Brazil and Mexico Lead IVD Investments in Latin America

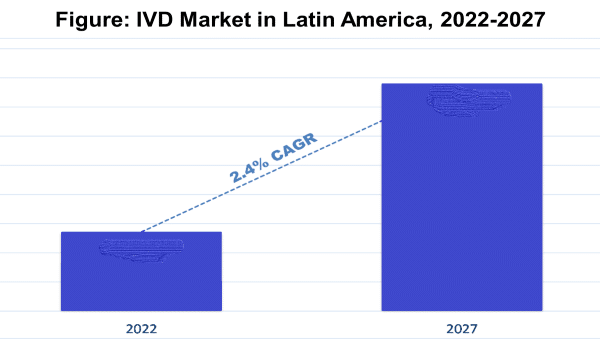

There are opportunities in Latin America for in vitro diagnostic manufacturers exploring expansion and sales growth, particularly in nations such as Brazil and Mexico, but also in more than a dozen other nations throughout the region. Between 2022-2027, the multi-billion dollar IVD market in Latin America is forecast to have a compound annual growth rate (CAGR) of 2.4% and thus provide IVD companies with the potential for new and notable regional business opportunities, according to The Market for In Vitro Diagnostic (IVD) Tests in Latin America (Argentina, Brazil, Chile, Colombia, Mexico, Peru, Venezuela and Other Nations), a recent report by Kalorama Information.

Brazil and Mexico represent the two largest countries in terms of population, accounting for more than half of Latin America’s total population–exceeding 340 million in a region with 646 million people. For this reason, these two countries have been the focus for many IVD suppliers in recent years. However, as economic conditions strengthen in other countries and demand increases for quality health services, there are additional opportunities in countries such as Chile, Colombia and especially Peru.

Growth Trends

Population growth, government insurance, newly insured patients, advancing technology and updated healthcare facilities will drive IVD growth in Latin America. An aging population that will significantly outpace total population growth will also be a factor.

“The region’s aging population will place additional pressure on health systems to deliver care to a population that will likely need more involved treatment as they grow older,” says Bruce Carlson, publisher for Kalorama Information.

In vitro diagnostic manufacturers investing in the region must be aware that Latin American countries differ in their use of the IVD testing market. Some countries are demonstrating higher growth than others due to economic factors.

Brazil is the number one IVD market in the Latin America with sales of more than $1 billion in 2022. Mexico is second in the area for IVD sales approaching $800 million. The Brazilian market is growing at steady pace with some ups and downs, as well as Chile, Colombia and Peru. The current political and economic climate is hindering growth in Argentina and Venezuela. However, the market region as a whole is an attractive market for IVD companies to develop.

Regional Challenges

Even though market growth is steady in Latin America, there are big challenges for the IVD industry to overcome. One of the challenges is that each country is a world on its own: different regulations on sales, many different reimbursement policies, diverse geography, various market access strategies and a number of logistic issues amongst others.

Since all the countries in Latin America also vary in size, healthcare infrastructure and affordability, the IVD companies need to tailor strategies for approaching each country´s market. Tailored strategies are needed for each different country and will assure success if they are conscientiously planned.

To learn about these recommended strategies and other insights purchase The Market for In Vitro Diagnostic (IVD) Tests in Latin America (Argentina, Brazil, Chile, Colombia, Mexico, Peru, Venezuela and Other Nations).