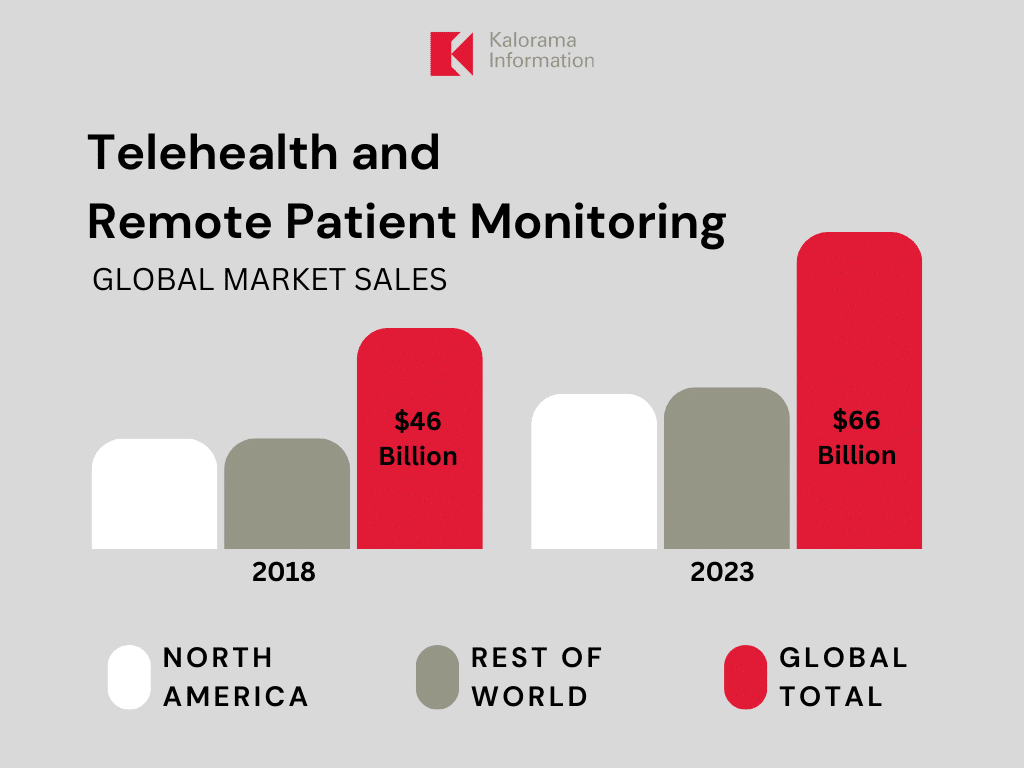

What’s Trending in the $66 Billion Global Telehealth and Remote Patient Monitoring Market

Digitally-enabled care, including remote patient monitoring and telehealth/telemedicine, is taking center stage in the healthcare environment. Nearly $66 billion was spent on patient monitoring and telehealth equipment, devices, and services worldwide during 2023, up from $46 billion in 2018, reports leading medical market researcher Kalorama Information in the new report, Remote Patient Monitoring and Telehealth Markets, 13th Edition. Growth is forecast through 2028.

North America leads the global market, accounting for almost half of total worldwide revenues. Furthermore, the United States is the largest individual market, followed by sales in China, Germany, and Japan. Emerging markets in Asia Pacific and Latin America are continuing to impact sales.

There are several factors driving growth in this market:

- Replacement of older, low-technology equipment with new wireless or remote units

- Growing acceptability and knowledge of technology features and benefits

- Additional monitoring efforts to alleviate healthcare problems before they require hospitalization or emergency department visits

- New technological advancements in the area of wireless connectivity

- Government incentives and rebates; growing demands for health facilities

- Increasing reimbursement coverage for remote care

While there is significant monitoring in some segments, sales will be driven by new technologies as older monitoring equipment is replaced by wireless or remote monitors. Growth will increase over the forecast period as compatibility, privacy, and security issues continue to be resolved. The long-term care environment is a growth segment for the market with many participants making additional expansions to monitoring infrastructure. Hospitals are also continuing to expand equipment capabilities to support remote monitoring technologies.

A paradigm shift occurred during the pandemic, which changed how telemedicine and remote patient monitoring are viewed by both the healthcare industry and patients. During the past three years, investment in telemedicine has accelerated, and subsequently, so has patient monitoring. As mentioned, several factors are changing the landscape of the healthcare industry. From the growing aging population to the increasingly digital health platform, the market must adapt to these changes and keep pace with the advancements in technology and expanded delivery of healthcare. The number of elderly individuals is increasing, leading to a higher demand for new and better medical technology products. However, many governments are focused on limiting and lowering public healthcare costs. One way the industry is meeting new requirements for cost savings and improving patient outcomes is through the use of telehealth.

Telehealth/telemedicine includes sending images to a specialist, live two-way video consultations between patient and provider, capturing and sending data from monitoring devices, and/or incorporating data and images into EMRs. Reasons for using telehealth include improved access to healthcare for patients in remote locations, cost-effectiveness, and patient demand.

Various delivery mechanisms for telehealth include the following:

- Networked Programs: Tertiary care hospitals and clinics with outlying clinics and community health centers in rural or suburban areas are linked. In the U.S. alone, there are more than 200 telehealth networks involving thousands of medical and healthcare institutions.

- Point-to-Point Connections: Hospitals and clinics use private networks to deliver services directly or outsource specialty services. It is reported that more than half of U.S. hospitals now offer some level of telehealth services.

- Primary or Specialty Care to the Home Connections: Connecting primary care providers, specialists, and home health nurses with patients over telephone-video systems for interactive clinical consultations.

- Home to Monitoring Center: Links are used for pacemaker, cardiac, pulmonary, or fetal monitoring, home care, and other services for patients in the home. More than 1 million people in the U.S. are monitored for cardiac conditions using remote monitors.

- Web-based E-health Patient Service Sites: Provide direct consumer outreach and services over the Internet.

For more information and insights, purchase Remote Patient Monitoring and Telehealth Markets, 13th Edition.

About the Report

This report focuses on global patient monitoring and telehealth market numbers, with specific market coverage for countries such as the United States, Japan, China, Germany, the United Kingdom, Canada, France, Italy, Brazil, and Mexico. Additionally, regional coverage includes North America, Europe, the Middle East, Africa (EMEA), Asia Pacific, and Latin America. Sales figures are presented at the manufacturers’ level in U.S. dollars, offering a close comparison to retail levels in many instances.

Remote Patient Monitoring and Telehealth Markets, 13th Edition builds on its predecessor by providing comprehensive coverage in the consumer-grade segment and on-demand telehealth services. The consumer segment has emerged as a significant aspect of the industry in recent years, prompting professional-grade device manufacturers to adapt their product designs and marketing strategies to tap into this new growth opportunity. This shift has impacted various segments, including glucose monitors, heart rate monitors, fetal and pregnancy monitors, pulse oximeters, sleep apnea devices, weight monitoring devices, and other similar product offerings.

Click HERE for more information.

About Kalorama Information

Kalorama Information, part of Science and Medicine Group, is the leading publisher of market research in healthcare areas, including in vitro diagnostics (IVD), biotechnology, medical devices, and pharmaceuticals. Kalorama Information produces dozens of reports a year. The firm offers a Knowledge Center, which provides access to all published reports.

Kalorama Information’s studies feature independent primary research conducted by experienced analysts. Researchers build their market analysis independently from published databases, validating data with inside industry contacts and extensive secondary research, so you can have confidence that you’re getting your information from the most trusted source in the industry!