Still Room to Grow in Infectious Disease IVD

Per Kalorama Information’s World Infectious Disease report:

Opportunities for infectious disease testing products vary widely between the developed and developing countries, according to our most recent report on infectious disease world markets. With favorable access to a complete range of tests and the operation of advanced medical delivery systems that reach most residents and in spite of making up only 12.4% of the world’s population, the major developed countries (Canada, Japan, South Korea, the United States, and the West European economies) accounted for almost 58% of global demand in 2021. This percentage correlated to $24.8 billion and nearly $26 per capita.

Although exceeding a total of $18.2 billion in 2021, combined demand for infectious disease IVD testing products in the developing world was equivalent to less than $3 per capita. Accordingly, access to these diagnostics in the various countries is widely imbalanced and often deficient depending on the location and availability of medical providers. Over the next several years, most developing world markets for infectious disease IVD testing products are projected to generate growth above the global average. However, the overall accessibility of tests will not improve significantly due to aging demographic patterns and continuing constraints on the availability of healthcare resources.

“Although exceeding a total of $18.2 billion in 2021, combined demand for infectious disease IVD testing products in the developing world was equivalent to less than $3 per capita.”

Kalorama World Infectious Disease Market Analysis

The total market for infectious disease IVD products in North America is predicted to reach almost $15.5 billion in 2031, up an annual average of 4.2% over the 2018 amount. Key regional trends related to product demand patterns are detailed below.

Over 90% of demand will be contributed by the United States, reflecting its dominance of regional medical activities and health spending as well as its higher relative pricing structure for medical products.

Canada, which covers all residents for medical benefits and delivers a high volume of hospital, surgical and outpatient procedures, will continue to form a broad, diverse market for infectious disease IVD products, but per capita demand will be equivalent to only about half of the United States average due to strict healthcare cost containment initiatives.

Imbalances and deficiencies in medical resources and a lower overall healthcare pricing structure will hold down overall infectious disease IVD product demand in Mexico; however, the country will provide above average growth opportunities for most products.

Total regional product demand in 2020 and 2021 and projected demand in 2020 reflects a high incidence of COVID-19 cases in the United States.

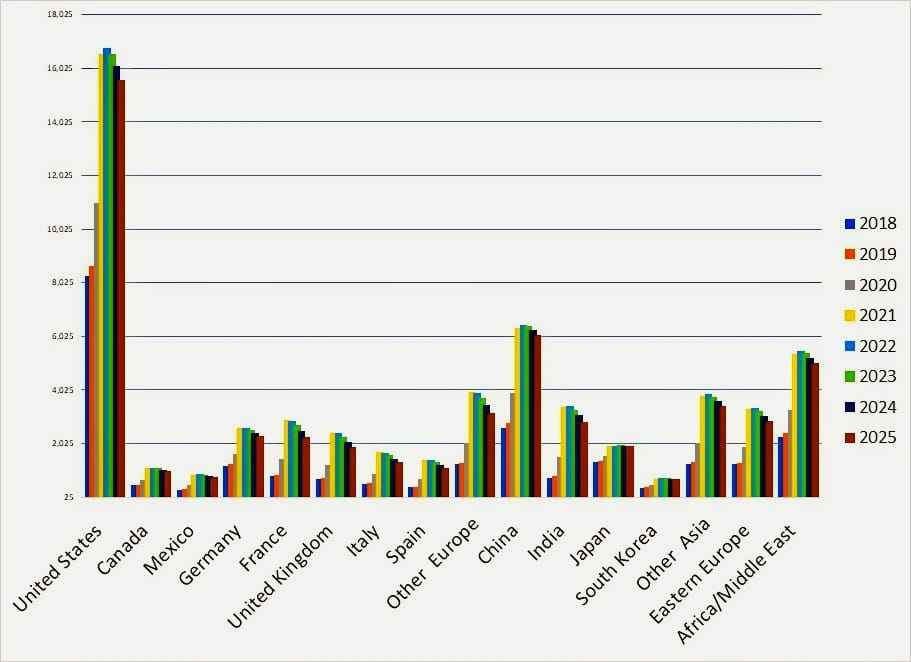

INFECTIOUS DISEASE MARKET BY COUNTRY OVER TIME

The total market for infectious disease IVD products in Western Europe is projected to reach almost $8 billion in 2031, up an annual average of 3.9% over the 2018 amount. Key regional trends related to product demand patterns are detailed below.

National health insurance plans cover the vast majority of residents in most countries for diagnostic testing services, including the detection of infectious diseases.

Infectious disease IVD products are subject to strictly regulated prices throughout most of the region, reflecting their below average growth rates in virtually all countries.

A high incidence of COVID-19 cases boosted related IVD testing demand in the region over the past few years, especially in Italy and the United Kingdom.

More Information: