IVD for Pets: A $2.7 Billion Global Market

The need for veterinary testing has grown in recent years, as the majority of U.S. households claim to have at least one pet in the family. This has created ample opportunity for the companion animal segment of the veterinary diagnostic market, which globally had sales of $2.7 billion in 2022. The findings are according to leading medical market researcher Kalorama Information in the report The World Market for Veterinary Diagnostics, 6th Edition, which examines the market based on companion animal (pets and domestic animals including horses) and food animal (livestock and production animals) diagnostics.

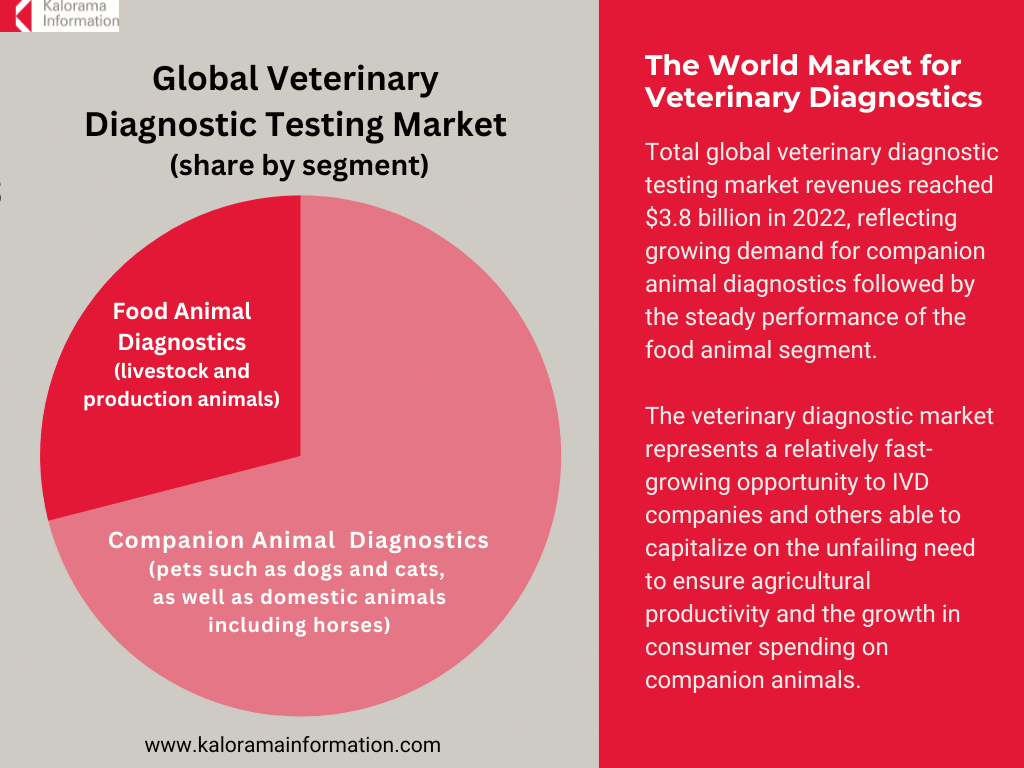

Total global veterinary diagnostic testing market revenues reached $3.8 billion in 2022, reflecting growing demand for companion animal diagnostics followed by steady performance of the food animal segment. The companion animal segment accounted for 71% of overall revenues. The veterinary diagnostic market represents a relatively fast-growing opportunity to in vitro diagnostic (IVD) companies and others able to capitalize on the unfailing need to ensure agricultural productivity and the growth in consumer spending on companion animals.

The companion animal diagnostics market includes IVD products—instruments, consumables, test reagents and test kits—for the diagnosis of disease and health conditions in household pets (primarily dogs and cats) as well as horses. Market performance is determined by diagnostic product demand from veterinary clinics, hospitals, reference labs, and governmental and research laboratories such as those found at universities and associated with government agricultural and animal health authorities. Test products performed by pet owners—such as pet blood glucose meters and strips, pregnancy and ovulation tests, and urinalysis strips and cups—are also included in the companion animal diagnostics market, but overall form a negligible share.

Growth in North American and European companion animal care markets has been sustained through the rising value of care, the use of premium services and products, and a subset of owners’ commitments to preventative care and routine visits with expanded services and treatments. The veterinary services market remains dependent upon increasing standards of care for companion animals through technological advancements and affordability of care.

Modern veterinary care is heavily reliant upon conventional IVD technologies and methods also used in human medical care. Fewer regulatory impositions relative to medical care allow veterinarians to perform in-office testing (or near-patient testing) without certification. Today, many veterinarians are choosing to perform routine testing themselves, including:

- clinical chemistry (panels of routine analytes to assess organ system health and animal wellness),

- hematology (complete blood count),

- critical care or point-of-care (POC) testing (blood gases, electrolytes,

- a handful of chemistry analytes),

- coagulation, urinalysis, and

- immunoassays for both infectious and non-infectious diseases.

Nevertheless, many required tests still need to be outsourced or sent out to reference labs, including immunodiagnostic assays that are not readily interpretable (with an in-office reader or visual immunochromatographic results), microbiology cultures, histology tests, and molecular assays (PCR, genotyping arrays).

Analyzer automation and the introduction of ease-of-use features from the clinical space to veterinary diagnostics have enabled test in-sourcing. Many veterinary clinics and hospitals are now purchasing core lab analyzers—chemistry, hematology, routine immunoassays, urinalysis—to shorten turnaround times, initiate responsive care during the same visit, and generate additional revenue. Veterinary reference laboratories are able to sustain business by performing demanded esoteric testing in pathology (histology), microbiology, and immunology. In-clinic diagnostics is the key feature of the contemporary market and it has increased instrument placements, led to greater companion animal test volumes, and increased industry revenues for veterinary diagnostics vendors and companies.

Dogs were responsible for about 34% of the global veterinary revenues in 2022 and about 49% of all companion animal testing revenues. Obesity and diabetes are the top issues facing companion dogs.