Molecular Diagnostics Market Now Larger Than the Economies of 50 Nations, per New Report

As molecular testing vendors meet this month in Baltimore for the Association for Molecular Pathology (AMP) 2019 meeting, market research firm Kalorama Information, specialist in in vitro diagnostics markets, estimates that tests aiding the detection and treatment of disease at the molecular level are the fastest-growing test category in all diagnostics. And the firm says the global market is estimated to be $8.7 billion in 2019.

This is according to the firm’s latest report, “The Worldwide Market for In Vitro Diagnostics Tests, 12th Edition.” Kalorama Information’s report is based on a detailed study of corporate financials, medical journals and statistics, and vendor interviews. The report comes out once a year.

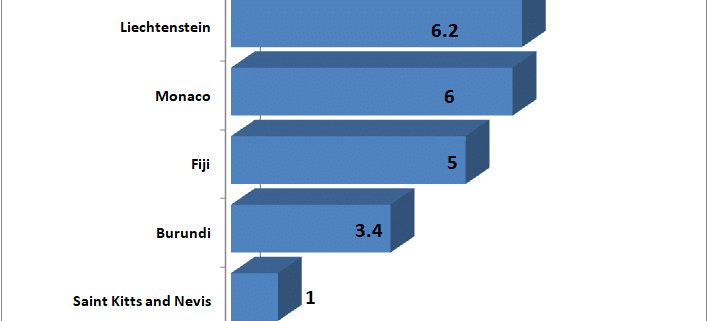

To put that in perspective, Kalorama says the molecular diagnostics market is larger than the economies of many countries. For instance, the market exceeds the individual GDPs of the Kyrgyz Republic at 8 billion or Fiji at $5 billion, or the smallest independent GDP in the world, the tiny 9-island nation of Tuvalu at $48 millions. More molecular diagnostic instruments and reagents will be sold this year than the GDP of Bermuda, Kosovo, and Sierra Leone, as well as those of 44 other nations, per World Bank statistics: https://databank.worldbank.org/data/download/GDP.pdf.

Why the popularity of molecular approaches? “It comes down to infectious disease,” said Bruce Carlson, publisher of Kalorama Information. “That’s been the primary sales area for molecular. Molecular provides the speed and accuracy so that treatment can be initiated in a proper fashion for these conditions.”

Kalorama’s report says that infectious disease diagnostics represent the largest market within IVD accounting for about 51% of the global molecular diagnostics market. Over 15 million office visits in the U.S. alone are for infectious disease-related cases, per CDC stats. (https://www.cdc.gov/nchs/fastats/infectious-disease.htm) And the type of equipment and their applications keep growing, meaning more sales and higher pricing.

“Molecular used to be confined to the lab, but now you can see molecular testing for flu or Strep at a CVS or Walgreens, with minimal operator experience needed.” said Carlson.

Molecular diagnostics will move beyond infectious disease in the future, according to Kalorama’s report. Cancer pathology is a major application area. Other growth segments carrier tests, and transplant diagnostics. A detailed analysis of each of these application segments is presented in the respective segment in Kalorama’s report.

Major vendors include Roche, Danaher, Abbott, Bio-Rad, bioMerieux, Thermo Fisher, and others.

—–

Country data for perspective only. Kalorama notes the following: Molecular Diagnostics Market 8.7 billion Kyrgyz Republic (8 billion), Kosovo (7.9 billion), Tajikistan (7.5 billion), Malawi (7 billion), Isle of Man (6.5 billion) Monaco (6.4 billion), Liechtenstein (6.2 billion), Guam (5.8 billion), Fiji (5.5 billion), Montenegro (5.4 billion), Mauritania (5.3 billion), Togo (5.3 billion), Maldives (5.2 billion), Somalia (4.7 billion), Eswatini (4.7 billion), Barbados (4.6 billion), Sierra Leone (4.0 billion), Guyana (3.6 billion), Cayman Islands (3.5 billion), Suriname (3.4 billion), Liberia (3.2 billion), Andorra (3.2 billion), Curaçao (3.1 billion), Burundi (3.0 billion), South Sudan (3.0 billion), Lesotho (2.7 billion), Greenland (2.7 billion), Aruba (2.7 billion), Faroe Islands (2.6 billion), Timor-Leste (2.5 billion), Bhutan (2.5 billion), Central African Republic (2.3 billion), Cabo Verde (1.9 billion), Djibouti (1.9 billion), Belize (1.9 billion) St. Lucia (1.8 billion), San Marino (1.6 billion), Gambia(1.6 billion), Antigua and Barbuda (1.6 billion), Northern Mariana Islands (1.5 billion), Seychelles (1.5 billion), Guinea-Bissau (1.4 billion), Grenada (1.2 billion), Comoros (1.2 billion), St. Kitts and Nevis (1.0 billion), Turks and Caicos Islands (1.0 billion), Vanuatu (.88 billion), Samoa (.86 billion) St. Vincent and the Grenadines (.81 billion), American Samoa (.63 billion), Dominica (.5 billion), Tonga (.45 billion) São Tomé and Principe (.422 billion), Micronesia, Fed. Sts. (.345 billion)