Health Revenue History, 2017-2022 ($ million)

Test to Treat

COVID-19

DIAZYME

COVID-19

DNA ELECTRONICS LTD (DNAE)

GENEDRIVE PLC (FORMERLY EPISTEM HOLDINGS)

• Table 26-3: genedrive Revenue History, 2020-2022 (in $ millions)

COVID-19

NUGENEREX DIAGNOSTICS (HDS)

IMMUNOSTICS, INC.

COVID-19

LOOP MEDICAL

MEDMIRA, INC.

• Table 26-4: MedMira Revenue History, 2017-2022 ($ thousands)

COVID-19

QUANTUMDX GROUP, LTD.

COVID-19

RHEONIX, INC.

COVID-19

VEREDUS LABORATORIES PTE LTD

COVID-19

CHAPTER TWENTY-SEVEN: COMPANY PROFILES: PRENATAL TEST SERVICE PROVIDERS

BERRY GENOMICS CO. LTD.

COOPERGENOMICS (DIVISION OF COOPERSURGICAL)

INEX INNOVATE

COVID-19

OXFORD GENE TECHNOLOGY

SEQUENOM, INC. (INTEGRATED GENETICS)

YOURGENE HEALTH

COVID-19

CHAPTER TWENTY-EIGHT: COMPANY PROFILES: QUALITY CONTROL & SAMPLE PRETREATMENT SPECIALISTS

10X GENOMICS

AGENA BIOSCIENCE, INC.

COVID-19

BIOTYPE DIAGNOSTIC GMBH

COVID-19

DXTERITY DIAGNOSTICS INC.

COVID-19

HORIZON DISCOVERY GROUP PLC

INCELLDX

LGC SERACARE LIFE SCIENCES, INC.

COVID-19

PREANALYTIX GMBH

PRECIPIO, INC. (FORMERLY TRANSGENOMIC)

COVID-19

QUANTERIX CORPORATION

COVID-19

STRECK INC.

CHAPTER TWENTY-NINE: TEST SERVICE PROVIDERS

23ANDME

AGENDIA BV

AMBRY GENETICS

COVID-19

ARUP LABORATORIES

COVID-19

ASPIRA WOMEN’S HEALTH ( FORMERLY VERMILLION INC.)

• Table 29-1: Aspira Women’s Health Revenue History, 2017-2022 (in $ millions)

BIOREFERENCE LABORATORIES

COVID-19

BIOTHERANOSTICS

BLUEPRINT GENETICS OY

BOSTON HEART DIAGNOSTICS

CAREDX, INC.

• Table 29-2: CareDx Revenue History, 2017-2022 ($ in thousands)

HELOMICS CORPORATION

LABCORP, LABORATORY CORPORATION OF AMERICA

• Table 29-3: Labcorp Revenue History, 2017-2022 ($ millions)

Precision Medicine

Diagnostics Services

DTC Home Testing

Collaborations and Expansion

COVID-19

MAYO CLINIC LABORATORIES

MDXHEALTH SA

• Table 29-4: MDxHealth Revenue History, 2017-2022 (in $ millions)

OPKO DIAGNOSTICS

• Table 29-5: OPKO Diagnostics Revenue History, 2017-2022 (in $ millions)

COVID-19

QUEST DIAGNOSTICS

• Table 29-6: Quest Diagnostics Revenue History, 2017-2022 ($ million)

Diagnostic Services

Oncology

Infectious Diseases

Prenatal and Women’s Health

Retail / Consumer Health

Expansion

COVID-19

SONIC HEALTHCARE