Description

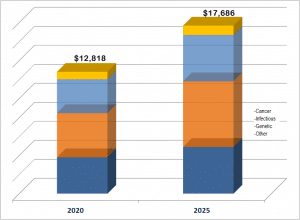

The market for LDTs offered as services is over 12 billion dollars, as indicated in this figure.

This is a unique report with a unique segmentation to help customers find the right segment for their needs. Two separate but related markets are discussed in this report: the market for clinical laboratory services using laboratory developed tests, and the market for products (platforms and consumables) sold to clinical laboratories who use these products to make LDTs. Both are large and rapidly growing markets. Chemistry Tests, Immunoassays Histology Stains, Flow Cytometry, Karyotyping, ISH, Gene Signatures, Microarrays are among the technologies used in lab develop tests. This report examines each technology category.

As part of the market analysis, the report offers the following data:

- Authorized Molecular-Based LDTs for Detection of Nucleic Acid from COVID-19

- Selected Companies Marketing Flow Cytometry Platforms

- Selected Companies Marketing Probes for FISH Based Tests in Clinical Laboratories

- Selected Companies Marketing Open PCR Platforms That Can be Used for LDTs

- Selected Companies Marketing Mass Spectrometers

- Selected Companies Marketing Next Generation Sequencing Platforms to Clinical Laboratories

- Selected Companies Offering LDTs for Hereditary Risk of Cancer

- Selected Companies Offering Pharmacogenomic Test Services Based on LDTs

- Selected Companies Offering Non-Invasive Prenatal Testing (NIPT) Chromosome Analysis Based

- Selected Companies Offering Autoimmune/Inflammatory Test Services Based on LDTs

- Selected Companies Offering Cardiovascular Test Services Based on LDTs

- Selected Companies Offering Neurological Test Services Based on LDTs

- LDT Services Market by Segment

- Infectious Disease (Infectious disease LDTs [not microbial ID by culture], Microbial identification [culture])

- Oncology (Hereditary Cancer/Risk of Cancer, Cancer Screening, Cancer Diagnosis/Prognosis/Monitoring)

- Genetic Testing (Risk of Disease (includes cancer), Chromosomal analysis/NIPT, Inherited disorders (prenatal, postnatal, carrier screening, other genetic testing applications, Diagnosis/Prognosis/Monitoring)

- LDT Services Market by Geography

- United States

- Europe

- Japan

- China

- Latin America

- Rest of World

- LDT Products Market: Market for Products Used by Clinical Laboratories for LDTs – By Product

- PCR

- Mass Spectrometry

- NGS

- Microarrays

- Other

- LDT Products Market: Market for Products Used by Clinical Laboratories for LDTs – by Geography

- United States

- Europe

- Japan

- China

- Latin America

- Rest of World

In this report, laboratory developed tests (LDTs) include all clinical tests developed by laboratories for their own use, in contrast to in vitro diagnostic (IVD) kits that are manufactured and sold by diagnostic companies for use by many different clinical labs. Clinical laboratories can develop LDTs based on any diagnostic test technology used in the clinical lab. For some technologies, such as chemistry tests or immunoassays, automated platforms with large test menus are commercially available. As a result, in some labs, development and use of LDTs based on these technologies may be less than the number of LDTs based on newer technologies such as next generation sequencing. However, laboratories may develop tests on widely used technologies such as immunoassays to offer tests for rare diseases. Clinical laboratories may also perform tests on types of specimens that are not included in the approved labeling for a test or may have other reasons why they decide to develop an LDT.

This significant activity in the development of new LDTs, growing revenues from current LDTs, and large addressable markets for many of the emerging LDTs has attracted the interest of investors and also other companies looking for acquisitions.

There have also been a significant number of acquisitions in recent years. Consolidation among companies and laboratories offering LDTs is expected to continue in the future. This is not a new trend in the clinical laboratory market. Major companies such as Quest Diagnostics and LabCorp have made numerous acquisitions to reach their current market positions. Smaller clinical laboratories have also been making acquisitions. In the segment of this market focusing on companies and laboratories offering services based on LDTs, many new companies continue to be founded – providing a continuing stream of smaller companies trying to grow, and that may grow by acquisitions or may be acquired.

Laboratory developed tests is an exciting field and market in which assays are being developed that may have the potential to transform certain aspects of healthcare. There are great number of companies in the LDT market. New LDTs are being developed and introduced, and some segments of this market (especially the market for cancer diagnosis, prognosis, personalized medicine, and monitoring patients) have become very competitive. Some companies will not survive, but there are also examples of successful companies. This field has attracted considerable interest from investors and from companies making acquisitions.

Companies covered in this report include:

23andme, Inc.

Adaptive Biotechnologies Corporation

Admera Health

Agendia Nv

Agilent Technologies Inc.

Ambry Genetics Corp.

BGI

Biodesix, Inc.

Biotheranostics, Inc.

Bruker Corporation

Caredx, Inc.

Centogene Ag

Epic Sciences, Inc.

Eurofins

Foundation Medicine, Inc.

Guardant Health, Inc.

Helix

Illumina, Inc.

Invitae Corporation

Laboratory Corporation of America (Labcorp)

LunglifeAI

MDXHealth

Myriad Genetics, Inc.

Natera, Inc.

Neogenomics

Opko Health, Inc./Opko Diagnostics

Pacific Biosciences of California, Inc.

Perkin Elmer, Inc.

Qiagen N.V.

Quest Diagnostics

Roche Diagnostics

Rosetta Genomics Ltd.

SCIEX Pte Ltd.

Thermo Fisher Scientific, Inc.

Waters Corporation