Urgent Care and Its Enemies

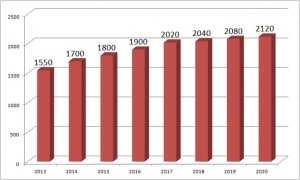

Urgent care locations have grown over the past decade, Kalorama estimates the urgent care locations in the United States to be 9,900, growing from nearly 7,000 in 2013. That’s spectacular growth, driven by a need for more healthcare services, improved insured populations and resistance to physician office waiting times. Because of these undisputable positives, it’s common to see the urgent care industry presented only with rose-colored glasses. Thus it should be stated that market growth is not without limits, in fact, a report from Kalorama Information suggests the “period of extensive location growth” for these centers may have passed. This is according to a recent report U.S. Urgent Care Center Market: https://kaloramainformation.com/product/the-u-s-market-for-urgent-care-centers/

What distinguishes urgent care centers is that they are a walk in clinic offering extended hour access for acute illness and injury care that is either beyond the scope or availability of the typical primary care practice but offer less services than an emergency room would. Estimates of locations vary as there are varying definitions of what an urgent care center is.

Growth cannot be without limits. In fact, a report from Kalorama Information suggests the “period of extensive location growth” for these centers may have passed.

The urgent care business model involves providing a full range of services of nonemergency acute care. UCCs differ from traditional physicians’ offices with procedure rooms for lacerations and fractures, a radiology department for x-ray services, and a laboratory. There is a need for these locations, but the industry will not be a “boom mode” forever. There are limiters to growth as well as drivers, and there is increasing visibility on those limiters. The fastest growth, Kalorama estimates, happened in the early part of this decade, between 2011 and 2017.

The Beginnings of Market Crowding

“There are certainly areas of the country where an urgent care center has popped up on almost every intersection,” says the Journal of Urgent Care in a recent article. Indeed, there is a growth trend but also visible limits to urgent care center growth. There are enough U.S. potential patients for each urgent care to have patient population of 30,000, Kalorama estimates, where many industry experts suggest a 50,000 patient area is optimal for a successful urgent care practice. This will be a limiter on the growth of urgent care center locations. It might be said that the current urgent care industry is satisfactory for meeting the needs of the U.S. population, but Kalorama does believe that there’s room to grow in rural areas and for more efficient operators to expand. No market operates at such a perfected level of supply and demand and, in some markets, say with a greater income level or where hospitals have closed, urgent care has worked beyond these estimates.

“In Charleston, SC, for example, there are over 45 urgent care centers serving a population of 127,000. There are more than 120 urgent care centers serving the 1.6 million people of Phoenix, AZ. This begs the question: are markets too saturated? ” – The Journal of Urgent Care

This trend has been seen with bank branches – explosive growth followed by retrenchment. Between 2010 and 2019, the number of full-service bank branches fell from almost 95,000 to just over 83,000, according to a Quartz analysis of data from the Federal Deposit Insurance Corp. (FDIC). That is a loss of 12%.

The fastest source of pure growth for urgent care locations will be in rural areas lacking urgent care, rather than in urban areas. In urban areas, clinic growth by specific chains or successful upstarts will tend to come at the expense of another chain.

Furthermore, patient traffic is often seasonal, being higher in urban areas and in winter months. Such patient droughts favor larger operators who can keep afloat during a slow season to await a busier one.

Variance in Quality and Performance

As we’ve indicated, some of the growth in urgent cares is coming from centers located nearby an existing urgent care. Even if both centers survive, metrics will drop in one or both. In the next five years, those competition battles will play out across the nation. Some urgent care locations and many urgent care chains are highly successful. But not all are. Patient volumes, revenue per patient, total clinic revenue, services offered, as well as testing capabilities and pharmacy services will all vary between urgent care centers. As to who will win out, utilization of the best techniques will go a long way to determine which center in a market wins out.

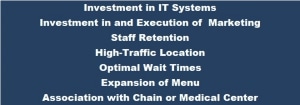

Qualities of a High-Growth Urgent Care Center

Not on this list, but important, is the role of urgent care consultants. Guidance from urgent care consultants, physicians with previous experience in urgent care or a national chain is a likely indicator of performance.

What does this variance in performance has to do with growth? Simply said, it means not all centers will be here in a few years. This will be a limiter on the growth of locations in the market. An exact estimate of successful and poor performing urgent care centers is difficult. It is possible that at least one-fourth of U.S. urgent care locations are operating at poor performance levels with under-average patient visits and per-clinic revenues. The competition could eliminate poor performers.

A Senior Problem?

Urgent care may have an issue with seniors, and if that is the case, it is a trend the industry will need to reckon with for future growth potential. A PNC Healthcare consumer survey found that 85 percent of seniors choose to see primary care physicians first. Only 11 percent of that population goes first to an urgent care center. A report by FAIR Health, a nonprofit that studies insurance claims, found that 60% of patient visits come from those 50 years old or younger.

Currently, Urgent care demographics lean towards younger and middle-aged customers, who to some degree are escaping physicians that older patients prefer. This isn’t to say that education programs and outreach couldn’t change this current trend, but so far urgent care is an option to avoid clogged waiting rooms and utilized by young and middle-aged, usually working persons and their children.

A report by FAIR Health found that 60% of patient visits come from those 50 years old or younger.

Why is this an issue? Care for seniors is where the largest dollars in healthcare are. Seniors are the growth area of healthcare spending. Urgent care centers will need to compete for that aging democratic to capture greater dollars per patient and accelerate growth to the most optimistic projections. This trend is troubling for the long term growth of urgent care centers, since spending is more likely to come from senior care than any other group. For instance, Information from the Department of Health and Human Services indicates that seniors spend $11,000 per year on healthcare vs. $1,900-7,000 from those under 65.

Competition from Retail Clinics and Other Venues

Just as urgent cares could fact their growing pain era, there are new forms of competition. Starting with retail clinics, but also from patient-friendly policies at doctor’s offices that can accommodate off-business hours. As for retail clinics, there are at least 2,000 locations across the U.S., mostly at drug stores and each one pulls to a degree from existing or potential urgent care. Some confuse these in-store health service locations, usually staffed by a nurse practitioner with urgent cares but they are not, they are competition, taking some of the high-volume visits away from urgent care. For retail clinics, according to Kalorama’s reporting on that industry – Total revenues are expected to continue to rise, driven by growth of each of the key metrics used to derive these estimates (patients treated, treatment fees, as well as clinic locations). Additionally, while the first clinics priced services extremely competitively to build business, as the clinics become more accepted, prices have gradually risen.

Growth in Retail Clinics

Although in most cases, this price increase will be smaller than the double-digit annual increases of healthcare service products and prices offered by other providers, it will nonetheless be necessary as retail clinics increasingly optimize their business models to maximize profitability and keep pace with ongoing increases in their own operating costs. For instance, the salaries for nurse practitioners continue to rise as demand for their services grows.

On the Bright Side…

Of course there are positives for urgent care: Growth is fueled by the need for alternatives for patients and healthcare providers. For patients, traditional physician office hours and crowded waiting rooms are not meeting needs. The time it takes to schedule a new patient physician appointment in 15 major metropolitan areas has increased by 30 percent since 2014, according to a new survey conducted by Merritt Hawkins, a national physician search firm and a company of AMN Healthcare.

The result is confirmed by other studies. The supply of doctors is also limited and the U.S. is feeling the pinch. Across the U.S., shortages of both general practice and specialist physicians are resulting in delays to treatment and long waiting times. And COVID-19 vaccines will be a likely boon for urgent care being front-line, accessible and able to serve those:

Kalorama Information’s Report: The Market for U.S. Urgent Care Centers

Kalorama Information has a detailed report on urgent care center markets. The report is available at: https://kaloramainformation.com/product/the-u-s-market-for-urgent-care-centers/