Description

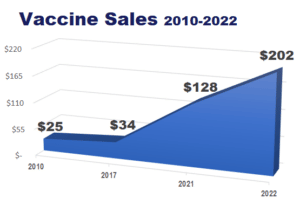

V A C C I N E M A R K E T E X C E E D S $200 B I L L I O N

In 2022, the global market for preventive vaccines is valued at $202.6 billion. That’s up from $34.1 billion in 2017, and just $25 billion in 2010. Infectious diseases are some of the deadliest dis

Sales increased from $127.6 billion in 2021 to $202.6 billion in 2022. Compare this to just $25 billion in 2010.

Since the advent of the pandemic, scientists around the world have stepped up research and development of preventative vaccines that will hopefully will be able to combat existing and new infectious disease threats. COVID-19 vaccines are the largest element of that growth, representing roughly two-thirds of the market. Given the persistence and variability of the COVID-19 virus, those vaccines are forecasted in the report for a five year period.

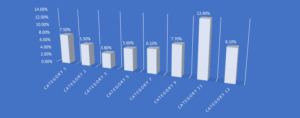

While the focus and attention on COVID-19 vaccines will drive growth in the market, and is the most exceptional element in recent years, there are many vaccine growth areas and vaccine sales growth was on an upswing for most of the past decade. Vaccines covered in the report with sizing and market share include:

- Hepatitis

- HPV

- Influenza

- Pneumococcal

- Tetanus and combinations

- Shingles

- COVID-19

- Pediatric Routine (HiB, MMR, Combinations, Polio, Varicella)

- Meningitis

- Pneumococcal Disease

- Travel and Other

Through 2027, growth will be fueled by favorable demographics (population growth, rising life expectancy), continued new product introductions, indication expansions for some products and rising usage, particularly in China and India.

However, mitigating against growth will be continuing concerns about vaccine safety, availability in developing countries and refusal to immunize.

A B O U T T H I S R E P O R T

MARKET REPORTING BY VACCINE SEGMENT

This report, The 2022 World Market for Vaccines is the most current and comprehensive look at adult and pediatric preventative vaccines. Kalorama has published this report since 2005 at two-year intervals. The report contains market forecasts, company market share and expert market estimates for vaccine categories. The report also looks at trends in the the market for human vaccines used to prevent various types of disease. It focuses on commercialized vaccines and developmental vaccines for diseases that are already vaccine-preventable, with a discussion of selected emerging vaccines. It also covers the COVID-19 vaccine market landscape and estimated market opportunity during the forecast period.

Competition in the market has increased over the years. Companies that compete in the vaccine market include Astra Zeneca, Pfizer, Moderna, Glaxo Smith Kline, CSL, Johnson and Johnson, Merck & Co, Inc., Sanofi Pasteur, Bharat Biotech and Takeda, among others.

Sales estimates for each market segment represent global revenues and are expressed in current dollars. Estimates are provided for the 2022 year and forecasts are provided for 2027. Historical information for this report was gathered from a wide variety of published sources including company reports and filings, government documents, legal filings, trade journals, newspapers and business press, analysts’ reports and

other sources. Interviews with company representatives and other experts were conducted to capture the perspectives from industry participants’ point of view and assess trends and form the basis of the forecasting and competitive analysis.

Vaccines provide long-term or permanent immunity against disease. A mainstay of preventative medicine for over 70 years, a vaccine is a biological preparation used to trigger an immune response to a selected disease. The term derives from Edward Jenner’s use of cowpox (“vacca” means cow in Latin), which, when administered to humans, protected them against smallpox.

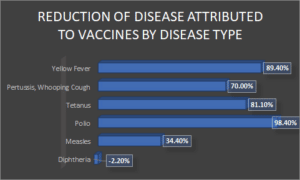

Because of the large number of deadly diseases that have been virtually eliminated through the proliferation of effective vaccines, vaccination is

generally viewed as one of the greatest public health achievements during the 20th century. As a result of widespread public vaccination, vaccine-preventable diseases and their resulting deaths are now rare in the developed nations and declining worldwide. Immunizations have eradicated smallpox; eliminated poliomyelitis in the Americas; and controlled measles, rubella, tetanus, diphtheria, Haemophilus influenzae type b, and other infectious diseases. The statistics provided in the table below illustrate the progress achieved in preventing selected infectious diseases through vaccination over the past 24 years on a global basis, with the most current available data from WHO. With the exception of whooping cough, which has experienced outbreaks in multiple nations in recent years, great progress has been made in the prevention of many very serious illnesses. Aside from protection from symptomatic illness and prevention of resulting death, other benefits of vaccination include improved quality of life and productivity. Societal benefits include prevention of disease outbreaks and reduction in healthcare costs.

A N E V E R – C H A N G I N G M A R K E T

Adult immunization is an important, but frequently overlooked, part of patient care. There are approximately 500 vaccines in development to prevent and treat diseases. Vaccination programs typically focus on children, and because of this, adults in industrialized countries are more likely to die as a result of vaccine-preventable diseases than are children. Vaccines are available to prevent a number of illnesses that contribute to morbidity and mortality in adults. These include:

- Cervical cancer;

- diphtheria and tetanus;

- influenza (flu);

- pneumococcal disease;

- hepatitis B;

- COVID-19;

- measles, mumps and/or rubella;

- varicella (chickenpox);

- travel-related diseases.

Vaccination protects not only individuals, but also entire communities from diseases spread by person-to-person transmission. When immunization programs achieve high levels of “community” immunity, the likelihood that an infected person will transmit the disease to a susceptible individual is greatly reduced. Community immunity provides indirect protection to adults who have health problems that prevent them from being immunized yet are still susceptible to the disease. Conversely, a decision to not vaccinate puts the individual and community at risk.

Immunizations are an essential component of preventive healthcare. Vaccination can prevent about 50% of deaths from pneumococcal disease and 80% of deaths from influenza-related complications in the elderly. Pharmacoeconomic studies have demonstrated the value of influenza and pneumococcal vaccines; however, despite various vaccination campaigns and promotional efforts, immunization rates for these diseases continue to be low in the elderly population.

The severity of influenza depends in part on the age profile and pre-existing health status of the population. In developing countries, influenza is generally considered less important than other infectious diseases, making its impact on morbidity and mortality as well as its economic burden largely unknown. In the developed nations, the effects of influenza are better documented. In the U.S., for example, the Centers for Disease Control (CDC) has found that:

- Influenza is responsible for 20,000 to 40,000 deaths annually, and up to 50,000 deaths and an estimated 200,000 excess hospitalizations at a cost of $750 million to $1 billion during epidemic years;

- Mortality from all pneumococcal disease results in about 40,000 deaths annually, with morbidity estimated at 500,000 cases of pneumonia, 50,000 cases of sepsis, and 3,000 cases of meningitis;

- Pneumococcal pneumonia accounts for up to 175,000 hospitalizations each year and is the most common cause of pneumonia. Together, pneumonia and influenza are the seventh leading cause of death, and the fifth leading cause of death among older adults;

- Although new cases of acute hepatitis A have declined by 92% over the past 10 years from 12 cases per 100,000 persons to less than 1.0 per 100,000 persons in 2017, hepatitis A remains among most common vaccine-preventable disease in travelers to other countries, with an estimated 25,000 new infections annually;

- Hepatitis B infections occur in 40,000 to 50,000 people per year. About 1.2 million people are chronically infected with the hepatitis B virus and can infect other household members and/or sexual partners; 25% have chronic active hepatitis, 4,000 die annually from HBV-related cirrhosis, and 800 die annually from HBV-related liver cancer;

- Forty or fewer cases of tetanus occur each year, but result in about 5 deaths annually in the U.S. Most deaths occur in those 60 years of age or older. Almost all reported cases of tetanus occur in persons who have either never been vaccinated, or who completed their primary series but have not had a booster vaccination in the past 10 years;

- Nearly 1 in every 10 people who get diphtheria will die from it;

- Less than 5% of adults are susceptible to infection with the chickenpox virus, but adults are much more likely to die from chickenpox than are children.

The total economic cost of treating these vaccine-preventable diseases among adults exceeds $10 billion each year and up to 50,000 adults die from vaccine-preventable diseases or their complications. Both public and private insurers are less likely to cover recommended immunizations for adults, and adults are not included in any universal state vaccine purchase and distribution system. Therefore, despite ongoing efforts to raise public awareness of the importance of adult inoculation and recent indication expansions for several pediatric vaccines to adult usage, a recent report from the CDC found that many adults still do not receive the recommended pneumococcal, herpes zoster and hepatitis B vaccinations.

However, risks are associated with all immunobiologics. No vaccine is completely safe or 100% effective. Vaccination risks range from common, minor, and local adverse effects to rare, severe, and life-threatening conditions. For example, some autoimmune diseases like acute disseminated encephalomyelitis, Guillain-Barré syndrome, transverse myelitis and multiple sclerosis are known to be connected to vaccines. In addition, some studies have linked a significant rise in autism to certain vaccines, although there is no widespread agreement on this. Thus, recommendations for immunization practices balance scientific evidence of benefits for each person and to society against the potential costs and risks of vaccination programs. These risks, however, have led to a rising number of individuals declining vaccination for themselves and their children, which in turn is believed to have contributed to recent increases in several serious, highly infectious conditions including mumps

T Y P E S O F V A C C I N E S

There are more than two dozen vaccine-preventable diseases for which vaccines have been formulated. Of these vaccines, four different types are currently available:

- attenuated (weakened) live viruses;

- killed (inactivated) viruses or bacteria;

- toxoid vaccines contain a toxin produced by the bacterium;

- genetically engineered/modified vaccines.

Attenuated viruses consist of live micro-organisms that have been cultivated under conditions which disable their virulent properties. They typically provoke more durable immunological responses and are, therefore, the preferred type of vaccine for healthy adults. Jenner’s cowpox vaccine represented the first use of a live, attenuated organism for vaccination. In that case, attenuation resulted from using a nonhuman virus in a human. The cowpox virus grew sufficiently in humans to induce an immune response. The figure below shows the process by which attenuated virus vaccines are created.

Since World War II, viruses for vaccines have been attenuated by serial passage of the human virus in cell culture of nonhuman origin—for example, chicken embryo or monkey kidney cells. During a successful attenuation, the virus loses virulence while retaining the antigens that stimulate protective immunity.

The use of live attenuated organisms continues to be used in preventing diseases such as rabies, yellow fever, poliomyelitis, measles, mumps, rubella, polio and chicken pox. However, as there is a risk that live-attenuated or replication competent viral vaccines given to pregnant women could cross the placenta and infecting the fetus, live vaccines are not recommended during pregnancy

A second type of vaccine, killed whole organisms, emerged in the late nineteenth century. These inactivated viruses were previously virulent micro-organisms that have been killed with chemicals or heat. The first developers used heat to inactivate the salmonella typhi and Vibrio cholerae bacteria that cause fever and cholera, respectively. Chemicals have since replaced heat to inactivate viruses used in killed whole vaccines. Most such vaccines have incomplete or short-lived immune responses and often require booster shots. The polio virus vaccine, developed by Jonas Salk, offers one example of a chemically inactivated vaccine. Other examples include vaccines for influenza, cholera, bubonic plague and hepatitis A.

A third type of vaccine, comprising purified components from pathogenic organisms, was developed in the early twentieth century to prevent tetanus and diphtheria. The bacteria that cause tetanus and diphtheria secrete disease-causing toxins. It is these toxins, rather than the micro-organisms themselves, that results in illness. Inactivated forms of these toxins, called toxoids, can raise “neutralizing” (inactivating) antibodies against the toxin. With improvements in the growth of bacteria and in the purification of macromolecules, inactivated toxins can be produced in bacterial cultures and used as vaccines. These types of vaccines are known for their relatively high efficacy.

Genetically Engineered/Modified Vaccines

Advances in biotechnology are enabling scientists to change the genetic structure of infectious microbes for use in vaccine development. In these “recombinant” vaccines, researchers alter an organism’s genetic structure by adding or removing a gene, which can then be used to induce an immune response. Examples of recombinant vaccines include the Haemophilus influenzae type b (Hib) vaccine, the hepatitis B vaccine and the pneumococcal conjugate vaccine.

More recent research has focused on developing vaccines that use only part of a bacterium or virus. These vaccines, called subunit vaccines, produce an effective immune response without creating separate and potentially harmful immune reactions to the many antigens carried on a microbe.

Subunit vaccines can contain anywhere from 1 to 20 or more antigens. The most common example is the subunit vaccine against hepatitis B that is composed of only the surface proteins of the virus. Previously made from the blood of chronically infected patients, the vaccine is now made by inserting a small portion of the virus’ genetic material into common baker’s yeast. This process induces the yeast to produce an antigen, which is then purified. The purified antigen, when combined with an adjuvant, a substance that stimulates the immune system, results in a safe and very effective vaccine. Other subunit vaccines include the vaccine against human papillomavirus (HPV) and a plague vaccine. Research is continuing on a recombinant subunit vaccine against hepatitis C virus.

Bacteria that cause diseases such as pneumonia and meningitis have an outer polysaccharide coating that cannot be recognized by the immature immune systems of young infants and, therefore, vaccines made from these bacteria are not effective in infants. By linking these outer coatings to proteins (e.g. toxins), the immune system can be led to recognize the polysaccharide as if it were a protein antigen. This enables the immune system to respond to the combined vaccine and produce antibodies, initiating an immune response against the disease-causing organism. This approach is used in the Haemophilus influenzae type B vaccine.

DNA vaccination (also known as nucleic acid vaccination) is a new technique for protecting against disease through the injection of genetically engineered, histone-free (“naked”) DNA designed to induce produce an immunological response. DNA vaccines offer a new way to immunize with materials that are entirely gene-based, expressed by the recipient’s own cells. This approach has several advantages over conventional vaccines, including fewer severe side effects, vaccination against many variants of a disease and no constant cooling requirements.

Developed from gene therapy experiments, DNA vaccines can either be purified from the disease-causing organism itself or genetically engineered to produce one or two specific antigens from a micro-organism. DNA vaccination differs from traditional vaccines in that just the DNA coding for a specific component of a disease-causing organism is injected into the body. The injection or oral administration of these non-disease-causing mimics mobilizes the immune system to protect the host from the disease.

Instead of taking a damaged pathogen, a single gene from that pathogen is artificially copied and multiplied. That gene is then injected into a muscle. For unknown reasons, muscle cells tend to take up this gene and use it as one of their own genes, making the product the gene describes. The immune system will recognize that product as foreign, and remember it, just like it does in conventional vaccination. Since the gene is produced artificially, it can be made much purer than any vaccine produced directly from pathogens. Several different genes can be mixed and injected simultaneously, making it possible to vaccinate against many variants of a pathogen, or against several different pathogens, at the same time. Because DNA vaccines generate cell-mediated immunity, the hope is that they will be effective against difficult viruses, even in cases where standard vaccines have failed to work. Additionally, the genes are cheap to produce, do not require cooling, and can be stored for years.

The main thrust of DNA vaccine technology currently lies in creating vaccines for viral, bacterial, or parasitic infections, such as hepatitis C virus, herpes simplex virus, HIV, human papilloma virus, malaria, influenza, and tuberculosis, which do not appear to induce neutralizing antibodies. It is also hoped that this technology could be used to control cancer and treat established chronic viral infections.

As of 2018, one DNA vaccine has been approved for use in humans and several have been approved for use in animals, lending support to the technology and suggesting that the creation of human products may continue to progress. In December 2008, for example, Fort Dodge Animal Health became the first U.S. company to gain approval for a DNA vaccine that protects horses against West Nile virus. The company’s West Nile-Innovator DNA, which is licensed by the U.S. Department of Agriculture, uses purified DNA plasmids to stimulate an immune response, unlike conventional vaccines that rely on the foreign proteins derived from disease-causing agents. It contains no live or killed viruses, no live vector or viral proteins, and there is no risk of reversion to virulence.

Additional product candidates are currently in human clinical studies. These include, for example, GeoVax Labs, which is in early stage testing of a recombinant DNA vaccine co-expressing human GM-CSF and non-infectious HIV virus-like-particles. The DNA vaccine is used to prime immune responses that are subsequently boosted by vaccination with a recombinant modified vaccinia Ankara (MVA) vectored vaccine. The MVA expresses the HIV virus-like-particles but does not express GM-CSF. The regimen builds on the GeoVax DNA/MVA vaccine that is currently in Phase II clinical testing through the HIV Vaccine Trials Network. These and other studies, however, remain in an early stage and it is not likely that a DNA vaccine will be introduced within the 5-year forecast period of this report.

Messenger RNA (mRNA) vaccines are relatively new vaccines that make proteins in order to trigger an immune response. mRNA vaccines have several benefits compared to other types of vaccines including a shorter manufacturing time and no live virus that can cause disease. mRNA vaccines are used to protect against COVID-19.

Similar to DNA vaccines, recombinant vector vaccines are vaccines that use an attenuated virus or bacterium to introduce microbial DNA to cells of the body. “Vector” refers to the virus or bacterium used as the carrier.

In nature, viruses attach to cells and inject their genetic material into them. In the laboratory, scientists have taken advantage of this process by inserting portions of the genetic material from other microbes into the genomes of certain harmless or attenuated viruses. The carrier viruses then convey that microbial DNA to cells. Recombinant vector vaccines closely mimic a natural infection and therefore are able to stimulate an immune system response.

Attenuated bacteria also can be used as vectors. In this case, the inserted genetic material causes the bacteria to display the antigens of other microbes on its surface as the harmless bacterium mimics a harmful microbe, provoking an immune response. Researchers are currently working on both bacterial and viral-based recombinant vector vaccines for HIV, rabies, and measles.

Viral vector vaccines have recently been used for Ebola outbreaks and a number of other studies have focused on viral vector vaccines against other infectious diseases such as Zika, flu, COVID-19 and HIV.