Molecular Point of Care Test Market Nearly Triples in One Year, Due to COVID-19.

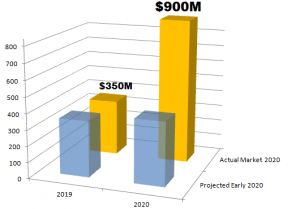

Molecular systems that can test at the point of care was always expected to be a factor in COVID-19. Last year, when our report published, the novel coronavrius was limited in most news accounts to a disease affecting Wuhan, China, we said this: “As presented, the revenues for this segment are forecast to increase from $360 million to $852 million between 2019 and 2024, with a compound annual growth (CAGR) of 18.8%.”

The spread of the disease in the United States and developed world would prove us wrong. Molecular point of care systems were in great demand, and eclipsed our projected market size estimate for 2024 was already exceeded by the end of 2020.

In our latest report, The Market and Potential for Molecular Point of Care (https://kaloramainformation.com/product/2021-molecular-point-of-care/) Kalorama estimates a market of $900 million dollars, with the lion’s share of that instruments and consumables purchased for COVID-19 testing purposes.

It’s not a surprise. Molecular point-of-care (mPOC) diagnostic solutions offer improvements in the sensitivity and specificity of existing near-patient and rapid tests while expanding the diagnostic capabilities at points of care such as hospital critical care units, physician offices, outpatient clinics, and community health posts in the developing world, and are used to assess conditions or admit patients. The concept of molecular point of care is to mix the accessibility of POC testing with the accuracy of molecular technology.

Molecular point-of-care (mPOC) diagnostic solutions offer improvements in the sensitivity and specificity of existing near-patient and rapid tests while expanding the diagnostic capabilities at points of care such as hospital critical care units, physician offices, outpatient clinics, and community health posts in the developing world, and are used to assess conditions or admit patients. The concept of molecular point of care is to mix the accessibility of POC testing with the accuracy of molecular technology. Kalorama has covered molecular point-of-care on a yearly or biyearly basis since 2013.

We projected 18% growth each year in molecular POC systems and consumables revenues. The spread of the disease in the United States and developed world would prove us wrong.

We define molecular point of care as near-patient PCR, sequencing or other NAT systems that offer small instrument size, near patient placement as well as fast turnaround of tests and that offer tests that are CLIA-waived or tests that require a lower threshold of operational training so that they may be in the next five years.

Cepheid’s GeneXpert, Abbot’s IDNOW, Roche’s Cobas Liat and bioMerieux’s BioFire are examples of mPOC systems.

COVID-19 has resulted in a huge acceleration in both system installations and spending on consumables per system. Cepheid’s installed base increased by around 30% in 2020 and bioMerieux’ systems sales increased from around 600 per quarter to around 2,000. Spend per system was reported by many companies to have increased around 50%-60%.

The molecular point-of-care market is overwhelmingly in the respiratory category, with most of that dedicated to influenza testing. Other tests include HAIs and STIs, among other diseases.