Watch the Companies That Make Cell and Gene Therapies For Pharma, Says New Report

There’s much talk about cell and gene therapy but a new report from a leading market research firm says that there’s a growing market over nearly two billion dollars for companies that make the cell and gene therapies.

In 2020, the total global cell and gene therapy BCMO market reached $1,842 million. Over the following 5 years, as cell therapy BCMO services continue to expand strongly along with usage of cell therapies. This is the finding in Kalorama Information’s new report, The Market for Cell and Gene Therapy Contract Manufacturing Organizations (CMOs).

The report said large CMOs include Lonza, Patheon, Catalent, WuXi and FUJIFilm Diosynth among many others.

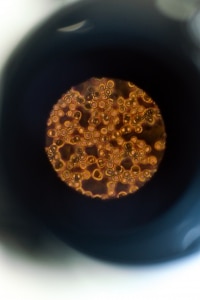

Cell and gene therapies are groundbreaking treatments with the potential to actually cure disease rather than simply manage symptoms. They are often designed as one-time treatments, that in some cases, can actually reverse the progression of an illness. With cell therapy, cells are cultivated or modified outside the body then injected into the patient, where they become a “living drug.” With gene therapy, genes are replaced, inactivated or introduced into cells, either outside or inside the body, to treat a disease.

Consequently, cell and gene therapy products are transforming the treatment of cancers and genetic diseases. Additionally, cell and gene therapies are expanding into other areas of medicine including autoimmune diseases, cardiovascular diseases, musculoskeletal disease, dermatological diseases and many others. With an estimated 50 million persons suffering from neurodegenerative diseases in the U.S. alone, the unmet need is great.

With this exciting potential, the science is moving ahead and now the industry needs to industrialize and standardize the manufacturing and commercialization of emerging products. Important next steps include standardized set-up and closed automated systems.

Cost is one of the largest issues facing the industry. The high cost of producing these new therapies is staggering, resulting in prohibitively high product costs. For example, after launching Kymriah, Novartis’s price tag was $475,000 and a second product, Yescarta, cost $375,000. A gene therapy for the eye, Luxturna, was priced at $425,000 per eye. Some therapies are even more expensive, with costs for Zolgensma and Zyntegio estimated at more than $2.1 million and $1.8 million, respectively. The high price tag seems to be related to the high cost of goods (CoG).

Advancements in manufacturing are helping to drive costs down but cell and gene therapy remain an expensive process, with researchers at the Department of Pediatrics at Oregon Health & Science University and Doernbecher Children’s Hospital in Portland recently predicting that of the 40 – 50 gene therapies currently undergoing clinical assessment, each will likely to be priced at more than $1 million per regimen. These high costs present major barriers to affordability and usage, particularly in government-funded healthcare plans such as Medicaid and Medicare. Talks have been ongoing as to how to fund these medicines in the short term and long term through capital markets, a risk pool from insurers or other means.

The current goal of industry is to transition from a manual process to a more standardized and automated set-up, as did monoclonal antibody production. This will take the industry to a platform that will serve large patient populations while reducing both costs and risks. In the meantime, some manufacturers are making progress with insurance reimbursement.

When a product is first introduced, a company must ensure that the pace of manufacturing can keep up with demand, as there will initially be a backlog. This is particularly true for new cell and gene therapies, which offer potentially curative solutions to debilitating illnesses. Experienced CDMOs can meet this need by seamlessly supplying these early customers, avoiding delays that often arise in the build-out of entirely new manufacturing facilities.

Although the logistics of cell and gene therapies are more complicated than for most other drugs, these challenges can be met. For example, Dendreon’s Provenge was initially criticized for its complicated logistics. After a rough start, Provenge has become the most sold cell-based medicinal product, with thousands of shipments worldwide within tight delivery windows.

These trends and more are covered in Kalorama’s report, available at https://kaloramainformation.com/product/market-for-cell-and-gene-therapy-contract-manufacturing-organizations/.