Modest Results, and Some Good News, for Major IVD Companies

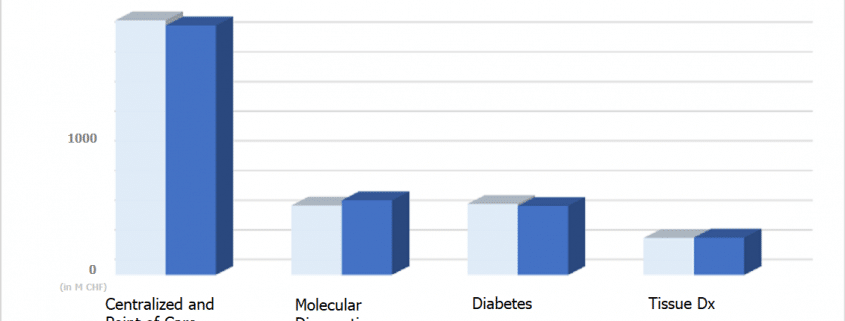

Results below expectations, perhaps explained by one-time events, were coupled with new product launches and some silver lining in niche markets, as the top two IVD companies announced first-quarter results. Roche’s Diagnostics division reported sales of $2.9 BN CHF (approx. $2.86 BN USD) and 1% growth, with Molecular Diagnostics as main contributor. That was flat growth since last year the division grew 5% in the first quarter.

Roche is the world’s largest diagnostic company and its results can speak to the broader market.

The company claimed temporary events and one-time offsets dampened growth, and there were some unusual events in the quarter. Distributor inventory reduction on point-of-care products in China and one time offsets in tissue diagnostics, also free-of-charge deliveries following the recall of CoaguChek test strips in the fourth quarter.

Within these results, a few events are notable for watchers of diagnostic markets:

- Roche reported that its molecular Point of Care Sales Up 18%, as cobas Liat finds markets in physician offices and decentralized hospital testing locations.

- Sales in cervical cancer diagnosis grew 52 percent and sales in blood screening grew 14 percent.

- While Diabetes care grew 1%, growth was 18% in North America due to recent management care contract wins.

- While sales in Japan and China were disappointing, EMEA sales were up 3% and Latin America was up 8%.

The company noted several product launches. The Cobas VivoDx system for antibiotic resistance testing provides results in under 6 hours and can perform 96 tests per 8-hour shift. NAVIFY mutation profiler combined with NAVIFY therapy matcher both [ph] as a curated knowledge base of genetic fragments to help interpret the clinical significance of the patients and identify suitable therapies. and the VENTANA PD-L1, SP142 Assay, the first FDA companion diagnostic approval for use in first line triple negative breast cancer or TNBC.

Kalorama Information’s Worldwide Market for In Vitro Diagnostic Tests provides market sizing and forecasting for all categories of the IVD market

Now in 11 Editions.

Abbot Diagnostics grew .2% on a reported basis to $1.8 BN dollars, though currency effects clouded otherwise 4.4% organic growth. Growth was driven by long-term double-digit growth in its Alinity molecular diagnostic platform and other products. But due to lower flu test revenues , rapid diagnostic revenues, comprising Alere, which Abbott bought in late 2017, decreased 4 percent to $537 million from $559 million.

New products included a CE Mark for Abbott’s Determine HBsAg2 rapid diagnostic assay. highly sensitive, easy-to-use, rapid lateral flow test enables identification of those with. And the company received a CLIA waiver for their BinaxNOW Influenza A & B Card 2 assay.