Worldwide IVD: 8 Key Trends to Watch in $106 Billion Market

In vitro diagnostics (IVDs) remain dynamic. The IVD market is a high R&D spend industry with constant innovations and routine interest from venture capital firms in diagnostic products. Nevertheless, the past few years have been very disruptive for IVDs. However, the resilient IVD industry has weathered the pandemic and is forging ahead with new technologies and increased opportunities that will sustain market growth through the foreseeable future.

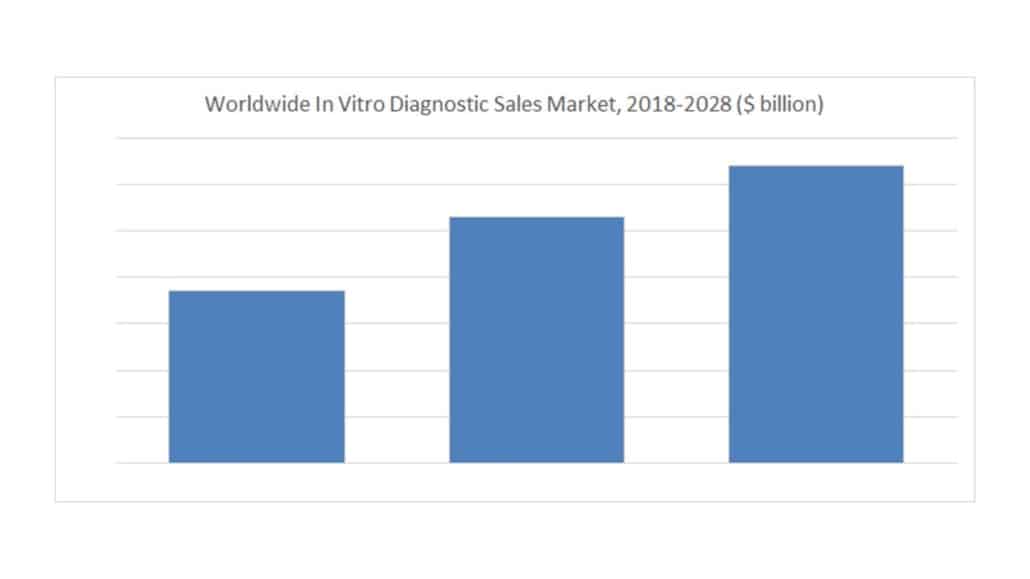

The global IVD test market is estimated at $106 billion in 2023 and is expected to grow 3.8% annually through 2028. This conclusion is among the analysis found in The Worldwide Market for In Vitro Diagnostic Tests, 16th Edition, the latest market research report from Kalorama Information. The report was published in August 2023 and is currently available for purchase. Kalorama Information’s estimate and forecast includes all commercial laboratory and hospital-based products, some research products used in clinical laboratories, and OTC product sales (not test services).

The COVID-19 pandemic led to an unprecedented demand for in vitro diagnostic expertise. In many ways, the IVD landscape in 2023 continues to feel the effects of the pandemic as testing for COVID-19 becomes more endemic. The pandemic impacted the world economy and created uncertainty in the stock market and affected supply chains all over the world. However, the IVD testing market was center stage for the fight against the coronavirus.

IVD’s pandemic frontline position led to a flurry of demand for polymerase chain reaction (PCR), next-generation sequencing (NGS), and serology-based rapid-test products. As a result, the market has opened several new areas of advancements including microfluidic technologies, microarrays and a growing significance of precision medicine including companion diagnostics and multiplex testing that will target significant growth opportunities. In addition, new products, changes in global health spending, regulatory changes in major markets and disease trends are among the factors that produce a constantly changing market picture.

There are also some growing segments in the market that have attracted industry attention. Among these are point-of-care (POC), next-generation sequencing (NGS), cancer testing, and companion diagnostics technologies. Immunochemistry, mass spectrometry, gene testing and molecular diagnostics are also segments of great market interest, and are anticipated to be a major part of the future of IVD.

Beyond these developments, Kalorama Information emphasizes several other key trends that will shape the present and future of IVD testing. Eight of these key trends in the market for IVD include:

- continued advancements in technology affecting growth;

- no shortage of innovation;

- increased interest and use of robotic and AI technologies;

- robust industry spending on research and development;

- the proliferation of syndromic/multiplex tests;

- the discovery and proof of biomarkers driving new test development;

- increased private insurance and the growth of the middle class in emerging countries;

- the popularity of diagnostics that can save long-term costs of treatment, limit infection or reduce hospital stays.

Opportunities abound in the global IVD market. The sheer size and breadth of reach both product-wise and geographically have allowed IVD giants such as Abbott Diagnostics, Roche Diagnostics, Danaher, and Siemens Healthineers to contribute to the overall growth of the international IVD market. Notably, new companies entered the IVD market space at a rapid pace throughout 2020, 2021, and 2022, largely introducing emergency use authorization (EUA) products to detect and guide care for COVID-19. Nearly 200 products for COVID-19 (not including lab-developed tests) were authorized, almost as quickly as they could be developed, by the FDA. These were mostly small operations, but large non-conventional companies entered IVD in some form or another including Amazon, Pfizer, Eli Lilly, Ford and Mayo Clinic. The market also found many well-known life science names such as Sherlock, Wuxi, Promega, Agena Biosciences, Guardant, Exact Sciences and Biocept moving quickly from oncology operations to jumping on infectious disease testing due to the virus. Imaging player Fujifilm even entered IVD with an acquisition related to the pandemic. And this still doesn’t account for the 100s of companies that specialize in specific test segments or serve their local markets.

For more information, purchase The Worldwide Market for In Vitro Diagnostics here.

About “The Worldwide Market for In Vitro Diagnostics”

This report, The Worldwide Market for In Vitro Diagnostics, now in its 16th Edition, details IVD activity on a global scope. The report looks at the entirety of the in vitro diagnostic market and makes forecasts, accesses trends, and scrutinizes vendor activities.

The report discusses tests and technologies that are currently available and those that are expected to take their place. Generally, current products and technologies establish the standard of care and its value to payers. Meanwhile, market analysis in this report covers world markets for in vitro diagnostics; however, the reader will find a bias toward the developed areas of the globe—North America, Japan and Western Europe.

The report also covers more than twenty core market segments, including:

- Blood Bank Molecular

- Blood Bank Screening

- Blood Grouping/Typing

- Circulating Tumor Cells

- Clinical Chemistry

- Coagulation

- Continuous Glucose

- COVID-19

- D-dimer

- Drugs of Abuse

- HbA1c Immunoassays, Lab-Based

- Hematology

- Histology/Cytology

- HPV, molecular

- Immunoassays, Infectious Disease

- Immunoassays, Other

- Mass Spectrometry

- Microbiology (ID/AST)

- Molecular Microbiology

- Nucleic Acid Assays

- Other

- POC Professional

- POC, OTC diabetes

- POC, OTC Other

Why Kalorama Information?

Kalorama Information, part of Science and Medicine Group, is the leading publisher of market research in healthcare areas, including in vitro diagnostics (IVD), biotechnology, medical devices, and pharmaceuticals. Kalorama Information produces dozens of reports a year. The firm offers a Knowledge Center, which provides access to all published reports.

Kalorama Information’s studies feature independent primary research conducted by experienced analysts. Researchers build their market analysis independently from published databases, validating data with inside industry contacts and extensive secondary research, so you can have confidence that you’re getting your information from the most trusted source in the industry!