BCMOs: Who’s Winning?

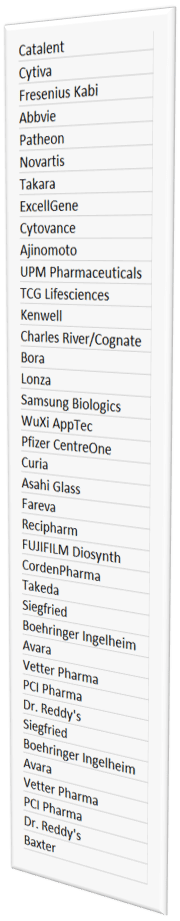

The global BCMO industry is highly fragmented, with 40 BCMOs/CDMOs accounting for roughly one quarter of the industry’s revenues and the remainder comprised of a large number of smaller players. Based upon 2021 figures, Catalent led the overall market with estimated BCMO sales of $2.2 billion It was followed closely by Cytiva with $2.0 billion While these market leaders are active in most of the geographic market segments, smaller players tend to focus on a few regions, particularly the U.S. and/or Western Europe. Besides market leaders, companies of interest include Dr. Reddy’s as well as WuXi AppTec, Pfizer CentreOne, Baxter. This according to Kalorama’s latest report on the sector: https://kaloramainformation.com/product/biopharmaceutical-contract-manufacturing-organization-cmo-market-2022

It should be noted that most of these companies do not separate their contract manufacturing from their contract research and development revenues; they also do not separately report their small molecule versus large molecule revenues. Therefore, these figures represent estimates based upon report information and industry averages.

The global BCMO industry is highly fragmented with 40 BCMOs/CDMOs accounting for roughly one quarter of the industry’s revenues

Future Market Trends

Many factors have impacted global drug makers in recent years. These trends, which are well established, are expected to continue through the next several years. Additionally, ongoing economic challenges will further pressure the industry, making drug maker financial performance even more important and tightening access to capital for smaller players. The following sections discuss near and longer term predictions for drug manufacturing and the BCMO industry.

Through the five year forecast period of this report, a variety of economic and pharmaceutical industry factors will intensify the pressure on drug developers including:

• Tight lending policies from risk averse banks and financiers;

• uncertainty within the corporate sector on healthcare and other costs;

• rising requests of drug makers to offer rebates and discounts on medications;

• ongoing patent expirations fueling a strong need for new product candidates;

• a high level of regulatory scrutiny across the drug lifecycle from testing and approval to manufacturing and marketing;

• new imperatives to contain spending and/or cut costs to improve reported performance, particularly focusing on manufacturing as it represents a high fixed cost asset;

• constrained internal manufacturing staff and capabilities in some areas, following prior downsizings coupled with continued high excess manufacturing capacity amongst other pharmaceuticals and BCMOs.

While all of these factors are important, the impact of the economic pressures cannot be overstated since many drug makers are publicly traded and financial pressures directly impact their budgets. In this environment, manufacturers will be extremely cautious about investments in new technologies, equipment or facilities, preferring to outsource to established experts rather than incur heavy capital costs building, expanding or upgrading their own internal capabilities. This is particularly true for mid size and emerging drug makers, whose resources are limited compared with the larger drug makers. This will have the net effect of stimulating contract manufacturing, although it will also increase pricing pressure on service providers and result in more risk sharing and other innovative agreements between sponsor and contractor.

Predicting the shape of the global drug manufacturing landscape in the long term necessarily involves a higher degree of uncertainty, particularly related to the state of regional economies. However, as of mid-2022, most analysts were optimistic about the healthcare sector.