What is the size of the Clinical Laboratory Market?

Clinical laboratories are an essential part of the health industry. It is estimated that between 70% – 80% of physicians’ diagnoses are a result of laboratory tests. In addition to diagnosing patients, clinical lab testing is performed to evaluate disease progression, monitor drug treatment and conditions, determine individual therapy, and several other reasons. It’s also a large business.

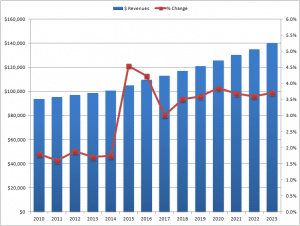

The global clinical laboratory market is valued at $116.9 billion, with nearly $55 billion generated from markets outside the United States. This according to Kalorama Information’s report on the topic: https://kaloramainformation.com/product/clinical-laboratory-services-market/

Several trends are continuing to shape the clinical laboratory market including the growing demand for early disease detection and diagnosis, personalized medicine, importance of disease monitoring and expanded technologies.

Clinical laboratories emerged in the late 1800s primarily as a result of the growing incidence of epidemics including tuberculosis and cholera. Hospital and independent laboratories were the two listed types of laboratories for several years with hospitals accounting for approximately 90% of laboratory facilities. The growth of clinical laboratories further surged after the discovery of antibiotics, which was essential to saving lives in the early 1900s.

Today, clinical laboratories are improving a physician’s ability to treat patients like never before. There is a shift in healthcare utilization primarily due to reducing healthcare spending, which makes the laboratory an even more valuable part of the treatment plan.

In efforts to reduce health-related costs, hospitals have been striving to reduce length of stays. In the United States, this has been a primary area of focus to reduce health spending, moving procedures and care to outpatient facilities when appropriate. Although stays in U.S. hospitals were thought to have declined to about 4.3 days on average there has been some indication of an increase among some demographics in recent years. For 2018, the average length of hospital stay is now reporting at around 5.5 days.

Hospital administration has attributed this largely due to the types of procedures and admissions which are more common in aging populations. To continue to try and keep stays at a minimum and ultimately reduce cost, monitoring technologies, diagnostic imaging and laboratory measures and disease/treatment monitoring through diagnostic laboratory practices are primary ways physicians and administrators are continuing to meet optimal healthcare outcomes while also reduce costs.

Global markets are also feeling pressures to reduce health spending and to some degree have focused on shifting health services to outpatient and home-based locations. The length of stay on a global level is estimated at 6.5 to 6.6 days on average with Russia and Japan among the higher days of hospitalization.

We can expect to see an increase in the number of clinical laboratories, particularly in the independent and community sectors, as these trends continue to influence the industry and add pressure to clinical laboratories in an effort to reduce costs and still provide adequate healthcare.

Key Issues and Trends Affecting the Market

There are several primary issues and trends affecting the clinical laboratory market. Demographics, disease prevalence, and increasing life expectancy will continue to fuel growth in the future. New developments will also positively influence growth. Some of these issues are discussed in this study.

Issues and trends explored in this study include:

• Demographics

• Growing Incidence of Disease

• New Developments

• Regulatory Environment

• Laboratory Regulation

• Reimbursement

• Payer Types

• Developments in Personalized Medicine

As governments continue to limit health spending, they impose restrictions on pricing, which can negatively affect revenues. Companies with a focus on one geographic region, such as Quest with its high involvement in the U.S. market, watch the government environment closely. The U.S. market is constantly under pressure to adapt to the CMS reimbursement restrictions and limitations. Some companies have reduced this risk by diversifying geographic participation and/or reducing dependence on Medicare/Medicaid payers. For most companies in this space, Medicare/Medicaid account for 15-25% of total revenues.

Newer technologies, molecular testing services, shifting test volume to less conventional areas

Molecular testing and other advanced testing techniques are continuing to show moderate growth and will likely be the new ‘normal’ in clinical laboratory offerings.

Leading Market Participants in the Clinical Laboratory Business

The clinical laboratory market is highly competitive in terms of prices, locations, and services offered. There are several hundred participants in the market with intense competition at the national, regional and local level for most labs. Larger laboratories such as Quest Diagnostics and LabCorp have advantages in the market due to the wide exposure, large number of locations, and greater financial positions. Smaller, independent laboratories may find it difficult to keep up with the fast-changing industry largely due to limited financial abilities to invest in new technologies and testing services.

Some laboratories, such as BioReference Labs have found success in operating on a regional basis while companies such as Myriad Genetics and NeoGenomics remain competitive by focusing on more specialized genetic-based testing.

This report provides an overview of some of the leading market participants in the clinical laboratory market.

Two companies, Quest Diagnostics and Laboratory Corporation of America, dominate the industry with combined laboratory service revenues of $14.2 billion in 2018.

The following companies are several of the leaders in the industry:

• Alere (Abbott)

• BioReference Laboratories, Inc.

• DaVita, Inc.

• Genomic Health, Inc.

• Laboratory Corporation of America

• Miraca

• Myriad Genetics

• NeoGenomics

• Quest Diagnostics

• Siemens

• Sonic Healthcare

• Spectra Laboratories (Fresenius)

• SYNLAB