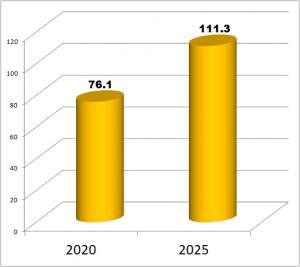

IVD Procedures – 76.1 Billion Annually and Growing

There are currently 76.1 billion in vitro diagnostics procedures annually. Procedure volumes will grow to 111.3 billion in 2025.The chart below depicts the current global estimate and forecast of IVD procedures, including glucose and excluding COVID-19. Population, aging, insurance levels and new test development are factors in the growth of procedures.

Global volumes of various IVD procedures are presented in millions and reflect the evaluation of a single analyte, marker, or other variable of interest. It should be noted that some IVD tests involve more than one procedure as they provide for the analysis of multiple analytes.

Global sales of IVD products are expressed in current United States dollars and reflect sales for the year 2020 and forecasts for each year in the 2021 to 2025 period. A table that measures the total amount of IVD product sales against the total volume of IVD procedures is presented for each major testing category. The report also includes estimates of average fees paid to clinical laboratories and medical establishments for specific groups of IVD procedures. The global volume of IVD procedures is forecast to increase 7.9% annually to 111.3 billion in 2025.

Procedure Volumes by Type Are Covered in Detail in Kalorama’s

Latest IVD Procedures Volume Report

https://kaloramainformation.com/product/ivd-procedure-volumes-2020-2025/

The IVD landscape in 2020 has shifted due to the impact of the COVID-19 pandemic. The pandemic is impacting the world economy and creating uncertainty in the stock market and affecting supply chains all over the world. However, the IVD testing market is center stage for the fight against the Coronavirus. In vitro diagnostic (IVD) products continue to see positive sales growth in many categories, although several categories have experienced a temporary drop due to the uptick of COVID-19 testing. New products, changes in global health spending, regulatory changes in major markets and disease trends are among the factors that produce a constantly changing market picture. There are some growing segments in the market that have attracted industry attention. Among these are next-generation sequencing (NGS), cancer testing, and companion diagnostics technologies. Immunochemistry, point-of-care (POC) testing, and molecular diagnostics are also segments of great market interest, anticipated to be a big part of the future of IVD.

Several trends and factors will underlie growth including:

• Steady population growth and aging, which will increase the number of individuals vulnerable to acute and chronic medical conditions.

• Evolving epidemiological patterns, which will keep major diseases such as cancer, diabetes, heart failure, hepatitis, HIV/AIDS, influenza, malaria, and tuberculosis major threats to human health.

• The expansion of healthcare cost containment initiatives, which will encourage medical providers to broaden the use of IVD

tests to detect serious diseases in early stages when treatment is less costly and more likely to succeed.

• The continuing widespread coverage of most developed world residents for basic and essential diagnostic procedures.

• Gradual improvements in the availability, accessibility, and diagnostic capabilities of developing world medical delivery systems.

• The periodic emergence of new infectious and viral disease threats, which will create a need for related IVD tests.

• Widening acceptance of routine health screening procedures in basic inpatient and outpatient care.

• Stepped up efforts by hospitals and other medical facilities to reduce the incidence and mortality of healthcare-associated infections (HAIs) and other inpatient complications.

• Advances in novel molecular and other advanced IVD technologies, which will increase disease detection capabilities.

• The adaptation of new and existing IVD procedures to point of care (POC) sites in hospitals, outpatient facilities, retail clinics, nursing homes, and other near patient markets.

• COVID-19 pandemic

IVD tests include well-established and newer, emerging technologies. Over the next several years, traditional tests based on clinical chemistry, immunoassays, hematology and conventional microbiology will account for the largest share of global procedural volume, or more than 83.3% of non-glucose tests in 2025. These older technologies will continue to build up patient volume based on low cost, broad applications, improving methods, and increasing availability in POC laboratories.