China: Molecular Point-of-Care’s International Market to Watch

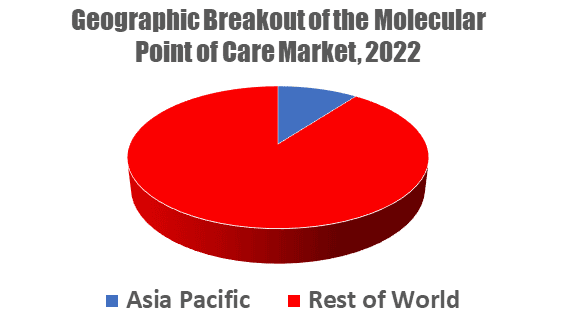

Molecular point-of-care (mPOC) is a multi-billion dollar market with expanding international intrigue. Though the mPOC market is led by North America and Europe, the Asia-Pacific region makes up 10% of the market’s worldwide sales, with China positioned as a burgeoning power within the APAC. Kalorama Information, a leading medical market research firm, covers mPOC’s global trends in the recently published report, The Market and Future Potential for Molecular Point of Care (mPOC), 2023.

COVID-19 is the major factor in market growth for China and other nations, and is the largest component of the mPOC market. However, China’s potential as a point-of-care (POC) market was already growing when the coronavirus focused the country’s healthcare system on in vitro diagnostic (IVD) and imaging testing. China has one of the largest economies in the world and its gross domestic product will soon surpass that of the U.S. But it remains a developing country outside the cities where point-of-care testing (POCT), until quite recently, played a relatively insignificant role.

Molecular point-of-care diagnostic solutions offer improvements in the sensitivity and specificity of existing near-patient and rapid tests while expanding the diagnostic capabilities at points of care such as hospital critical care units, physician offices, outpatient clinics, and community health posts in the developing world, and are used to assess conditions or admit patients. The concept of molecular point of care is to mix the accessibility of POC testing with the accuracy of molecular technology. The molecular POC diagnostics market includes sales of clinical IVD systems (tests, consumables and instruments) used outside of central clinical laboratories such as hospital laboratories and reference or independent laboratories. Molecular diagnostics includes tests that detect or interrogate nucleic acid analyte sequences using processes such as nucleic acid amplification, hybridization with oligonucleotide probes, and nucleic acid sequencing.

In China specifically, POC testing market is closely aligned with government hospital clinics. Government hospitals dominate the clinical laboratory landscape in China, and associated doctors and overall hospital operations are heavily dependent upon testing fees, especially with pharmaceutical reform that has limited profits from hospital pharmacies. Private clinics and physician practices represent an ancillary channel for POC testing products. The penetration of analyzers among private clinics and physician practices in China are believed to so far be relatively minor. The development of a private practice industry in China will likely feed the fellow emergent industry of private lab testing, otherwise primary care testing will be provided by hospital labs. The location of most private practices in cities will make sample collection and delivery relatively quick for physicians.

Global initiatives supported by organizations such as the Clinton Foundation HIV/AIDS Initiative; Roll Back Malaria; UNAIDS; United States President’s Emergency Plan for Aids Relief (PEPFAR); the Global Fund to Fight AIDS, Tuberculosis and Malaria (“Global Fund”); and the World Health Organization (WHO) have increased screening for some of the most burdensome emerging infectious diseases in developing countries. Some of the programs use rapid tests and some standard microscopic techniques and are performed in community clinics where no formal lab services are available. Significant IVD demand through these international organizations creates POC testing markets in even the least developed countries and regions.

Chinese central and provincial governments have also played a significant role in the expansion of the POC testing market. Screening campaigns have targeted diseases such as HPV, prenatally evident conditions, hepatitis, and infectious emerging diseases such as avian flu and drug resistant tuberculosis. Additional studies have assessed the role of rapid POC tests in sexually transmitted infection (STI) control in China.

“The Chinese market is very complex and continuously changing. Government reforms will increase funding for public hospitals, decentralized care, and support expanded medical insurance. At the same time, the government will tighten the management and oversight of medical institutions, health insurers, and retailers.”

Kalorama Information

These reforms along with increasing incidence of cancer, diabetes, heart disease and infectious diseases such as HIV, hepatitis and STIs, provide opportunities for point-of-care, advanced tests and molecular diagnostics.

Even today, IVD testing is concentrated in large laboratories affiliated with 2,418 top-tier (aka class III) hospitals in the major cities. Come 4 a.m. at any of China’s class III hospitals, people start to line up for care, including lab testing. It is not uncommon for these facilities to be doing 20,000 or more tests per day on automated immunoassay and chemistry analyzers. The over 600,000 village clinics will remain a “potential” market some time. POCT is more likely to emerge among the community health centers that have emerged in cities nationwide since healthcare reform. Before China committed to healthcare reform and improvements in medical infrastructure and health insurance system a decade ago, diagnostics in the countryside—outside of rapid tests for pregnancy and ovulation—was comprised of stethoscopes, thermometers and mercury manometers. Still other integrated molecular analyzers are marketed primarily as solutions for low-resource countries and health facilities in the developing world. System cost is a major parameter for such systems, which do not always integrate sample preparation (often performed through simple manual procedures) and use chromatographic, photodiode, or low-cost optical sensors. The most significant molecular diagnostic platforms designed largely for use in the resource-poor labs or distributed use in the developing world include the Alere q (HIV) and genedrive’s recently launched Genedrive (HCV, MTB in development) platforms; both platforms are CE-marked.