Long History of Disease Threats Boosts Blood Screening Market

From In Vitro Diagnostics Business Outlook Newsletter – Subscribe Today.

Zika isn’t something covered in the news much anymore but in the blood screening IVD market, it still matters. So do all the other past disease threats to a pure blood supply, and the possible future threats. New disease threats reaching the level of concern of blood banks will factor into some component of the growth in this market. Although cases and concern have receded, Zika is an example of the nature of threats to the blood supply and drive for safety which will impact new testing. These events have a long history. First it was hepatitis B and C, then HIV, Chagas, BSE and West Nile and more recently emerging threats Zika Virus, Plasmodium species (malaria), Dengue virus, chikungunya, yellow fever and COVID-19 and its variants.

Blood screening is a medical process that scans the blood for infectious diseases or conditions. In developed nations, donated blood is screened for various pathogens. It is a mature market; however, growth comes from new technologies, increased volume and increased testing in developing nations. Blood screening testing’s primary objectives are to monitor the appearance of newly discovered infectious agents in the blood supply, determine the causes of transfusion reactions of unknown etiology, assess the effectiveness of new donor screening methods, and evaluate the donation process to improve the adequacy of the blood supply. Blood screening diagnostic markets are driven primarily by the aging of developed markets, new test applications and emerging markets, with the last probably the most important factor in an otherwise low-growth category. As developing nations decide to increase blood safety measures, NAT testing will drive growth in the market.

“Nearly 120 million units of donated blood are collected globally each year, with 42% of the blood collected going to middle- and low-income countries, home of 80% of the world’s population.” – In Vitro Diagnostic Business Outlook

At present there are no restrictions on donating blood after a COVID-19 vaccination for people receiving an inactivated or RNA-based vaccine.

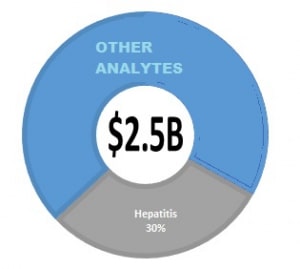

The market for screening is estimated at 2.5B, as shown in the figure opposite, with HIV and Hepatitis contributing to revenue and new tests contributing to growth. Pathogen removal systems are a boon to blood collection but can impact testing markets and must be considered in future outlook. The increased worry of new diseases emphasizes the need for proactive pathogen removal solutions for blood units collected from donors. This is the most cost-effective approach because adding new tests increases the cost of producing safe blood and blood products for transfusion.

The global blood screening market is evolving on many levels. In the technique sector, the market in developing regions has moved to molecular technologies on a more consistent basis, while developing nations are still building infrastructures with immunoassay technologies. New disease threats continue to be an area of concern and increase opportunities for blood screening. Although COVID-19 testing is not required or recommended by major authorities, including the CDC and FDA, there have been mixed processes in blood screening which include COVID-19 as part of the test procedures. Many countries continue to move toward a sustainable, volunteer-based donation system. As volume increases, laboratory structures begin to evolve and invest in more sophisticated equipment, including shifting from manual to automated systems, adopting NAT, and moving toward multiplex assay testing options.

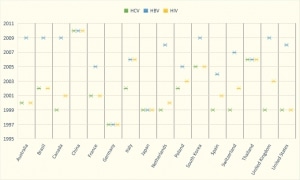

Since the late 1990s, many other countries have adopted NAT testing on all or some portion of blood donations. Despite this widespread adoption of NAT, approximately 50% of the 108 million reported donations of blood are still not tested with NAT technology. Developing and low-resource countries represent the most recent group of countries to start to explore advanced blood screening with NAT.

NAT TESTING PROGRESS – BY COUNTRY (Courtesy of In Vitro Diagnostic Business Outlook).

From Kalorama Information and Science and Medicine Group (publishers of Instrument Business Outlook) comes a new publication focusing on the business of clinical testing.

In Vitro Diagnostics Business Outlook offers the following:

- 2x Monthly Coverage of a Fast-Growing, High Interest Market

- Market Sizing and Forecasting of IVD Market Segments in Every Issue

- Clinical Chemistry, Infectious Disease Testing, Oncology, Hematology, Blood Banking, Coagulation, Point of Care–Updates on the Important Test Categories You Need to Know About

- Industry Watch – Developments with COVID-19 and Other Testing

- M&A, Distribution, Partnerships Tracked and Charted

- New Product Introductions and Company Announcements

- Company Profiling and Quarterly Results Summaries

- Regional Market Coverage

SUBSCRIBE TODAY https://kaloramainformation.com/product/in-vitro-diagnostics-business-outlook Global Licenses For Organization Reading Available.