The Interplay of IVD and Vaccines

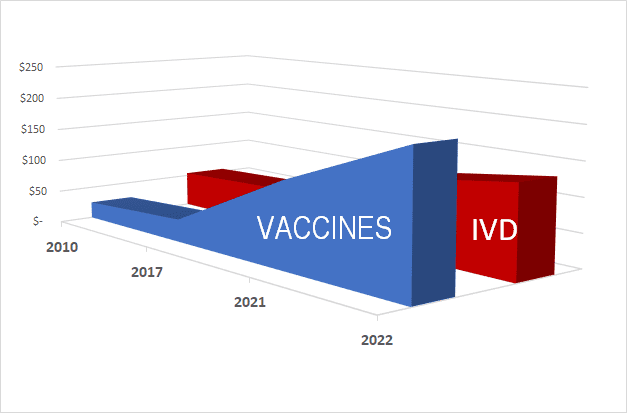

Worthy of note. We’ve published reports on in vitro diagnostics and vaccines two months a part. And the two markets are not unrelated. Testing procedure volumes will relate, usually, to the occurrence of disease. Vaccines are intended to prevent disease. (Tests perform that function as well, by suggesting isolation or treatment of patients, but vaccines perform that function more directly). So there can be a temptation to think that the success of a vaccine might limit the demand for testing. Simply said this hasn’t been the case in markets Kalorama has covered. Kalorama’s vaccines report (https://kaloramainformation.com/product/the-2022-world-market-for-vaccines/) estimates a 202-billion-dollar market for vaccines in 2022, while the Worldwide IVD market projects a $127 billion-dollar in vitro diagnostics market. Both have grown extensively and are indicated for continued growth this decade.

Nothing about the presence of a strong vaccine market has precluded the presence of a strong IVD market. Vaccines do not capture testing markets, both are usually employed to great effect simultaneously in the containment of a health problem.

Kalorama Information

The question came up with cervical cancer vaccines, or better said vaccines, that target HPV. The entry of these vaccines coincided with the reverse trend, consistent growth in all forms of HPV testing – both traditional paps and also molecular HPV testing. HPV molecular is one of the fastest testing markets, and yet at the same time Merck has sold billions in Gardasil. This question of if vaccines might reduce the need to test has come up again with the success of COVID-19 vaccines. But both the market for COVID-19 vaccines and the market for COVID-19 testing has grown simultaneously.

The chart above shows growth in the vaccine market. While growth has upticked faster in the vaccine market due to the influx of COVID-19 vaccines (along with previously growing influenza and shingles markets), the IVD market has also grown during the same time, albeit not as large. Nothing about the presence of a strong vaccine market has precluded the presence of a strong IVD market.

Could the reverse be true? Could the vaccine market be boosting the IVD market. There’s more coincident evidence for that theory, actually, in that we’ve seen growth of vaccines and IVD in the last dozen years (IVD grew faster in the dozen years before that). But it would not seem to be any more provable than the theory that vaccines hurt IVD sales. More likely, as significant health issues occur in the population, and there are many reasons to think that will continue, both these techniques are needed. The upward trend of both markets says more about the seriousness of world governments and international agencies in tackling disease than anything else. As healthcare spending, healthcare insurance systems, and available technologies increase, so does the market.

Kalorama’s recent vaccine report also notes the importance of IVD diagnostic testing to the development of vaccines. To improve vaccine efficacy going forward, the CDC and the Association of Public Health Laboratories (APHL) recently shared revised guidelines with public health laboratories for submitting flu viruses to CDC for testing. The revised guidelines set the recommended number of flu viruses of each type and subtype to be submitted to CDC by each laboratory, along with when and how those viruses should be submitted. This is expected to yield a more balanced and comprehensive view of antigenic, genetic, and antiviral properties of the main groups of flu viruses circulating in the U.S. In past seasons, the viruses submitted to CDC were not fully representative of the main circulating flu viruses (H1N1, H3N2, and B) as predominantly circulating viruses were over-represented among submitted samples.