We Keep Saying The Chinese IVD Market is Growing. That’s Because it Is.

We keep saying it, but that is only because it remains true: China continues to be an untapped market for IVD manufacturers. It’s certainly not out of a desire to follow the crowd. As China’s rate of growth has slowed, we’ve noted that. Yet based on our global market analysis, the IVD market there remains attractive. In 2014, we estimated the market at 2.2 BN. It’s now 6.3BN and growing. With one-fifth of the world’s population, it is the second largest clinical laboratory market in Asia and one of the world’s fastest growing. But by world standards, the healthcare system needs modernization and expansion to serve rural populations. Even in the major cities, most residents cannot afford healthcare. Our latest report The In Vitro Diagnostics Market in China, is out: https://kaloramainformation.com/product/in-vitro-diagnostics-ivd-market-in-china-2021/

China is the second largest clinical laboratory market in Asia and one of the world’s fastest growing. But by world standards, the healthcare system needs modernization and expansion to serve rural populations. Even in the major cities, most residents cannot afford healthcare.

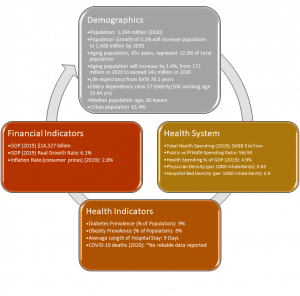

That’s because it is a large country but also one with needs. In the last 30 years, the rate of Chinese economic growth has been impressive, averaging 8% – 10% growth in GDP per year. The economy has grown more than 10 times during that 30-year period, with China’s GDP now exceeding $14 trillion. Most analysts project that based on these GDP measures, China will become the largest economy in the world by mid-21st century. However, China’s state spending on health has failed to keep up with its booming economy. In 2020, China’s government health expenditure was less than 7% of GDP, ranking China in the bottom 20% of the world by the WHO. While this has expanded in recent years, the amount is still minimal considering the size of the population and the huge gap to be filled.

Furthermore, government spending has tended to favor urban populations; according to the WHO, only 25% of public-health money was devoted to rural areas, home to roughly 40% of the population. The hospital and clinic infrastructure is supported by at least 18,000 hospital-based labs. They help support hospital services that have been cut in order to help fund expansion into rural areas.

The Chinese government has announced initiatives to strengthen the sophistication of its hospital network, especially in the rural sector. The plan is to support private hospitals in their efforts to raise funds and reduce bureaucratic red tape for new facilities. The State Council of the People’s Republic of China (Beijing) announced in June 2015 the implementation to integrate private-capital-invested hospitals into the medical insurance system, a move designed to encourage the development of new medical institutions. Among other measures, the approval process to set up a hospital or clinic had the intentions to be streamlined, and preconditions, including the number of beds, would be canceled.

Raising capital for such institutions through equity financing and project financing would also be supported.

As an in vitro diagnostics (IVD) market, China trails only the populous, developed economy markets of the United States, western European countries, and Japan. The country and its healthcare system are confronted by challenges shared by less developed countries, but also burdens common among developed middle-income and affluent countries such as diabetes, cardiovascular disease, and diseases of aging. China as an IVD market opportunity is defined by its standing next to other populous countries with demonstrated economic promise for over the past decade – Brazil, Russia and India; collectively with China referred to as one of the important, rapidly growing “BRIC” nations.

These are all findings of our report. Some other notable conclusions:

• China represents the most attractive IVD market in the developing world and among BRIC nations. Additionally, the Chinese IVD market has been and is projected to be the fastest growing among the top-ten national IVD markets.

• Urban healthcare markets in China – defined by better-equipped and better-funded city hospitals and patients seeking medical care at such institutions – are significantly more lucrative opportunities for international IVD companies than rural healthcare markets. The relative strength of urban healthcare markets is due to the superior financial resources and spending power of middle-class and affluent patients, greater reimbursement and coverage features under government insurance programs for urban residents, and greater existing representation by international companies in major cities and China’s directly-controlled municipalities.

• Major international IVD companies already have a significant presence in the Chinese market and represent potential competitive barriers to prospective market entrants. Major companies enjoy significantly greater financial resources to afford costs associated with product certification, clinical trials, and agent representation. Certification or registration of products under different provinces in the fragmented Chinese market also favors larger companies able to build distribution more rapidly. Additionally, larger companies are more able to make the acquisitions necessary to establish direct distribution and local manufacturing operations.

• A large number of domestic Chinese IVD companies are also active in this market, and benefit from established relationships within the health care infrastructure as well as relatively low operating costs.

Kalorama’s report is The In Vitro Diagnostics Market in China https://kaloramainformation.com/product/in-vitro-diagnostics-ivd-market-in-china-2021/