U.S. Consumer Out-of-Pocket Healthcare Spending to Grow 10% Annually Through 2028

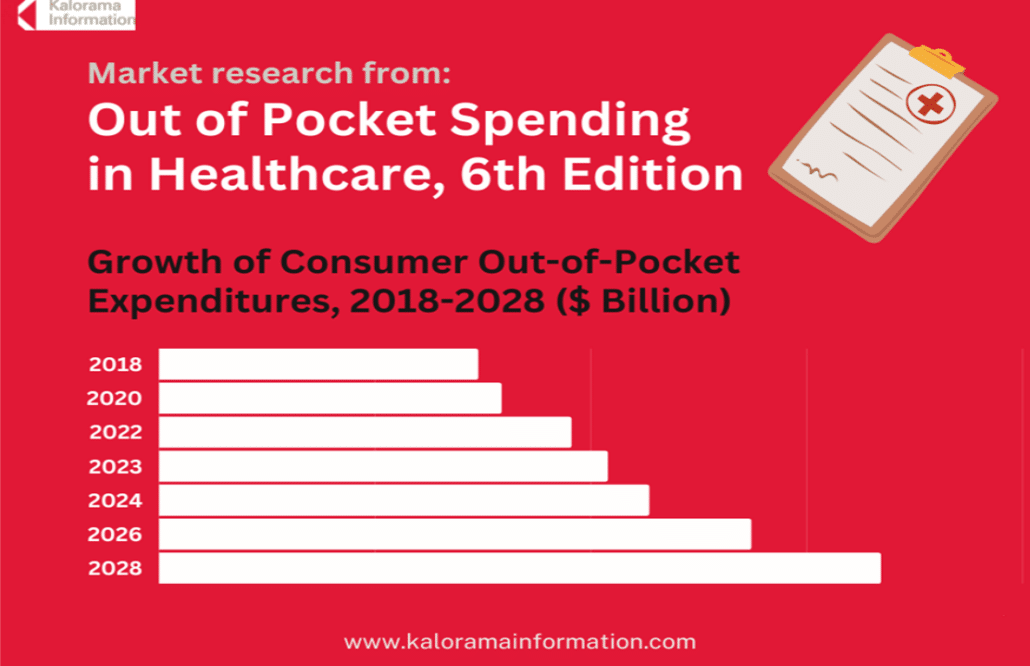

Out-of-pocket expenditures (OOP) have long weighed upon the United States healthcare system and consumers. The weight is as heavy as ever in 2023 as OOP healthcare spending by consumers will reach an estimated $519 billion by year’s end, up almost 9% from 2022 with continued annual growth of 10% forecast through 2028. These findings are based on new data featured by leading medical market research publisher Kalorama Information in the recent report Out of Pocket Spending in Healthcare (Pharmaceuticals, Surgeries, Tests, Electives, Premiums, Copays, Doctor Visits, Other), 6th Edition.

The report estimates U.S. consumer out-of-pocket spending on healthcare, particularly direct payments to providers and financed payments, for both elective and non-elective products and services. Excluded from forecasts are healthcare premiums paid to healthcare plan sponsors or employers.

Kalorama Information reveals that over the next five years, total consumer out-of-pocket expenditures for healthcare are expected to continue rising, with trends established over the past several years continuing through the foreseeable future. While the COVID-19 pandemic of 2020 and 2021 caused a temporary pullback in consumer out-of-pocket healthcare spending, the historic trend resumed in 2022, initiating the current growth trajectory.

Multiple drivers are contributing to significant OOP spending growth. These include:

- government, regulatory and insurance/payer actions, including Managed Care Organization cost shifting and numerous policy changes that make healthcare more expensive;

- business and economic trends, including actions taken by the business community and healthcare providers;

- high recent inflation, following increased government spending during the COVID-19 pandemic;

- pent-up demand for medical products and services during COVID-19 lockdown;

- social pressures related to rising standards of attractiveness;

- demographic trends that affect large groups of people such as obesity, aging and chronic conditions. Less common, yet expensive, demographic trends include mental illness and addiction.

Greater gains will be mitigated by continued rising usage of lower cost medications (generic drugs, OTC medicines, Rx-to-OTC switches), growing utilization of disease management programs and the proliferation of low premium, high deductible health plans. Furthermore, salary growth will continue to lag healthcare cost increases as well as residual inflation. As consumers are unable to afford rising expenditures, they will increasingly forgo treatment and/or search for less expensive options such as generic or OTC medications.

For more information, or to purchase Out of Pocket Spending in Healthcare (Pharmaceuticals, Surgeries, Tests, Electives, Premiums, Copays, Doctor Visits, Other), 6th Edition, please visit: https://kaloramainformation.com/product/out-of-pocket-spending-in-healthcare-6th-edition-pharmaceuticals-surgeries-tests-electives-premiums-copays-doctor-visits-other/.