Molecular Oncology Test Sales Reach $6 Billion

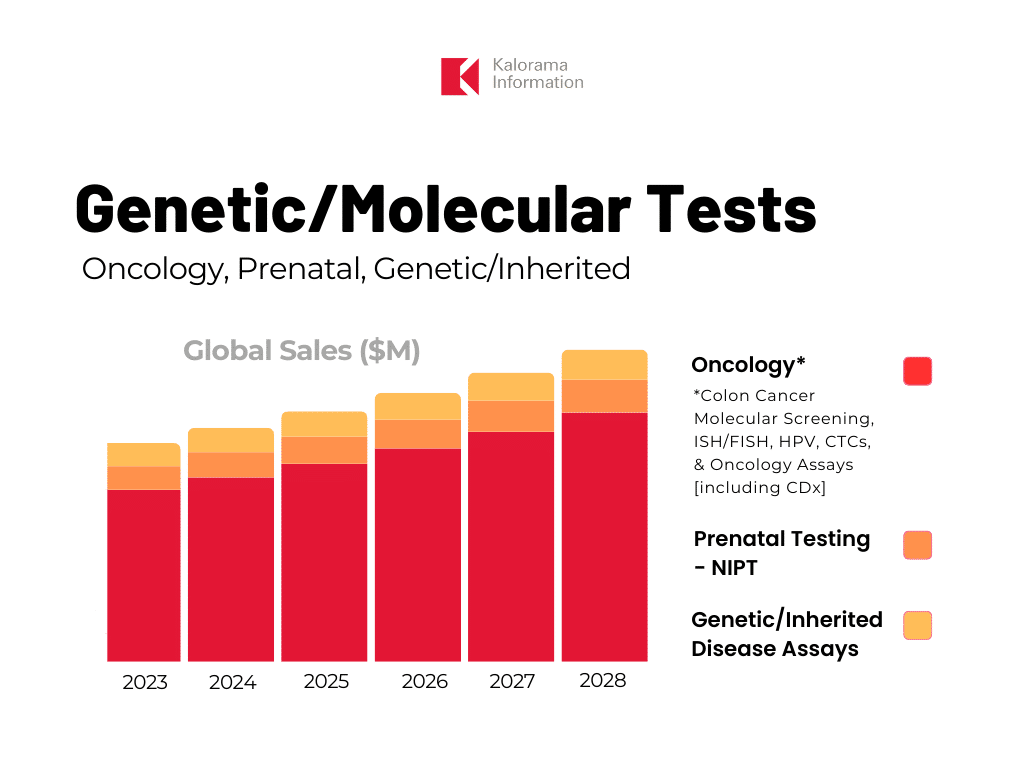

One of the most explored applications of molecular diagnostics is oncology, a segment with sales exceeding $6 billion in 2023, according to new data published in Molecular Diagnostics in Oncology, Genetic/Inherited Diseases, and NIPT, 2023-2028, now on sale by leading medical and diagnostic market research firm Kalorama Information.

In the report, the oncology segment is comprised of colon cancer molecular screening, in situ hybridization (ISH)/fluorescence in situ hybridization (FISH), human papillomavirus (HPV), circulating tumor cells (CTCs), and oncology assays including companion diagnostics (CDx). The oncology assays segment is the largest and fastest growing in the market. Kalorama Information’s report also covers other molecular diagnostic categories including prenatal testing-NIPT and genetic/inherited disease assays.

Molecular oncology diagnostic tests are used for the screening, therapy selection, diagnosis, and relapse monitoring of cancer. The genetic analysis of samples using PCR and next-generation sequencing (NGS) technologies helps researchers detect genetic changes and patterns in tumor tissues, ultimately helping physicians determine the most effective treatment options for individuals.

The application market for molecular diagnostic assays in oncology has been shaped by an influx of new technologies and treatments to address a prioritized disease burden in the developed world. Far surpassed by infectious disease in terms of current molecular diagnostics market size, oncology has yet to develop the same molecular assay breadth and routine use. Strong market potential is suggested for molecular diagnostics in oncology. There is strong clinical demand for diagnostics able to detect cancer early, provide prognosis, guide implementation of targeted therapies, and non-invasively monitor the efficacy of therapy and progression of the disease. Kalorama Information anticipates future molecular diagnostic workups in cancer could emulate those found in robust molecular diagnostics markets such as in virology.

Pharmacodiagnostics is one of the fast-growing sub-segments within the cancer molecular diagnostics market, especially with the increasing affordability of NGS that helps to gain a deep genetic understanding of cancers. Companion and complementary diagnostics in oncology are expected to drive the liquid biopsy market in the coming years.

Cancer as a whole poses one of the greatest threats to human health globally. The United Nations’ International Agency for Research on Cancer (IARC) estimates that more than 19 million new cases and nearly 10 million cancer-linked deaths occurred worldwide in 2020. The proliferating cancer threat is boosting world demand and growth opportunities for specific, sensitive tests, as well as precision medicine and companion diagnostics for treating cancer.

Molecular diagnostics are used in many different ways in oncology in relation to the purpose and timing of the tests. These include screening, diagnosis, prognosis, treatment selection, hereditary disease risk, etc. Areas of healthcare that were less common in past decades are now using the techniques more frequently, such as hereditary cancer, various early screening tests, and companion diagnostics.

Since at least the mid-1960’s testing of formalin fixed paraffin embedded (FFPE) tissue biopsy material with either immunohistochemical stains, or more recently, in situ hybridization molecular probes (histopathology) has been the mainstay of cancer diagnostics. Since then and to this day histopathology has been the gold standard for cancer diagnostics.

Histological staining of tumor tissue is a good start for detecting gene targets in biopsied tissue, but as the trend to using cancer drugs that target specific genes more precisely more advanced molecular techniques have come to market. Thus, other molecular tools have been applied to cells extracted from FFPE tissue including polymerase chain reaction (PCR), microarrays, single nucleotide polymorphisms (SNP) probes, comparative genomic hybridization (CGH) for analyzing copy number variations (CNVs) and sequencing to determine the best therapeutic options.

However, cancer testing is much more than diagnosis. With advances in cancer research and the development of effective treatment regimens, the survivor rate has increased for the most common cancers. This means more people have to be monitored for a recurrence of their cancer every three to six months immediately after finishing their treatment schedule and sometimes yearly thereafter. Invasive biopsy in this case is now being replaced by non-invasive tests for cancer cells and cancer cell nucleic acids in urine, blood and other body fluids. These non-invasive tests are also developed for monitoring the effectiveness of a drug regimen over the course of the treatment schedule.

Advances in cancer research fuel growth in the detection of molecular tumor markers in blood and urine. Still in the early introductory phase, these molecular tumor markers test for the analysis of mutations of known human genes used to diagnose common gene disorders involved in cancer and the management of cancer drug therapy.

The first wave of biopsy-less tests includes DNA methylation patterns as specific markers for disease. Epigenomics is a good example of one of the companies that developed such tests. Epigenomics developed a technique called MethyLight that selectively amplifies mutated DNA methylation patterns in body fluids but not normal methylation signals, thus potentially enabling early diagnosis of cancer without the need to take biopsies.

About Kalorama Information

Kalorama Information, part of Science and Medicine Group, is the leading publisher of market research in healthcare areas, including in vitro diagnostics (IVD), biotechnology, medical devices, and pharmaceuticals. Kalorama Information produces dozens of reports a year. The firm offers a Knowledge Center, which provides access to all published reports.

Kalorama Information’s studies feature independent primary research conducted by experienced analysts. Researchers build their market analysis independently from published databases, validating data with inside industry contacts and extensive secondary research, so you can have confidence that you’re getting your information from the most trusted source in the industry!